Introduction

On July 4, 2019 the Act on Tax on Goods and Services, binding from September 1, 2019 introduces the obligation to report in an electronic document that consist of Standard Audit File VAT declaration with registers (JPK_V7M). Requested new electronic document includes both VAT records (a set of information on purchases and sales, which results from the entrepreneur's VAT records for a given period), as well as a VAT declaration (VAT-7 and VAT-7K declaration). The obligation is applied to the reporting period starting from October 1, 2020. From this date taxpayers settling VAT monthly will be required to send JPK_V7M by the deadline appropriate for submitting the declaration, i.e. by the 25th day of the month following the VAT period.

Overview

This article explains how to set up and work with Dynamics AX 2012 R3 to report JPK_V7M (here and further “JPK_VDEK”).

The article is composed of three parts:

-

Setup – describes how to prepare your AX 2012 R3 to report JPK_VDEK.

-

Report generation – describes business user steps to generate an XML file in JPK_VDEK format (JPK_V7M (1)).

-

Implementation details – provides addition information about implementation of reporting for specific scenarios such as split payment reporting and some other.

Setup

To prepare your AX 2012 R3 to report JPK_VDEK you must do the following setup:

-

Export resource file

-

Setup outbound ports

-

Import XSD schema

-

Setup Reporting codes

-

Setup markers for master data

Export resource file

Open AOT > Resources, select the AifOutboundPortReportVDEK_PL, select Export in the right click menu and specify a folder to save the XSLT file.

Setup outbound ports

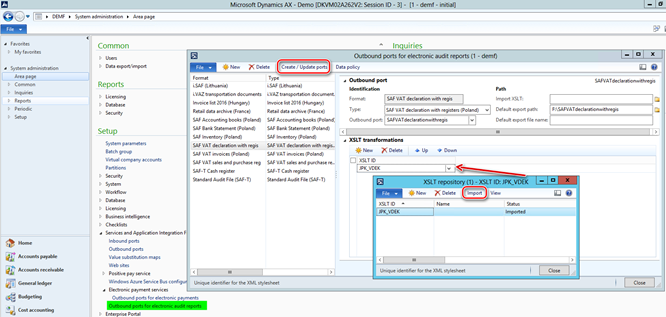

Open System administration > Setup > Services and Application Integration Framework > Outbound ports for electronic audit reports, click "Create / Update ports" button. As a result, new “SAF VAT declaration with regis” format of “SAF VAT declaration with registers (Poland)” type will be created:

Import from XSLT file saved on the previous step and add “JPK_VDEK” as XSLT transformation for the new format.

Import XSD schema

Before you start importing the new “SAF VAT declaration with registers” XSD schema to AX, you should download it directly from government web site and save it locally.

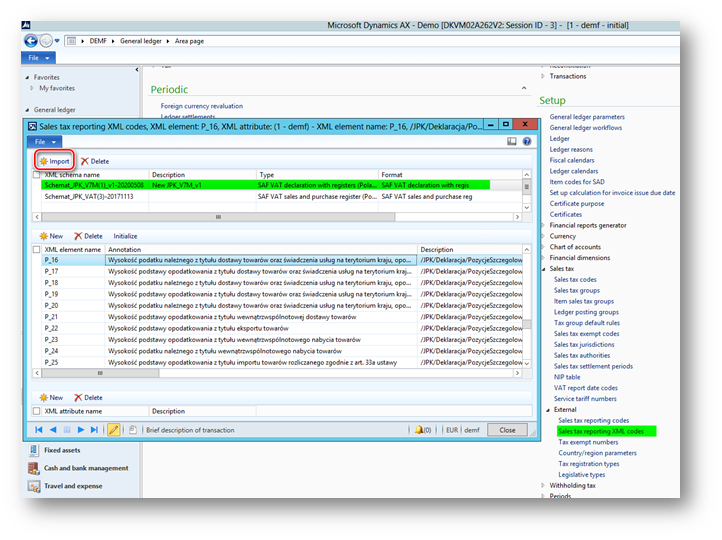

Open General ledger > Setup > Sales tax > External > Sales tax reporting XML codes, click Import button on the action pane and select the XSD file saved preliminary from the government web site.

Specify Type = “SAF VAT declaration with registers (Poland)”, Format = “SAF VAT declaration with regis” for the newly created line for “SAF VAT declaration with registers” XSD schema. When import is done, you will find all the tags of the report with their annotation from the schema file.

