Scope of setup guide

This setup guide explains the SII feature as released with the following Cumulative Updates:

SII Setup page

The feature is enabled on the SII Setup page where you need to import a certificate. Successful import of certificate will enable the feature.

When the feature is enabled, posted sales, purchase and service invoices, credit memos and corrective memos are submitted to the tax authorities.

Enabled

-

Enable the SII feature (is automatically enabled when you import certificate)

Batch submission of documents

The Enable Batch Submission and Job Batch Submission Threshold fields control if and how documents are submitted in batches

Enable Batch Submissions

-

Enable batch submissions of documents.

-

When you enable batch submissions you can either manually submit document in batches or automatically

-

Not enabled: each document is submitted when you post the document, and the result is shown in the SII History page

-

Automatically: Documents are transferred to SII History with Status = Pending when you post them and submitted in batches when threshold value is met or exceeded, see info on Job Batch Submission Threshold below

-

Job Batch Submission threshold

-

Specify the threshold number of documents with status = Pending that will trigger an automatic batch submission.

-

“Enabled” and “Enabled Batch submission” must both be set to Yes for the threshold value to have effect.

-

If Threshold = 0, documents will be submitted in “single” submission mode, which means that they will be submitted when you post the document

-

If Threshold > 0 it is used for batch submission. If number of pending entries exceeds the threshold value the system submits ALL pending auto entries.

-

User can always manually submit documents while they are Status = Pending (Retry, Retry All).

-

Import certificate

-

Import a valid certificate for the company.

Schedule initial upload

-

Use this action when you want to create an XML file with the required records for the initial phase from Jan 1st to June 30th, 2017.

-

This must be done before December 31st, 2017 (current requirement as of June 19, 2017).

Show SII History

-

You can review the SII history.

IMPORTANT NOTE

The solution points to the actual (live, production) endpoints for the mandatory phase, as of July 1, 2017.

If you want to test the solution you need to change the endpoint to the ones specified in the documentation provided by the tax authorizes, see website: http://www.agenciatributaria.es/AEAT.internet/SII.html

Current description of endpoints is found in ”Información sobre Fase de Pruebas y fase de Producción del SII” (as of June 19, 2017).

SII information on documents – invoice and transaction types

On sales, purchase and service orders, invoices, credit memos and corrective invoices you can enter SII information.

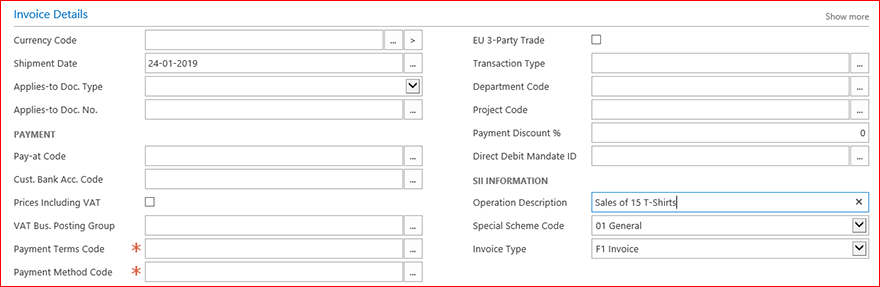

Invoice Details from sales Invoice (similar fields are found on the other documents, the list of option values differ):

Operation Description

-

You can enter a description of the transaction.

-

Default is blank and if left blank the Operation Description will be taken from the Posting Description when the XML file is generated.

Special Scheme Code

-

You can enter a value for Regimen codes.

-

Defaults will be 01 for domestic customers/vendors, 02 for exports.

-

When “Unrealized VAT” is set in the General Ledger Setup (cash-based) the default value will be 07 and you cannot change it unless you change the setup in the General Ledger.

Invoice Type

-

You can select an invoice type.

-

Default is F1 for invoices and R1 for credit memos and corrective invoices.

-

You can choose F2 for simplified invoices. Simplified invoices do not have the counterpart information.

Note: The fields contain options currently not supported. Partners can customize solutions using these options.

