Introduction

Value Added Tax (VAT) was introduced in the United Arab Emirates on 1 January 2018. The issued Federal Decree Law No. (8) of 2017 on Value Added Tax, outlines the tax scope, rate, responsibility for tax, supply of goods and services in all cases, including supply in special cases, supply of more than one component, supply via agent, supply by government entities and cases of deemed supply. Check more details about VAT regulations on Federal Tax Authorities of United Arab Emirates website.

Note: Apart from delivery of this update to UAE VAT reporting localization functionality, Microsoft will work with the UAE Federal Tax Authorities to obtain accreditation for tax accounting software providers.

Overview

Standard sales tax functionality in Microsoft Dynamics AX 2012 R3 for Finance and Operations fulfils majority of legislation requirements of United Arab Emirates VAT law. Following country/region specific enhancements has been added for UAE VAT localization in order to align with UAE requirements in area of VAT reporting:

-

Sales Tax configuration in General ledger parameters has been extended with additional fields required for VAT reporting.

-

VAT Reverse Charge functionality has been enabled for UAE (ARE country/region context) to properly record taxable domestic operations within GCC territory.

-

UAE country/region specific Sales Invoice and Credit notes printout layouts have been added with additional columns and VAT summary information.

-

Sales Invoice and Credit notes for UAE are printing in two languages including new ar-AE Arabic language for user interface.

-

VAT Return declaration report is printed to electronic file format ready for uploading to e-TAX FTA portal.

-

Standard Audit File functionality has been shared with UAE local functionality. Required by Federal Tax Authorities FTA VAT audit file (FAF) can be exported accordingly to required Comma separated file format.

See the detailed information about the standard sales tax functionality under the following links:

-

Set up conditional sales taxes (is used for cash accounting basis)

Activation of United Arab Emirates localized functionality

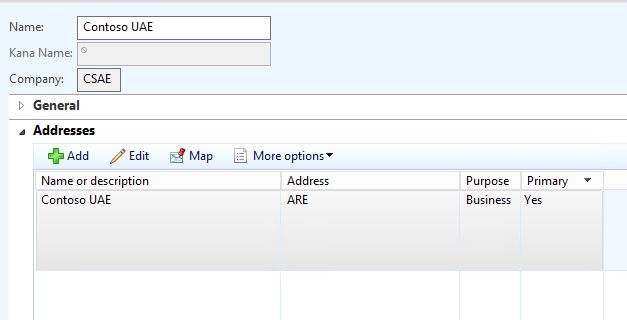

UAE country/region specific functionality is activated through configuration Localized functionality region in configuration of Legal entity. In case Localized functionality region is detected using company address make sure primary address of legal entity has country code set to ARE.