Setup Reporting code

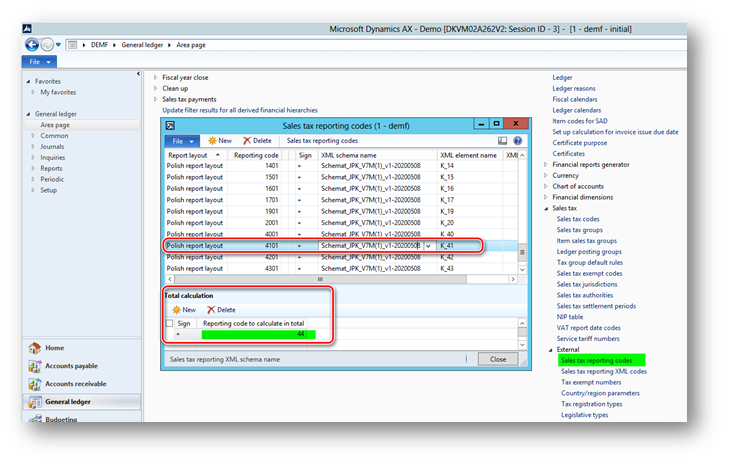

Open General ledger > Setup > Sales tax > External > Sales tax reporting code, add new reporting codes with Report layout = “Polish report layout” for the new “SAF VAT declaration with registers” report.

For example:

|

Reporting code |

XML schema name |

XML element name |

Reporting code to calculate in total |

|

1001 |

Schemat_JPK_V7M(1)_v1 |

K_10 |

10 |

|

1101 |

Schemat_JPK_V7M(1)_v1 |

K_11 |

11 |

|

… |

Schemat_JPK_V7M(1)_v1 |

… |

… |

|

3101 |

Schemat_JPK_V7M(1)_v1 |

K_31 |

32 |

|

3201 |

Schemat_JPK_V7M(1)_v1 |

K_32 |

33 |

|

3301 |

Schemat_JPK_V7M(1)_v1 |

K_33 |

36 |

|

3401 |

Schemat_JPK_V7M(1)_v1 |

K_34 |

37 |

|

3501 |

Schemat_JPK_V7M(1)_v1 |

K_35 |

38 |

|

3601 |

Schemat_JPK_V7M(1)_v1 |

K_36 |

39 |

|

4001 |

Schemat_JPK_V7M(1)_v1 |

K_40 |

43 |

|

4101 |

Schemat_JPK_V7M(1)_v1 |

K_41 |

44 |

|

4201 |

Schemat_JPK_V7M(1)_v1 |

K_42 |

45 |

|

4301 |

Schemat_JPK_V7M(1)_v1 |

K_43 |

46 |

|

4401 |

Schemat_JPK_V7M(1)_v1 |

K_44 |

47 |

|

4501 |

Schemat_JPK_V7M(1)_v1 |

K_45 |

48 |

|

4601 |

Schemat_JPK_V7M(1)_v1 |

K_46 |

49 |

|

4701 |

Schemat_JPK_V7M(1)_v1 |

K_47 |

50 |

For example:

Add only those XML elements which must be collected from tax transactions with reporting codes.

Setup markers for master data

This part of setup is specific for JPK_VDEK. There are some elements in JPK_VDEK report values which must report additional characteristic of invoices as specific markers:

|

Name |

Name En |

Name PL |

Description En-us |

Description Pl |

|

GTU_01 |

Supply of alcoholic beverages |

Dostawa napojów alkoholowych |

Supply of alcoholic beverages - ethyl alcohol, beer, wine, fermented beverages and intermediate products as defined in the provisions on excise duty |

Dostawa napojów alkoholowych - alkoholu etylowego, piwa, wina, napojów fermentowanych i wyrobów pośrednich, w rozumieniu przepisów o podatku akcyzowym |

|

GTU_02 |

Goods referred to in art. 103 item 5aa |

Dostawa towarów, o których mowa w art. 103 ust. 5aa |

Delivery of goods referred to in art. 103 item 5aa of the Act |

Dostawa towarów, o których mowa w art. 103 ust. 5aa ustawy |

|

GTU_03 |

Supply of heating oil |

Dostawa oleju opałowego |

Supply of heating oil within the meaning of the provisions on excise duty and lubricating oils, other oils with CN codes from 2710 19 71 to 2710 19 99, excluding products with CN code 2710 19 85 (white oils, liquid paraffin) and plastic greases falling within the CN code 2710 19 99, lubricating oils of CN code 2710 20 90, lubricating preparations of CN heading 3403, excluding plastic lubricants of this heading |

Dostawa oleju opałowego w rozumieniu przepisów o podatku akcyzowym oraz olejów smarowych, pozostałych olejów o kodach CN od 2710 19 71 do 2710 19 99, z wyłączeniem wyrobów o kodzie CN 2710 19 85 (oleje białe, parafina ciekła) oraz smarów plastycznych zaliczanych do kodu CN 2710 19 99, olejów smarowych o kodzie CN 2710 20 90, preparatów smarowych objętych pozycją CN 3403, z wyłączeniem smarów plastycznych objętych tą pozycją |

|

GTU_04 |

Supply of tobacco products |

Dostawa wyrobów tytoniowych |

Supply of tobacco products, dried tobacco, liquid for electronic cigarettes and innovative products within the meaning of the provisions on excise duty |