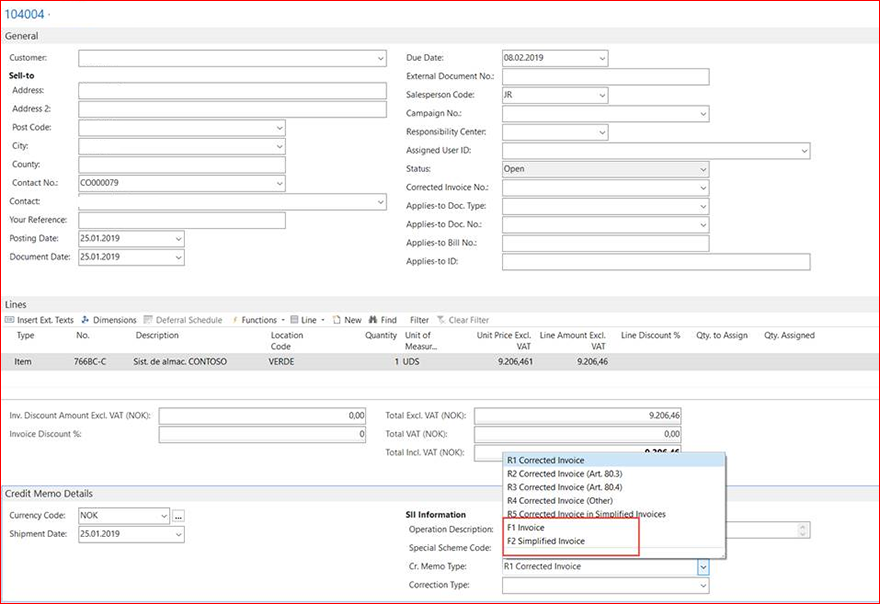

Credit memos with Invoice Type F1/F2

You are able to send credit memos with type F1/F2 if needed.

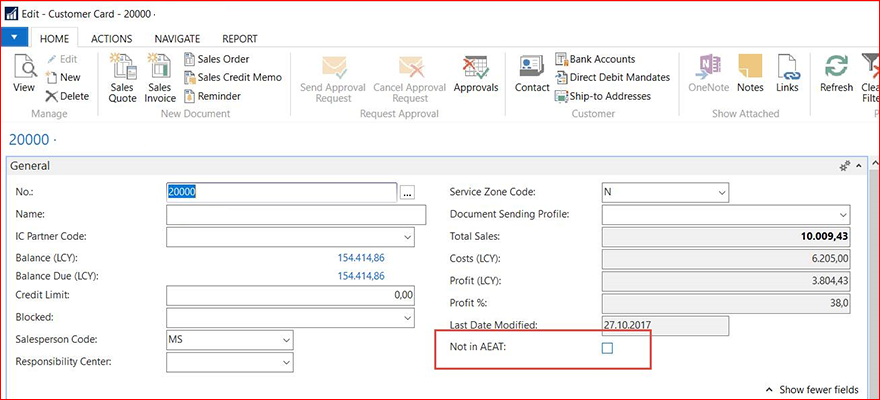

SII information on Customer Card – Not registered in AEAT

If a customer’s NIF number is not yet registered in the AEAT database when you submit a document the document will be rejected.

In this case you must can select the checkbox Not in AEAT on the Customer Card and resubmit the document.

Not in AEAT

-

You can select this checkbox and resubmit the document from the SII History page. A second submission of the document will fill in the XML in the correct way for this scenario.

-

When you resubmit the corrected document the submission will be Accepted with Errors, which is the expected response for such a document.

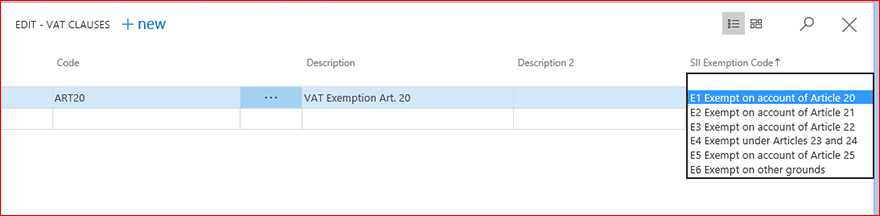

SII information on VAT clauses – VAT exemptions

To indicate VAT exemptions under the SII scheme you can select an Exemption code for a VAT Clause or you can create new VAT Clause that corresponds to the exemption.

