Introduction

On July 13, 2017, the Financial Secretary to the Treasury and Paymaster General in the United Kingdom announced that Making Tax Digital (MTD) for value-added tax (VAT) takes effect on April 1, 2019.

Dynamics AX 2012 R3 supports MTD for VAT of the United Kingdom. To support the MTD for VAT requirements on Dynamics AX 2012 R3 the hotfixes were released: # 4488588, # 4515253, # 4505299, # 4527009, # 4523295.

Current update provides possibility to collect a common summarized VAT return basing on tax transactions posted in several Legal entities in AX 2012 R3. It is assumed that all the tax transactions for VAT return are in the same system using the same data base and it is supposed that tax transactions include all the information necessary for VAT return of the United Kingdom and preliminary VAT 100 report is correctly generated as for the VAT return in each legal entity involved into the summarized VAT return.

To use correctly the update the following steps must be done in each legal entity involved into the summarized VAT return:

-

Tax transactions are posted in each subsidiary legal entity according to the rules and principles of the United Kingdom.

-

VAT settlement (“Settle and post” procedure) is done in each subsidiary legal entity.

-

“VAT 100” report is correctly generated for preview in each subsidiary legal entity.

To report to HMRC a VAT return of the VAT group, one legal entity must be setup for interoperation with MTD APIs. Learn more how to setup an interoperation with VAT MTD in the KB # 4488588.

This article describes how to additionally setup and extend usage of the MTD for VAT feature for a “VAT group” scenario with the assumptions noticed above.

Overview

To prepare your Dynamics AX 2012 R3 to report VAT return for a VAT group, make sure that your business processes and the system setup are in-line with the following terms:

-

Tax information from all the subsidiaries is registered in the same system – AX 2012 R3.

-

All the tax transactions are correctly reflected in the system in accordance with the rules and principles of the United Kingdom.

-

Settlement periods for all the legal entities involved to the VAT group are defined identically and in full accordance with the period intervals defined in HMRC online account.

-

VAT settlement (Sales tax payment procedure) is done in each subsidiary legal entity.

-

“VAT 100” report is correctly generated for preview in each subsidiary legal entity.

-

One legal entity is setup for interoperation with HMRC according to the documentation (KB # 4488588) and user can request VAT obligations from this legal entity for the VAT group.

This article provides information:

-

How to setup additionally Web applications form to collect data from several legal entities for VAT return reporting of the VAT group.

-

How to use VAT returns submission form to collect information for VAT return reporting from several legal entities.

How to setup additionally Web applications form to collect data from several legal entities for VAT return reporting of the VAT group

To prepare your AX 2012 R3 to collect data from several legal entities for VAT return reporting of the VAT group:

-

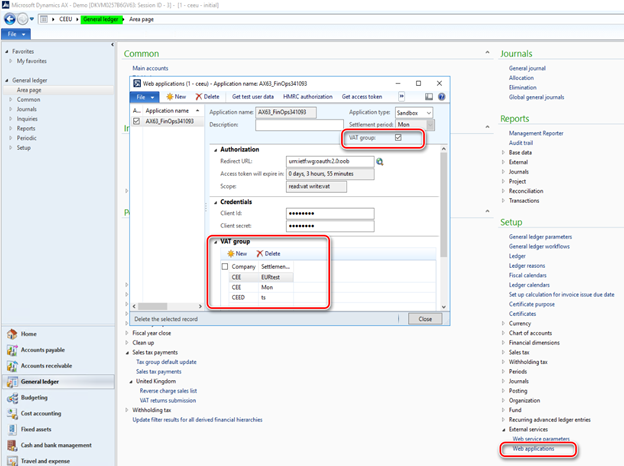

Open General ledger > Setup > External services > Web applications form.

-

Select the web application you are going to use for interoperation with HMRC for VAT reporting of VAT group and mark “VAT group” check box:

3. Go to “VAT group” fast tab and define Companies and related Settlement periods, tax transaction in which must be included into the VAT returns of the VAT group.

Important note : Only one web application marked as “VAT group” can be marked “Active”.

How to use VAT returns submission form to collect information for VAT return reporting from several legal entities

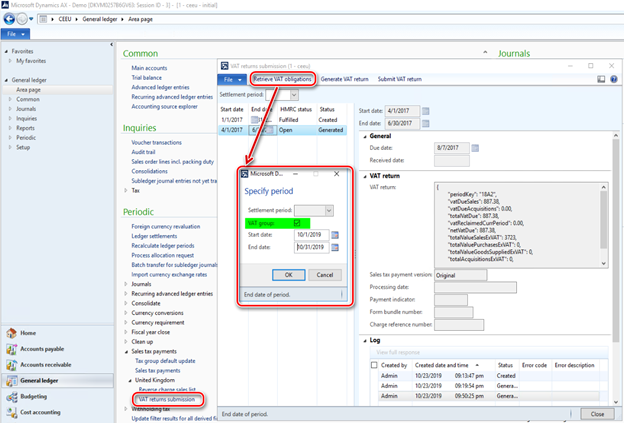

To interoperate with HMRC the VAT returns submission form is used. Lear more how to use this form in the KB # 4488588. Work with this form as usually for generation and submission to HMRC of VAT return for the VAT group. On retrieving of VAT obligations (via Retrieve VAT obligations button on the Action pane), mark “VAT group” check box:

When VAT obligations are retrieved, and you generate VAT return (via Generate VAT return button on the Action pane), system will collect tax transactions for VAT return from legal entities and VAT settlement periods according to the setup in Web applications form for the active web application marked “VAT group”.

Hotfix information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Download update for Microsoft Dynamics AX 2012 R3

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

A supported hotfix is available from Microsoft. If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.