Dostawa wyrobów tytoniowych, suszu tytoniowego, płynu do papierosów elektronicznych i wyrobów nowatorskich, w rozumieniu przepisów o podatku akcyzowym |

|

GTU_05 |

Delivery of waste |

Dostawa odpadów |

Delivery of waste - only those specified in item 79-91 of Annex 15 to the Act |

Dostawa odpadów - wyłącznie określonych w poz. 79-91 załącznika nr 15 do ustawy |

|

GTU_06 |

Supply of electronic devices |

Dostawa urządzeń elektronicznych |

Supply of electronic devices as well as parts and materials for them, exclusively specified in item 7-9, 59-63, 65, 66, 69 and 94-96 of Annex 15 to the Act |

Dostawa urządzeń elektronicznych oraz części i materiałów do nich, wyłącznie określonych w poz. 7-9, 59-63, 65, 66, 69 i 94-96 załącznika nr 15 do ustawy |

|

GTU_07 |

Supply of vehicles |

Dostawa pojazdów |

Supply of vehicles and car parts with codes only CN 8701 - 8708 and CN 8708 10 |

Dostawa pojazdów oraz części samochodowych o kodach wyłącznie CN 8701 - 8708 oraz CN 8708 10 |

|

GTU_08 |

Delivery of precious and base metals |

Dostawa metali szlachetnych oraz nieszlachetnych |

Delivery of precious and base metals - only those specified in item 1-3 of Annex 12 to the Act and in item 12-25, 33-40, 45, 46, 56 and 78 of Annex 15 to the Act |

Dostawa metali szlachetnych oraz nieszlachetnych - wyłącznie określonych w poz. 1-3 załącznika nr 12 do ustawy oraz w poz. 12-25, 33-40, 45, 46, 56 i 78 załącznika nr 15 do ustawy |

|

GTU_09 |

Supply of medicines and medical devices |

Dostawa leków oraz wyrobów medycznych |

Supply of medicines and medical devices - medicinal products, foodstuffs for particular nutritional uses and medical devices covered by the notification obligation referred to in Art. 37av section 1 of the Act of 6 September 2001 - Pharmaceutical Law (Journal of Laws of 2019, item 499, as amended) |

Dostawa leków oraz wyrobów medycznych - produktów leczniczych, środków spożywczych specjalnego przeznaczenia żywieniowego oraz wyrobów medycznych, objętych obowiązkiem zgłoszenia, o którym mowa w art. 37av ust. 1 ustawy z dnia 6 września 2001 r. - Prawo farmaceutyczne (Dz. U. z 2019 r. poz. 499, z późn. zm.) |

|

GTU_10 |

Supply of buildings |

Dostawa budynków |

Supply of buildings, structures and land |

Dostawa budynków, budowli i gruntów |

|

GTU_11 |

Provision of services - gas emission |

Świadczenie usług w - gazów cieplarnianych |

Provision of services in the scope of transferring greenhouse gas emission allowances referred to in the Act of 12 June 2015 on the greenhouse gas emission allowance trading system (Journal of Laws of 2018, item 1201 and 2538 and of 2019 items 730, 1501 and 1532) |

Świadczenie usług w zakresie przenoszenia uprawnień do emisji gazów cieplarnianych, o których mowa w ustawie z dnia 12 czerwca 2015 r. o systemie handlu uprawnieniami do emisji gazów cieplarnianych (Dz. U. z 2018 r. poz. 1201 i 2538 oraz z 2019 r. poz. 730, 1501 i 1532) |

|

GTU_12 |

Provision of intangible services |

Świadczenie usług o charakterze niematerialnym |

Provision of intangible services - exclusively: consulting, accounting, legal, management, training, marketing, head offices, advertising, market and public opinion research, in the field of scientific research and development works |

Świadczenie usług o charakterze niematerialnym - wyłącznie: doradczych, księgowych, prawnych, zarządczych, szkoleniowych, marketingowych, firm centralnych (head offices), reklamowych, badania rynku i opinii publicznej, w zakresie badań naukowych i prac rozwojowych |

|

GTU_13 |

Transport services and storage management |

Usług transportowych i gospodarki magazynowej |

Provision of transport services and storage management - Section H PKWiU 2015 symbol ex 49.4, ex 52.1 |

Świadczenie usług transportowych i gospodarki magazynowej - Sekcja H PKWiU 2015 symbol ex 49.4, ex 52.1 |

|

SW |

Mail-order sale |

Sprzedaży wysyłkowej |

Delivery as part of the mail-order sale from the territory of the country, referred to in art. 23 of the Act |

Dostawa w ramach sprzedaży wysyłkowej z terytorium kraju, o której mowa w art. 23 ustawy |

|

EE |

Telecommunications |

Usług telekomunikacyjnych |

Provision of telecommunications, broadcasting and electronic services referred to in art. 28k of the Act |

Świadczenie usług telekomunikacyjnych, nadawczych i elektronicznych, o których mowa w art. 28k ustawy |

|

TP |

Links between the buyer and the supplier |

Istniejące powiązania między nabywcą a dokonującym |

Existing links between the buyer and the supplier of the goods or service provider referred to in art. 32 section 2 point 1 of the Act |

