Summary

According to the orders of the Federal Tax Authority of the Russian Federation №ММВ-7-21/509@ from 30.08.2018, and №ММВ-7-21/118@ from 02.03.2018, form and electronic format of Land tax declaration were updated

Business requirements

According to the orders of the Federal Tax Authority of the Russian Federation №ММВ-7-21/509@ from 30.08.2018, and №ММВ-7-21/118@ from 02.03.2018, form and electronic format of Land tax declaration were updated.

Main changes are the following:

- In case of changing the Cadastral cost of Ground area during the reporting period, separate Section 2 should be generated, and land tax should be calculated separately for the period before the change and after the change. For this calculation reason, a new coefficient Ki (Change coefficient) is introduced (line 145 of the declaration)

- In case of changing from coefficient 2 to coefficient 4 for the ground areas where the housing construction is handled, also a separate Sections 2 should be created for land tax calculation with coefficient 2 and with coefficient 4. For this calculation reason, an existing coefficient Kv (Ownership coefficient) should be used.

- A new line 245 is introduced where Tax allowance as tax rate reduction should be reflected.

Overview

The following changes are implemented in the Microsoft Dynamics AX 2012 R3:

Changes in fixed asset card:

- You can track the history of Tax base (cadastral cost) changes for Ground area fixed asset

- You can track the history of Tax base (cadastral cost) changes for distributed Ground are fixed asset.

Changes in Land tax – ground areas tax register:

- Separate lines are created for the scenarios when a separate Sections should be generated in the declaration

- New fields Cost change factor and Cost change period are added

- New fields Allowance by reduction of rate and Allowance by reduction of rate amount are added.

User guide

Define Cadastral cost, Cadastral number, Category, Owned share for Ground area

In the fixed asset card, on the tab Technical information, you can define Cadastral number and Category of the Ground area. On the tab Tax reporting, you can define Tax base and Owned share.

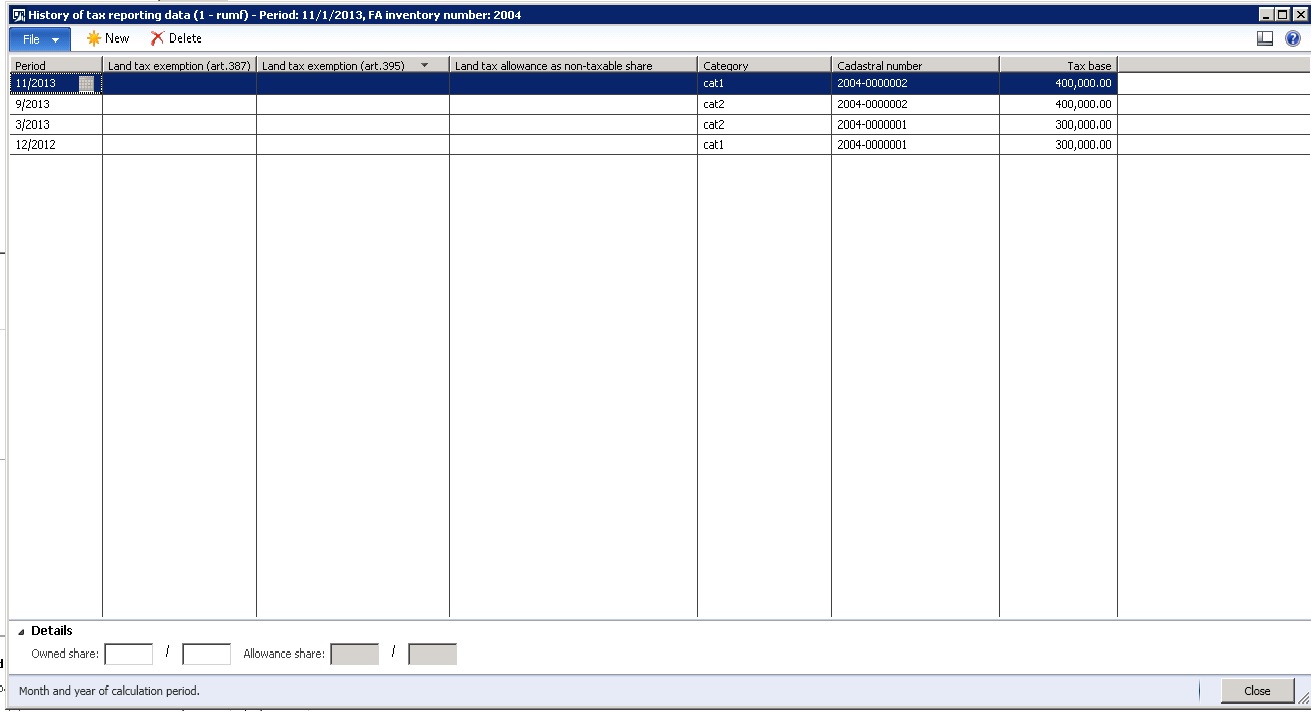

When the cadastral value (tax base) of the ground area is changed because of the change in quantitative or qualitative characteristics, you can define the new values in the form History of tax reporting data. Click Tax reporting data button in the Action pane of fixed asset card.

Define the Period, from which the change occurs (period format is Month-Year), define new value of Category, Сadastral number, Tax base and Owned share.

You may define only those values which are changed and not define values which are not changed. Values which are defined in this form, are not editable in the fixed asset card.

Note. When you define a Tax base change for the first time, you should create two lines: first with old values for the historical period and a new one with new values.

Note. Same form is used to define Land tax allowances.

Define the date when the housing construction is started on the Ground area.

In the fixed asset card, on the Technical information tab, define the value in the Start date of building

Calculate tax registers and generate declaration in the standard way.

Hotfix Information

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs2.microsoft.com/Support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

How to obtain the update

The updates are available for manual download and installation:

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.

File Information

Settings of electronic reporting for Land tax declaration are released through the following links:

PartnerSource: https://mbs.microsoft.com/partnersource/Global/deployment/downloads/hot-fixes/msdax2012r3taxdecru

CustomerSource: https://mbs.microsoft.com/customersource/Global/AX/downloads/hot-fixes/msdax2012r3taxdecru

More Information