Introduction

On 23rd of October 2018 in Italy the Law Decree 119 (L.D.119/2018) introduced a change in value-added tax (VAT) management in Italy that takes effect on July 1, 2019. Here is a summary of the change:

-

VAT payers can recover the input VAT in the VAT settlement for the month when the VAT point is triggered, even if the purchase invoice is received and recorded in the input VAT ledger before the fifteenth day of the next month. This rule doesn’t apply to transactions where the VAT point is triggered in a fiscal year that differs from the fiscal year in which the purchase invoice is received.

-

For supplies of services and supplies of goods, the invoice can be issued by the fifteenth day of the month after the month in which the VAT point was triggered. Invoices that are issued and booked before the fifteenth day of the month after the month in which the VAT point was triggered must be included in the VAT settlement of the previous month.

-

Currently, invoices must be issued no later than the VAT point of the transaction (that is, the date of the delivery for the domestic sales of goods). In particular, invoices can be issued up until midnight of the day when the VAT point was triggered. Starting on July 1, 2019, the invoice can be issued within 10 days of the VAT point. If the invoice isn’t issued at the VAT point, it should include, in addition to the invoice date, a reference to the VAT point date.

Invoices that are booked before the fifteenth day of the next month, but that have a reference to the previous VAT settlement, should not interrupt the sequential posting. Invoices with VAT point date in the previous month but invoice date in the current month should be booked in a chronological sequence with the invoices in the current month with a reference to the fact that these invoices are related to the previous VAT settlement.

Companies that issue the sales invoice on the same day, without applying the change that is introduced by L.D.119/2018, will remain compliant.

Overview

This hotfix is delivered to support the changes introduced by the L.D.119/2018 on Microsoft Dynamics AX 2012 R3.

The regulatory feature introduces a new date-type field for VAT transactions – Date of VAT register. The additional date will serve as a VAT point determination criterion for including VAT transactions in the scope of the sales tax settlement period and, effectively, in VAT returns reporting.

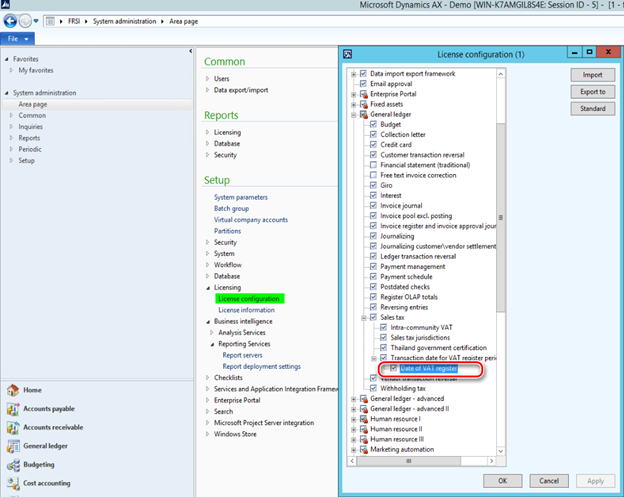

“Date of VAT register” activating

The Date of VAT register field is shared globally and can be enabled in legal entities with primary address in any country. To switch on this functionality “Date of VAT register” configuration key must be enabled in System administration > Setup > Licensing > License configuration under the General ledger > Sales tax > Transaction date for VAT register period:

When “Date of VAT register” configuration key is enabled, user can define additionally for sales tax transactions date of tax point by using Date of VAT register field.

“Date of VAT register” field appears in more than 20 forms. These forms include journals, sales orders, purchase orders, free-text invoices, vendor invoice journals, and project invoices. When you update or post the documents, all taxes are posted by using the corresponding date of the VAT register, and the date is included on forms such as the customer and vendor invoice journals forms.

Note, that system doesn’t allow to post an invoice with value of “Date of VAT register” field in a closed interval of sales tax settlement period.