Istniejące powiązania między nabywcą a dokonującym dostawy towarów lub usługodawcą, o których mowa w art. 32 ust. 2 pkt 1 ustawy |

|

TT_WNT |

Intra-Community acquisition as part of a three-party transaction |

Wewnątrzwspólnotowe nabycie w ramach transakcji trójstronnej |

Intra-Community acquisition of goods by the second most-taxable person as part of a three-party transaction under the simplified procedure referred to in Chapter XII, Chapter 8 of the Act |

Wewnątrzwspólnotowe nabycie towarów dokonane przez drugiego w kolejności podatnika VAT w ramach transakcji trójstronnej w procedurze uproszczonej, o której mowa w dziale XII rozdziale 8 ustawy |

|

TT_D |

Delivery of goods outside of Poland as part of a thri-party transaction |

Dostawa towarów poza terytorium kraju w ramach transakcji trójstronnej |

The supply of goods outside the territory of the country by the second VAT payer under a tri-party transaction under the simplified procedure, referred to in chapter 8 of section XII of the VAT Act |

Dostawa towarów poza terytorium kraju dokonana przez drugiego w kolejności podatnika VAT w ramach transakcji trójstronnej w procedurze uproszczonej, o której mowa w dziale XII rozdziale 8 ustawy |

|

MR_T |

Tourism services taxed on the basis of a margin |

Usług turystyki opodatkowane na zasadach marży |

The provision of tourism services taxed on the basis of a margin in accordance with art. 119 of the Act |

Świadczenie usług turystyki opodatkowane na zasadach marży zgodnie z art. 119 ustawy |

|

MR_UZ |

Second-hand goods, art, antiques |

Towarów używanych, dzieł sztuki, antyków |

Supply of second-hand goods, works of art, collectors' items and antiques, taxed on the basis of a margin in accordance with art. 120 of the Act |

Dostawa towarów używanych, dzieł sztuki, przedmiotów kolekcjonerskich i antyków, opodatkowana na zasadach marży zgodnie z art. 120 ustawy |

|

I_42 |

Customs procedure 42 (import) |

Procedury celnej 42 (import) |

Intra-Community supply of goods after importation of these goods under customs procedure 42 (import) |

Wewnątrzwspólnotowa dostawa towarów następująca po imporcie tych towarów w ramach procedury celnej 42 (import) |

|

I_63 |

Customs procedure 63 (import) |

Procedury celnej 63(import) |

Intra-Community supply of goods after importation of these goods under customs procedure 63 (import) |

Wewnątrzwspólnotowa dostawa towarów następująca po imporcie tych towarów w ramach procedury celnej 63 (import) |

|

B_SPV |

Transfer by art. 8a paragraph 1 of the VAT Act |

Transfer z art. 8a ust. 1 ustawy |

Transfer of a single-purpose voucher made by a taxpayer acting on his own behalf, taxed in accordance with Art. 8a paragraph 1 of the Act |

Transfer bonu jednego przeznaczenia dokonany przez podatnika działającego we własnym imieniu, opodatkowany zgodnie z art. 8a ust. 1 ustawy |

|

B_SPV_DOSTAWA |

Goods and services to which the single-purpose voucher relates (Article 8a paragraph 4 of the VAT Act) |

Dostawa towarów oraz świadczenie usług (art. 8a ust. 4 ustawy) |

Supply of goods and provision of services to which the single-purpose voucher relates to a taxable person who issued the voucher in accordance with Article 8a paragraph 4 of the Act |

Dostawa towarów oraz świadczenie usług, których dotyczy bon jednego przeznaczenia na rzecz podatnika, który wyemitował bon zgodnie z art. 8a ust. 4 ustawy |

|

B_MPV_PROWIZJA |

Brokering services of multi-purpose vouchers |

Usług pośrednictwa o transferu bonu różnego przeznaczenia |

Provision of brokering services and other services related to the transfer of multi-purpose vouchers, taxed in accordance with art. 8b paragraph 2 of the Act |

Świadczenie usług pośrednictwa oraz innych usług dotyczących transferu bonu różnego przeznaczenia, opodatkowane zgodnie z art. 8b ust. 2 ustawy |

|

ZakupVAT_Marza |

Input VAT - margin |

Podatek VAT - marża |

The amount of purchases of goods and services purchased from other tax payers for the direct benefit of the tourist and of second-hand goods, works of art, collectors' items and antiques connected with sales taxed on the basis of a margin in accordance with art. 120 of the VAT Act |

Kwota nabycia towarów i usług nabytych od innych podatników dla bezpośredniej korzyści turysty, a także nabycia towarów używanych, dzieł sztuki, przedmiotów kolekcjonerskich i antyków związanych ze sprzedażą opodatkowaną na zasadzie marży zgodnie z art. 120 ustawy |

|

P_65 |

Activities mentioned in art. 122 |

Czynności o których mowa w art. 122 ustawy |

The tax payer performed the activities mentioned in art. 122 of the VAT Act. Tax exemption for the supply, import and purchase of investment gold. |