IMPORTANT

The default values are provided to cover standard scenarios. Your business and type of business transactions and any customization you may have may require you to select a different value to meet the reporting requirements under SII. Microsoft can make no guarantee that the use of default values will be compliant in all cases.

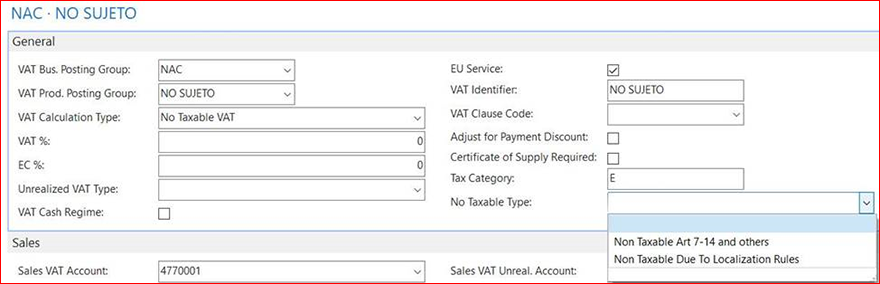

SII information in VAT Posting Groups

To enable reporting on “Non Taxable Due To Localization Rules” there is a new field in the VAT Posting Setup (No Taxable Type). This can either be empty or have one of the following options, as illustrated:

No Taxable Type

-

If it is empty or set to Non Taxable Art 7-14 the system will use the value for Non Taxable Art 7-14 in the submissions. You can use the Non Taxable due to Localization Rules if this applies to the document

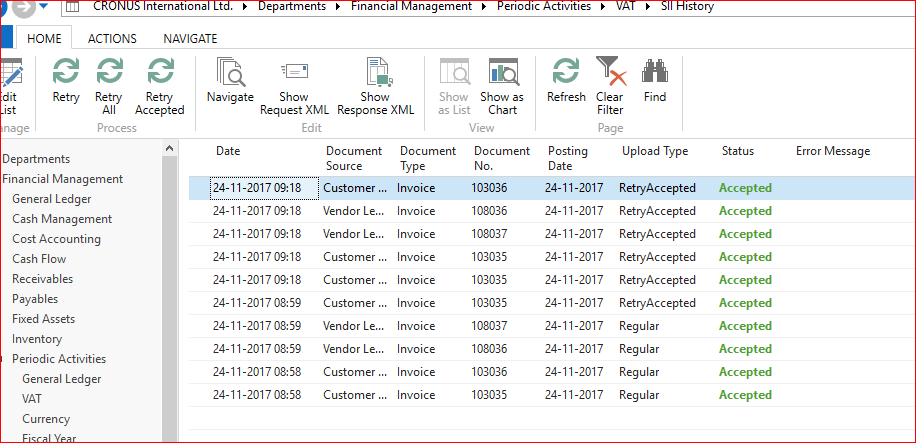

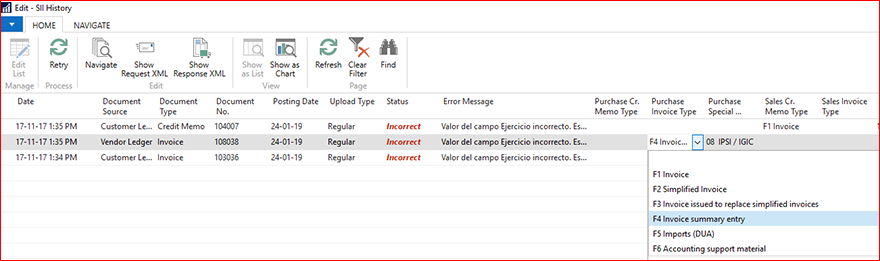

SII History page

You can view all submitted documents from the SII History page. You can also see if a document was rejected and you can see the rejection message.

Retry

-

You can resubmit rejected documents.

-

Multiple page selection is used when Batch is enabled.

-

-

Note: In some cases, the information submitted is tied to the document and you therefore must cancel – create a credit memo manually - the document and send a new with updated information.

RetryAll

-

Sends all not-accepted entries regardless of the page selection (all system entries).