“Date of VAT register” field appears also in the following reports:

-

General ledger > Reports > Reconciliation > Sales tax > Specification

-

General ledger > Reports > Reconciliation > Transactions > Sales tax transactions

-

General ledger > Reports > Reconciliation > Transactions > Groupings > Sales tax transactions - details

-

General ledger > Reports > Reconciliation > Transactions > Groupings > Sales tax specification by ledger transaction

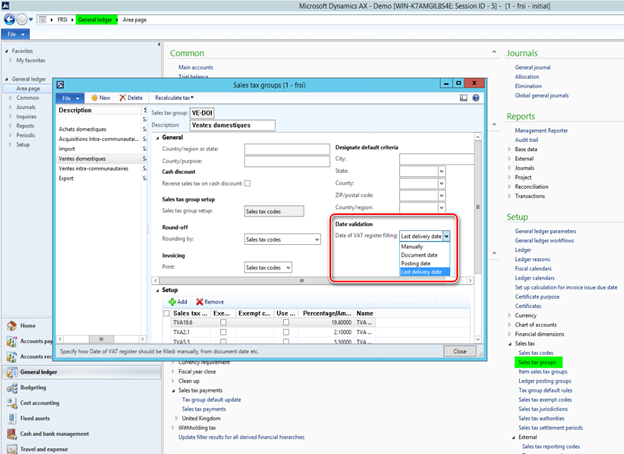

Auto-filling of “Date of VAT register” value

“Date of VAT register” configuration key enables possibility to select a method of auto-filling of “Date of VAT register” field via the Date of VAT register filling parameter on the Sales tax groups form:

This option fills in automatically “Date of VAT register” field during invoice creation. The following methods are available to select:

-

Manually – no value will be defined for Date of VAT register field. User can manually define the value before invoice posting.

-

Document date – value of Date of VAT register field will be defined automatically on document date change.

-

Posting date - value of Date of VAT register field will be defined automatically on posting date change.

-

Last delivery date - the date of last packing slip (for sales order) or product receipt (for purchase order) will be populated as Date of VAT register of the invoice.

“Date of VAT register” filling after invoice posting

If for some reason an invoice is posted with empty “Date of VAT register” field, it is still possible to fill it in. To do so, open General ledger > Inquires > Tax > VAT register transactions form. This form represents sales tax transactions with empty “Date of VAT register” field. You may select one record for update or a set of records. To define the value for Date of VAT register field of the select record(s), click “Date of VAT register” button on the Action pane of the form and specify the value in the “Date of VAT register” field of the dialog. Updated record(s) will be automatically filtered out from the list of records on the VAT register transactions form.

System doesn’t allow to update “Date of VAT register” field with a value in a closed interval of sales tax settlement period.

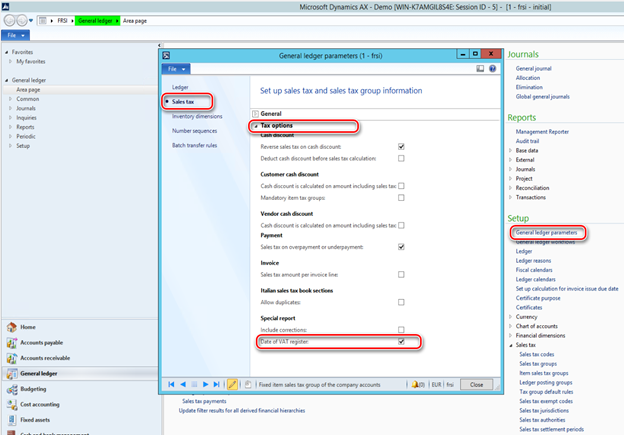

“Date of VAT register” impact on VAT settlement and reporting

When “Date of VAT register” configuration key is enabled, user in legal entity with primary address in Italy will be able to activate “Date of VAT register” parameter on General ledger parameters form:

When this parameter is switched on, sales tax settlement process (General ledger > Periodic > Sales tax payments > Sales tax payments) and “Italian sales tax payment report” will consider sales tax transactions by “Date of VAT register” instead of date of transaction posting.

Note, that system will not allow:

-

to switch On “Date of VAT register” parameter in General ledger parameters form if there are tax transactions posted in open interval of sales tax settlement period with value of “Date of VAT register” field in a closed interval of sales tax settlement period.

-

to switch Off “Date of VAT register” parameter in General ledger parameters form if there are tax transactions with value of “Date of VAT register” field in a closed interval of sales tax settlement period but posted in open interval of sales tax settlement period.