Podatnik wykonywał w okresie rozliczeniowym czynności, o których mowa w art. 122 ustawy |

|

P_67 |

Tax liability reduction |

Obniżenie kwoty zobowiązania podatkowego |

The tax payer benefits from tax liability reduction mentioned in art. 108d of the VAT Act |

Podatnik korzysta z obniżenia zobowiązania podatkowego, o którym mowa w art. 108d ustawy |

|

Import |

Import |

Import |

Designation concerning input tax on imports of goods, including import of goods taxed in accordance with art. 33a of the VAT Act |

Oznaczenie dotyczące podatku naliczonego z tytułu importu towarów, w tym importu towarów rozliczanego zgodnie z art. 33a ustawy |

|

FP |

Invoice issued to the receipt by art. 109 sec. 3d |

Faktura, o której mowa w art. 109 ust. 3d ustawy |

Invoice issued to the receipt, mentioned in art. 109 sec. 3d of the VAT Act |

Faktura, o której mowa w art. 109 ust. 3d ustawy |

|

RO |

Internal summary document |

Dokument zbiorczy wewnętrzny |

Internal summary document including sales from cash registers |

Dokument zbiorczy wewnętrzny zawierający sprzedaż z kas rejestrujących |

|

MK |

Invoice reffered to art.21 |

Faktura art. 21 |

Invoice issued by a taxpayer who is a supplier of goods or services and who has chosen the cash accounting method specified in art. 21 of the VAT Act |

Faktura wystawiona przez podatnika będącego dostawcą lub usługodawcą, który wybrał metodę kasową rozliczeń określoną w art. 21 ustawy |

|

VAT_RR |

Invoice referred to art.116 |

Faktura VAT RR, art.116 |

VAT invoice referred to in art. 116 of the VAT Act |

Faktura VAT RR, o której mowa w art. 116 ustawy |

|

WEW |

Internal document |

Dokument wewnętrzny |

Internal document |

Dokument wewnętrzny |

These markers can be defined for reporting purposes depending on tax transactions data. Transactional data must be sufficient to define values of these elements. Setup Sales tax codes, Sales tax groups and Item sales tax groups or use Customers and Vendors groups or Customers and Vendors to provide enough information to differentiate tax transactions for all markers introduced in JPK_VDEK. AX 2012 R3 allows to setup markers for the following master data:

|

Marker |

Sales tax codes |

Sales tax groups |

Item sales tax groups |

All customers |

Customer groups |

All vendors |

Vendor groups |

|

GTU_01 |

X |

|

X |

X |

X |

|

|

|

GTU_02 |

X |

|

X |

X |

X |

|

|

|

GTU_03 |

X |

|

X |

X |

X |

|

|

|

GTU_04 |

X |

|

X |

X |

X |

|

|

|

GTU_05 |

X |

|

X |

X |

X |

|

|

|

GTU_06 |

X |

|

X |

X |

X |

|

|

|

GTU_07 |

X |

|

X |

X |

X |

|

|

|

GTU_08 |

X |

|

X |

X |

X |

|

|

|

GTU_09 |

X |

|

X |

X |

X |

|

|

|

GTU_10 |

X |

|

X |

X |

X |

|

|

|

GTU_11 |

X |

|

X |

X |

X |

|

|

|

GTU_12 |

X |

|

X |

X |

X |

|

|

|

GTU_13 |

X |

|

X |

X |

X |

|

|

|

|

|

|

|

|

|

|

|

|

SW |

X |

X |

X |

X |

|

|

|

|

EE |

X |

X |

X |

X |

|

|

|

|

TP |

X |

X |

X |

X |

|

|

|

|

TT_WNT |

X |

X |

X |

X |

|

|

|

|

TT_D |

X |

X |

X |

X |

|

|

|

|

MR_T |

X |

X |

|

|

|||

|

MR_UZ |

X |

X |

|

|

|||

|

I_42 |

X |

X |

X |

X |

|

|

|

|

I_63 |

X |

X |

X |

X |

|

|

|

|

B_SPV |

X |

X |

X |

X |

|

|

|

|

B_SPV_DOSTAWA |

X |

X |

X |

X |

|

|

|

|

B_MPV_PROWIZJA |

X |

X |

X |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

P_65 |

X |

X |

X |

X |

X |

X |

X |

|

P_67 |

X |

X |

X |

X |

X |

X |

X |

|

|

|||||||

|

ZakupVAT_Marza |

X |

X |

|||||

|

|

|||||||

|

I MP |

X |

X |

X |

X |

|||

|

|

|||||||

|

Sprzedaży_FP |

X |

X |

X |

X |

X |

||

|

Sprzedaży_RO |

X |

X |

X |

X |

X |

||

|

Sprzedaży_WEW |

X |

X |

X |

X |

X |

||

|

|

|||||||

|

Zakupu_MK |

X |

X |

X |

X |

X |

||

|

Zakupu_VAT_RR |

X |

X |

X |

X |

X |

||

|

Zakupu_WEW |

X |

X |

X |

X |

X |

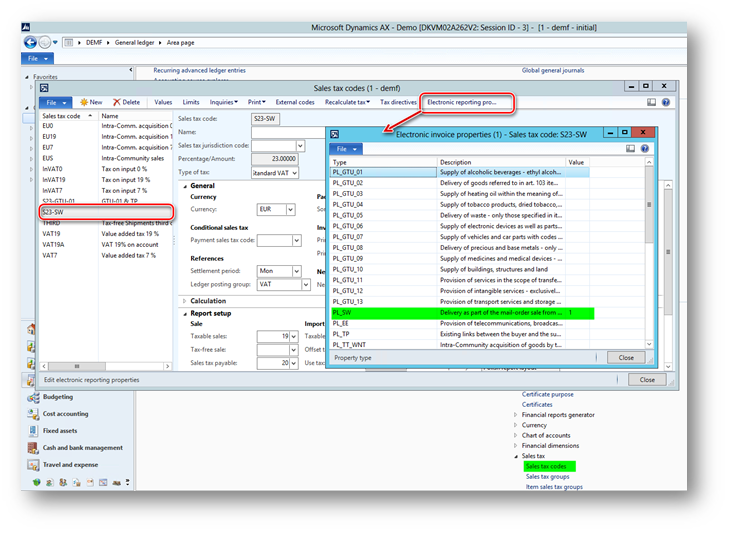

To setup markers for master data use Electronic reporting properties button on the Action pane of each form of the master data. For example, to setup markers for Sales tax codes:

-

Open General ledger > Setup > Sales tax > Sales tax codes form and select the tax code for which you want to setup markers.

-

Click Electronic reporting properties button on the Action pane and set ‘1’ for those markers which must be reported for all the transactions with this tax code:

If you want to specify markers specifically for other available master data, use the same button for the forms of other master data in the same way.

During JPK_VDEK report generation, system analyzes all the setup provided and if marker is defined any of the master data related to particular invoice, the invoice will be marked with this marker.

Setup of the markers can be introduced or changed at any time, even after transaction posting. Make sure that your marker setup is up to date and correctly reflect the case for JPK_VDEK before report generation.

Report generation

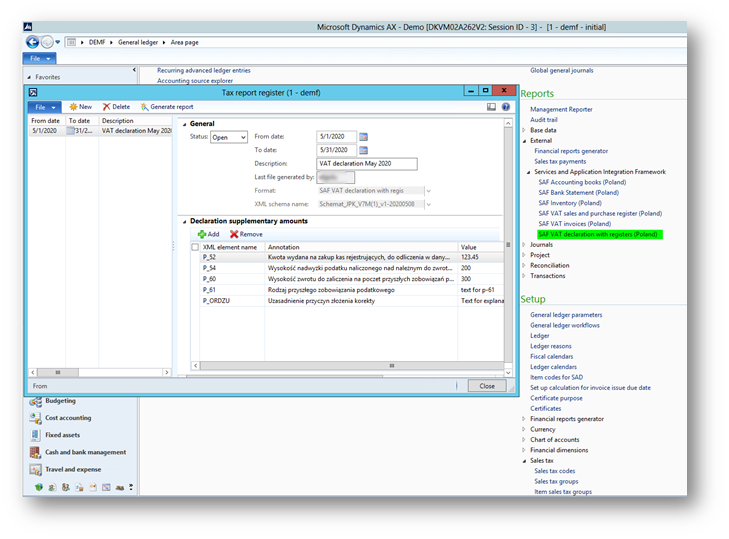

To generate JPK_VDEK report, open General ledger > Reports > External > Services and Application Integration Framework > SAF VAT declaration with registers (Poland) form, click New button on the Action pane and fill in the fields.

Fields description:

|

Field name |

Description |

|

From date |

Specify the first date of the reporting period. |

|

To date |

Specify the last date of the reporting period. |

|

Description |

Specify a description for report. This description is not included into the report and serves for user only. |

|

Last file generated by |

This field is field in automatically by the system. Each time which report is generated this field is filled in with the User ID. |

|

Format |

Select SAF VAT declaration with regis” format you defined for JPK_VDEK during setup. Save the information to enable “XML schema name” field. |

|

XML schema name |

Select XML schema name you imported during ‘Import XSD schema’ step of the setup. Save the information to enable “Declaration supplementary amounts” fast tab. |

On “Declaration supplementary amounts” fast tab, add and specify values for some of the following elements of the declaration you may want to report:

|

Name |

Description (En) |

Description (Pl) |

|

P_39 |

Non-Negative Integer, Maximum digits: 14 The value of surplus of input VAT over output VAT moved from previous period. |

Wysokość nadwyżki podatku naliczonego nad należnym z poprzedniej deklaracji |

|

P_49 |

Non-Negative Integer, Maximum digits: 14 The amount spent on the purchase of cash registers, to be deducted in the given period, reducing the value of output VAT The amount specified in P_49 cannot be > P_38 - P_48. If P_38 - P_48 <= 0, then you should show 0. |