Configure Sales tax parameters

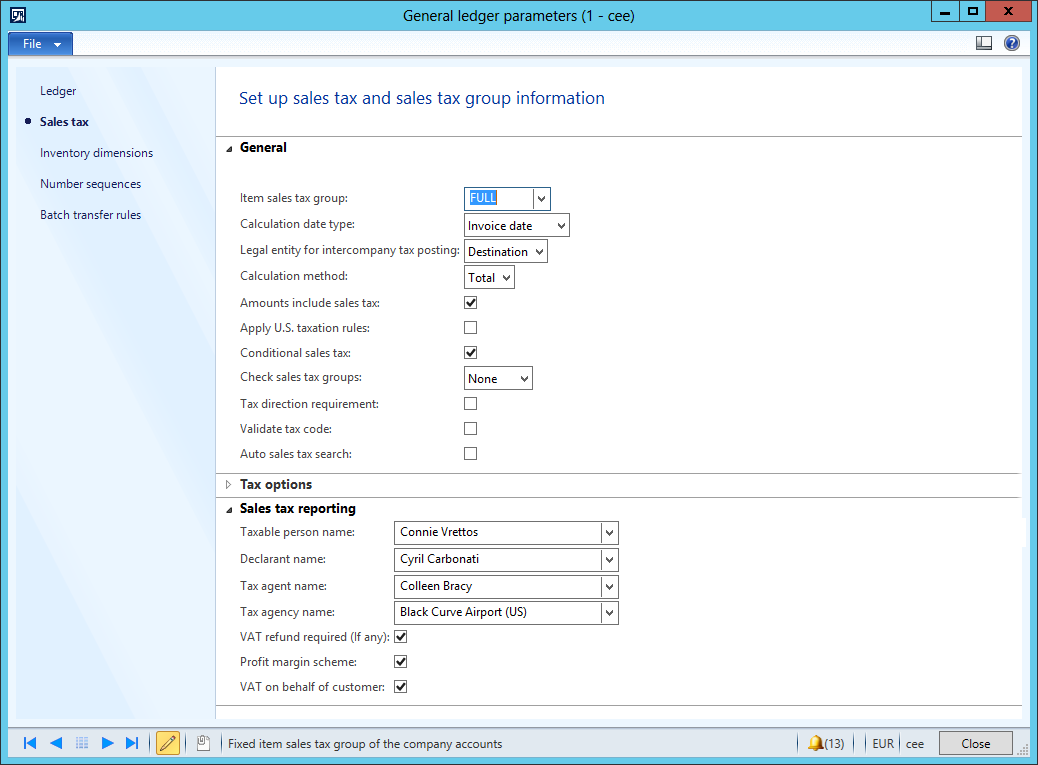

VAT Declaration and FAF audit file require additional information which is required to be setup in configuration of legal entity. Open General Ledger >> General ledger parameters >> Sales tax and in section Sales tax reporting select following information:

-

Taxable person name - electronic VAT reports require name of the taxable person. Name in English and Arabic will be populated in reports. Defining Party in Global Address Book use Known As field to enter names in other language like Arabic in case Legal Entity UI language is set to English.

-

Declarant name - Information about person preparing VAT declaration will be included in the electronic report.

-

Tax agency name, Tax agent name - Tax Agency Name, Tax Agency Number, Tax Agent Name and Tax Agent Approval Number are required in electronic reporting in case VAT report areprepared by contracted tax agent - vendor.

-

VAT refund required - Select this option if a VAT refund is due and company requests to receive VAT refund.

-

Profit margin scheme - Company should mark this option if they operate in special business scheme using Profit Margin scheme.

-

VAT on behalf of another person - Mark this option if your company operate as an agent who pays import VAT on behalf of another taxable person.

Learn more about VAT reporting requirements from instructions at UAE Federal Tax Authorities website in section dedicated to Requirements Document for Tax Accounting Software.

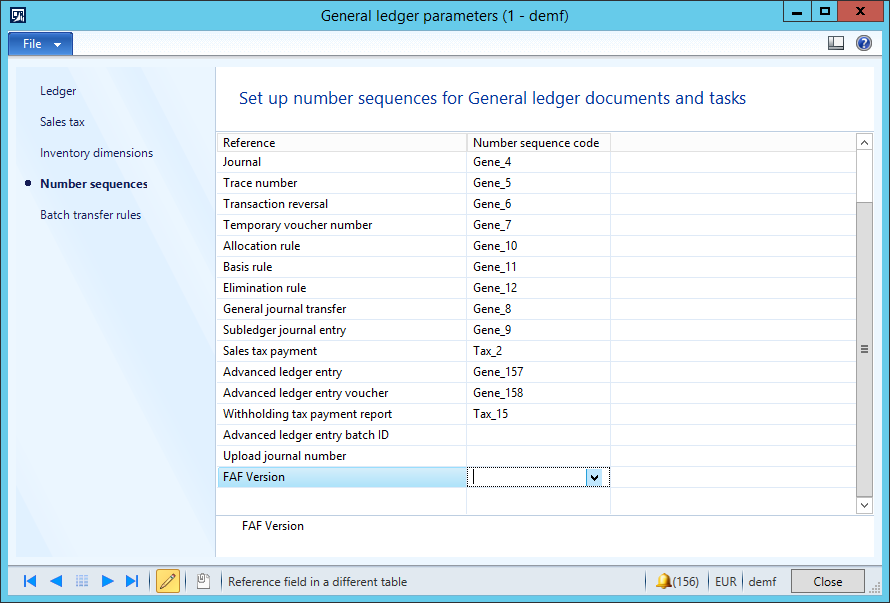

FTA VAT audit file (FAF) require additional setup to keep continues versioning of generated files. Open General Ledger >> General ledger parameters >> Number Sequences >> FAF Version and select a sequence related to versions of FAF declaration.