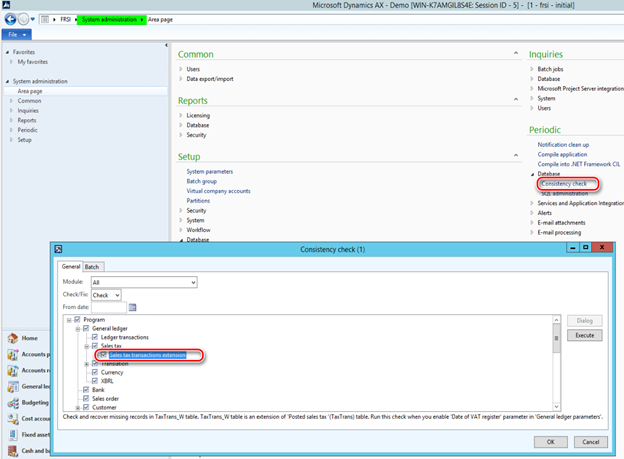

“Sales tax transactions extension” consistency check

“Date of VAT register” field is physically stored in a TaxTrans_W table which is an extension of TaxTrans table. When a company switches on “Date of VAT register” parameter in General ledger parameters form, data source queries on some forms in the system starts working differently, joining the TaxTrans_W table. It is possible that user will not be able to see tax transactions posted in the past period. It is because there are no corresponding transactions in TaxTrans_W table because it was not used in the past.

To avoid this issue, we recommend running “Sales tax transactions extension” consistency check. Open System administration > Periodic > Database > Consistency check form and mark Program > General ledger > Sales tax > Sales tax transactions extension check box (you don’t need to mark the parent checkboxes if you want to run only Sales tax transactions extension check):

Run “Sales tax transactions extension” consistency check with:

-

“Check” option to find out if there are missing transactions in TaxTrans_W table in your system. As a result, system will inform you about how many transactions in TaxTrans table miss corresponding records in TaxTrans_W table.

-

“Fix” option if you want to compensate missing records in TaxTrans_W table. As a result, system will insert corresponding records to the TaxTrans_W table and Posted sales tax transaction in the past periods will be seen again everywhere in the system.

Make sure that you have chosen the right date in From date on the dialogue. Leave From date field blank if you want to recover all the tax transactions in the system.

“Sales tax transactions extension” consistency check is available when “Date of VAT register” configuration key.

Changes in the Italian sales tax payment report

You may run “Italian sales tax payment report” via the following menu items:

-

General ledger > Reports > Transactions > Sales tax (Italy)

-

General ledger > Periodic > Sales tax payments > Sales tax payments

-

General ledger > Reports > External > Sales tax payments, Sales tax (Italy) button

-

General ledger > Reports > External > Sales tax payments, Print report button (when Italian report layout is defined for the Sales tax authority specified for the Sales tax settlement period of the selected Sales tax payment line)

“Date of VAT register” parameter on General ledger parameters form doesn’t impact on list of invoices represented on Sales tax book section(s) page(s), all the invoices posted in the related Sales tax book sections during the selected period will be included into the report. Nevertheless, resulting amounts of VAT will be calculated depending on “Date of VAT register” parameter on General ledger parameters form:

-

when “Date of VAT register” parameter on General ledger parameters form is switched On – by “Date of VAT register” of tax transactions in the period.

-

when “Date of VAT register” parameter on General ledger parameters form is switched Off – by posting date of tax transactions in the period.

When “Date of VAT register” parameter on General ledger parameters form is switched On, “Italian sales tax payment report” will additionally provide the following information:

1. Pages of sales tax books sections: new “Date of VAT point (Date of VAT register)” (in Italian: “Momento di effettuazione dell’operazione”) column – represents the value of “Date of VAT register” of tax transaction.

2. Totals by each sales tax book section is represented in three groups:

-

Operations in the actual period with competence date in the actual period

-

Operations in the actual period with competence date in the previous period

-

Operations in the next period with competence date in the actual period

3. Totals by sales and purchase books are represented in three lines:

-

Total operations in the actual period with competence date in the actual period

-

Total operations in the actual period with competence date in the previous period

-

Total operations in the next period with competence date in the actual period

4. Summary section which represent total VAT amounts by sales tax books sections grouped by sales tax book sections, is represented separately in three parts:

-

Operations in the actual period with competence date in the actual period

-

Operations in the actual period with competence date in the previous period

-

Operations in the next period with competence date in the actual period

5. Totals on summary section which represent total VAT amounts by sales tax books sections grouped by sales tax book sections, is represented separately in three lines:

-

Total operations in the actual period with competence date in the actual period

-

Total operations in the actual period with competence date in the previous period

-

Total operations in the next period with competence date in the actual period

Additionally, “Total calculated considering competence date” amount is provided in a separate line.

Hotfix information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Download update for Microsoft Dynamics AX 2012 R3

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

A supported hotfix is available from Microsoft. If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.