Kwota wydana na zakup kas rejestrujących, do odliczenia w danym okresie rozliczeniowym pomniejszająca wysokość podatku należnego |

|

P_50 |

Non-Negative Integer, Maximum digits: 14 The amount of tax covered by the abandonment of collection P_50 cannot the > P_38 - P_48 - P_49. If P_38 - P_48 - P_49 < 0 => P_50 = 0. |

Wysokość podatku objęta zaniechaniem poboru |

|

P_52 |

Non-Negative Integer, Maximum digits: 14 The amount spent on the purchase of cash registers, to be deducted in the given period and to be returned in the given settlement period or increasing the amount of input tax to be transferred to the next settlement period If P_48 > = P_38 or the amount of benefits for the purchase of cereals registering above from the surplus tax on accrued then in P_52 manifests itself the remaining amount of benefits for the purchase of cereals are recorded, privileged taxpayer for reimbursement or deduction from the tax payable for subsequent billing periods. |

Kwota wydana na zakup kas rejestrujących, do odliczenia w danym okresie rozliczeniowym przysługująca do zwrotu w danym okresie rozliczeniowym lub powiększająca wysokość podatku naliczonego do przeniesienia na następny okres rozliczeniowy |

|

P_54 |

Non-Negative Integer, Maximum digits: 14 The amount of input tax surplus to be returned to account designated by the tax payer |

Wysokość nadwyżki podatku naliczonego nad należnym do zwrotu na rachunek wskazany przez podatnika |

|

P_55 |

The refund to the bank account referred to in art. 87 sec. 6a of the VAT Act: 1-yes Return to the taxpayer's VAT account within 25 days |

Zwrot na rachunek VAT, o którym mowa w art. 87 ust. 6a ustawy: 1 – tak Zwrot na rachunek VAT podatnika w terminie 25 dni |

|

P_56 |

The refund to the bank account referred to in art. 87 sec. 6a of the VAT Act: 1-yes Return to taxpayer's settlement account within 25 days |

Zwrot na rachunek VAT, o którym mowa w art. 87 ust. 6a ustawy: 1 – tak Zwrot na rachunek rozliczeniowy podatnika w terminie 25 dni |

|

P_57 |

The refund to the bank account referred to in art. 87 sec. 6a of the VAT Act: 1-yes Return to taxpayer's settlement account within 60 days |

Zwrot na rachunek VAT, o którym mowa w art. 87 ust. 6a ustawy: 1 – tak Zwrot na rachunek rozliczeniowy podatnika w terminie 60 dni |

|

P_58 |

The refund to the bank account referred to in art. 87 sec. 6a of the VAT Act: 1-yes Return to taxpayer's settlement account within 180 days |

Zwrot na rachunek VAT, o którym mowa w art. 87 ust. 6a ustawy: 1 – tak Zwrot na rachunek rozliczeniowy podatnika w terminie 180 dni |

|

P_60 |

Non-Negative Integer, Maximum digits: 14 The amount of refund to be credited against future tax liabilities |

Wysokość zwrotu do zaliczenia na poczet przyszłych zobowiązań podatkowych |

|

P_61 |

String (1..240), must be used if P_60 is used. The type of future tax liability |

Rodzaj przyszłego zobowiązania podatkowego |

|

P_68 |

Non-Negative Integer, Maximum digits: 14 The amount of the correction of the taxable basis, mentioned in art. 89a sec. 1 of the VAT Act |

Wysokość korekty podstawy opodatkowania, o której mowa w art. 89a ust. 1 ustawy |

|

P_69 |

Non-Negative Integer, Maximum digits: 14 The amount of the correction of the output tax. mentioned in art. 89a sec. 1 of the VAT Act |

Wysokość korekty podatku należnego, o której mowa w art. 89a ust. 1 ustawy |

|

P_ORDZU |

String (1..240) Explanation of reasons for submitting corrected VAT return |

Uzasadnienie przyczyn złożenia korekty |

Implementation details

Split payment (MPP) marker

“MPP” marker is introduced in JPK_VDEK report for both sales and purchases register.

If company does operations for which split payment procedure must be applied, “Split payment” feature must be used (KB 4339927). Current implementation of “MPP” marker reporting is based on KB 4339927.

User does not need to do any specific setup to get “MPP” reported in JPK_VDEK when “Split payment” feature is used. The algorithm of “MPP” marked identification is the following:

-

Sales invoice will be marked with “MPP” marker if it was posted with a Method of payment, in setup of which “Split payment” check box is marked.

-

Purchase invoice will be marked with “MPP” marker if it was posted with Payment specification in setup of which “Split” is set in “Payment specification parameter”.

Overdue customer invoice

Business requirement

-

<P_68> element of the Declaration part must report (if procedure is applied by the company) amount of taxable base for “overdue” invoices in the reporting period (transactions posted to deduct VAT for not payed issued invoices during 150 days period after payment due date)

-

<P_69> element of the Declaration part must report (if procedure is applied by the company) amount of VAT for “overdue” invoices in the reporting period (transactions posted to deduct VAT for not payed issued invoices during 150 days period after payment due date)

-

If the procedure is applied by the company, “Overdue” invoices in the period in which due date (150 days), this transaction must be reported with “WEW” document type including, the information about the Customer from the original invoice and amount with “-“ negative sign.