Retry Accepted

-

The same as “Retry”, but only for “Accepted” entries.

-

Multiple page selection is used.

-

Show Request XML

-

Open the submitted XML document to see what information you have sent to the tax authorities.

Show Response XML

-

Open the received response XML from the tax authorities. This XML file can be used to troubleshoot if the submitted document was rejected.

Note: The XML documents as provided as-is. Hence, you may want to use an XML viewer to better view the information in the XML file.

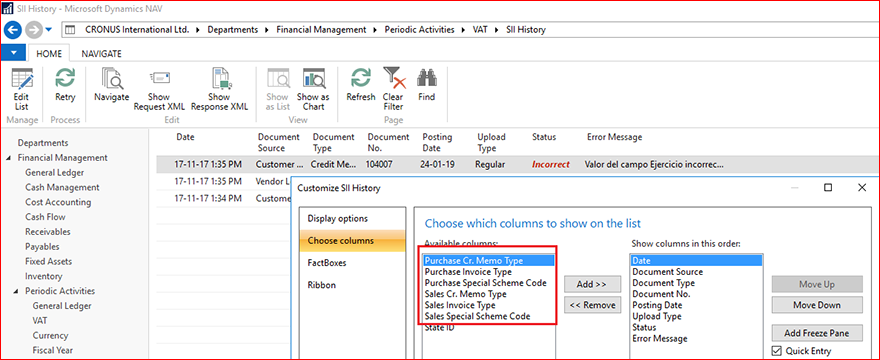

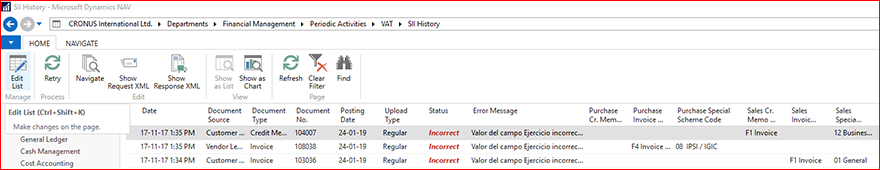

Editing SII information on already submitted entries

If you select incorrect values for the SII parameters on the documents submitted and the document is rejected you can change the values and resubmit the document

To make changes to a rejected document, you

-

Open SII History page and press Choose Columns, add the fields “Invoice Type”, “Cr. Memo Type” and “Special Schema Code” for both Sales and Purchase on page.

-

Press Edit List to change values in the SII related fields.

-

Press Retry to send document with the modified values

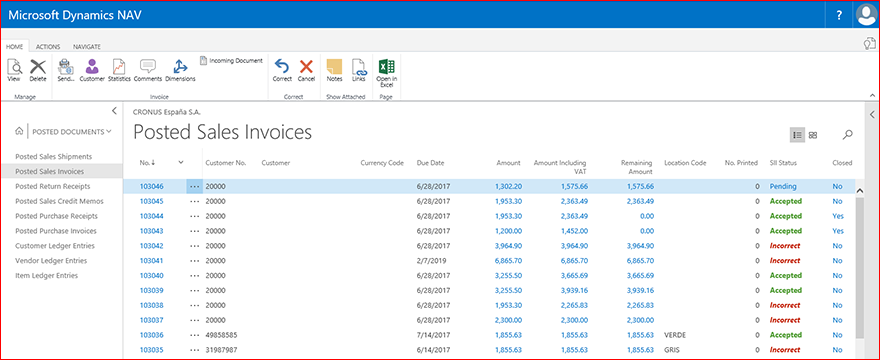

SII status on Posted Document lists

You can also see the SII Status on the lists for the posted documents.

The SII Status is a link to the SII History page with a filter for the document so it’s easier to track the document’s history.

Example from Posted Sales Invoices list.

Initial submission – January 1st – June 30th

From the SII Setup page, you can create an XML file to submit documents covering the initial reporting period January 1st to June 30th, 2017.

Note: It is mandatory to submit the initial file before December 31st, 2017

Known issues & Prerequisites

Technical prerequisites – Job queue

The integration utilizes Job queue for sending requests to SII, hence Job Queue needs to be enabled/started.