-

If procedure is applied by the company, “Payed overdue” invoices in the period in which an overdue invoices was payed, the transaction must be reported with “WEW” document type, all the information about the Customer from the original invoice and amount with “+“ positive sign.

-

If “overdue” and “payed overdue” transactions are in the same reporting period: it is allowed to report (if procedure is applied by the company) or not report both (together) in Sales register. <P_68> and <P_69> elements of the Declaration part are not reported in this case.

Supported business user scenario in AX 2012 R3

“Overdue customer invoice” scenario is a scenario during which an invoice issued to a customer can go through three stages:

-

Invoice is issued to a customer: tax transactions are posted; invoice is included to JPK > Ewidencja > SprzedazWiersz as usually, according to tax setup and markers setup.

-

If the invoice is not payed for 150 days period after payment due date, the company can apply the Overdue debt VAT periodic task (Accounts receivable > Periodic > Overdue debt > Overdue debt VAT). Tax transactions resulting this task will be reflected in JPK_VDEK report with: - all the information about the customer from the original invoice (posted on step 1), - amounts reported in the same K_* elements as in the original invoice but with negative sign, - same markers will be applied as in the original invoice, - <TypDokumentu> element will be marked as “WEW” (internal document), - <KorektaPodstawyOpodt> marker will be applied. Moreover, amounts (base amount and tax amount) from this invoice (internal document) will be included and reported in P_68 and P_69 elements of the declaration part of the report.

-

If the invoice posted on step 1 and not payed for 150 days period after payment due date company applied the Overdue debt VAT periodic task, was payed, the company must apply again ‘Overdue debt VAT’ periodic task in the period when the invoice was payed. Tax transactions resulting this task will be reflected in JPK_VDEK report with: - all the information about the customer from the original invoice (posted on step 1), - amounts reported in the same K_* elements as in the original invoice with positive sign, - same markers will be applied as in the original invoice, - <TypDokumentu> element will be marked as “WEW” (internal document), - <KorektaPodstawyOpodt> marker will be applied.

Amounts (base amount and tax amount) from this invoice (internal document) will NOT be included and reported in P_68 and P_69 elements of the declaration part of the report.

If step 2 and step 3 had place in the same reporting period, P_68 and P_69 elements of the declaration part of the report will not be affected.

Overdue vendor invoice

Business requirement

-

Original invoices must be reported in <K_42> and <K_43> elements for acquisition of goods and services and in <K_40> and <K_41> elements for acquisition of fixed assets.

-

If the procedure is applied by the company, “Overdue” invoices in the period in which due date, this transaction must be reported with “WEW” document type including, the information about the Customer and invoice number from the original invoice and amount of VAT with “-“ negative sign in <K_46> element.

-

If procedure is applied by the company, “Payed overdue” invoices in the period in which an overdue invoices was payed, the transaction must be reported with “WEW” document type, all the information about the Customer and invoice number from the original invoice and amount of VAT with “+“ positive sign in <K_47> element.

Supported business user scenario in AX 2012 R3

“Overdue vendor invoice” scenario is a scenario during which an invoice received from a vendor can go through three stages:

-

Vendor invoice is posted: tax transactions are posted; invoice is included to JPK > Ewidencja > ZakupWiersz as usually, according to tax setup and markers setup.

-

If the invoice is not payed after payment due date, the company can apply the Overdue debt VAT periodic task (Accounts payable > Periodic > Overdue debt > Overdue debt VAT). Tax transactions resulting this task will be reflected in JPK_VDEK report with: - all the information about the customer from the original invoice (posted on step 1), - VAT amount reported in <K_46> element with negative sign, - <TypDokumentu> element will be marked as “WEW” (internal document).

-

If the invoice posted on step 1 and not payed after payment due date company applied the Overdue debt VAT periodic task, was payed, the company must apply again ‘Overdue debt VAT’ periodic task in the period when the invoice was payed. Tax transactions resulting this task will be reflected in JPK_VDEK report with:- all the information about the customer from the original invoice (posted on step 1), - VAT amount reported in <K_47> element with positive sign, - <TypDokumentu> element will be marked as “WEW” (internal document).

P_54 and {P_55, P_56, P_57, P_58}

When you report amount of input tax surplus to be returned to account designated by the taxpayer in P_54 element you must also report one of the following fields:

-

P_55,

-

P_56,

-

P_57,

-

P_58.

System does not decide which one of these field you want to report together with P_54, select appropriately one of them and specify ‘1’ as value to have report correctly fulfilled.

P_59

If you specify value for P_60, system will automatically report P_59 in JPK_VDEK. You do not need to add this element and set ‘1’ value for it additionally to P_60 amount.

Hotfix Information

A supported hotfix is available from Microsoft. There is a "Hotfix download available" section at the top of this Knowledge Base article. If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.