Configure Tax authority

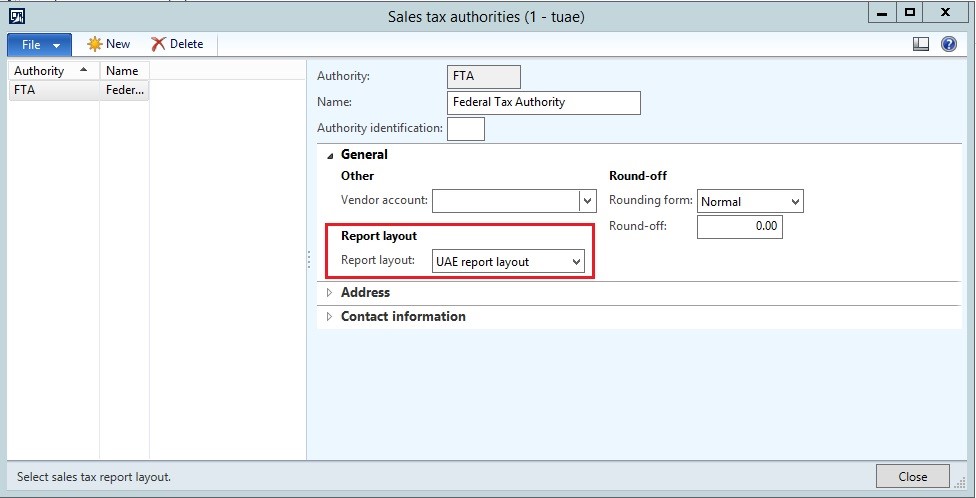

Federal Tax Authority needs to be setup as sales Tax authority. Once vendor account will be associated with tax authority system will create automatic payments to vendor payables during the settlement process and subsequently payments can be released against vendor (tax authority). Navigate to General Ledger >> Setup>> Sales tax >> Sales tax authorities and setup your FTA office information using information from following example:

With Configured Tax Authority you may proceed to associate Sales tax settlement periods with the tax authority you have just configured and Sales tax codes.

Configure Sales tax codes

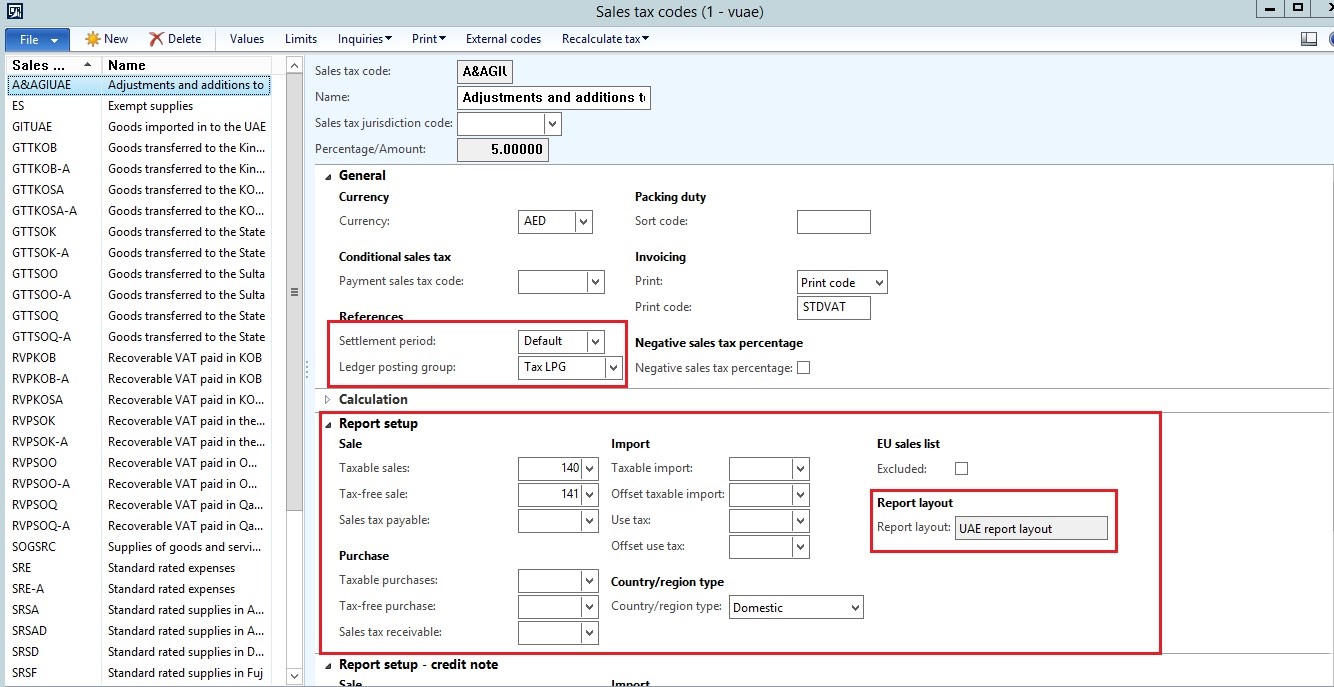

VAT Declaration electronic report is based on configuration of specific sales tax UAE report layout which should be set up in Tax Authority and get propagated to configuration of Sales tax codes.

To run UAE report layout representing the electronic VAT declaration it is necessary to setup appropriate numbers of reporting codes associated with each VAT declaration reporting amount.

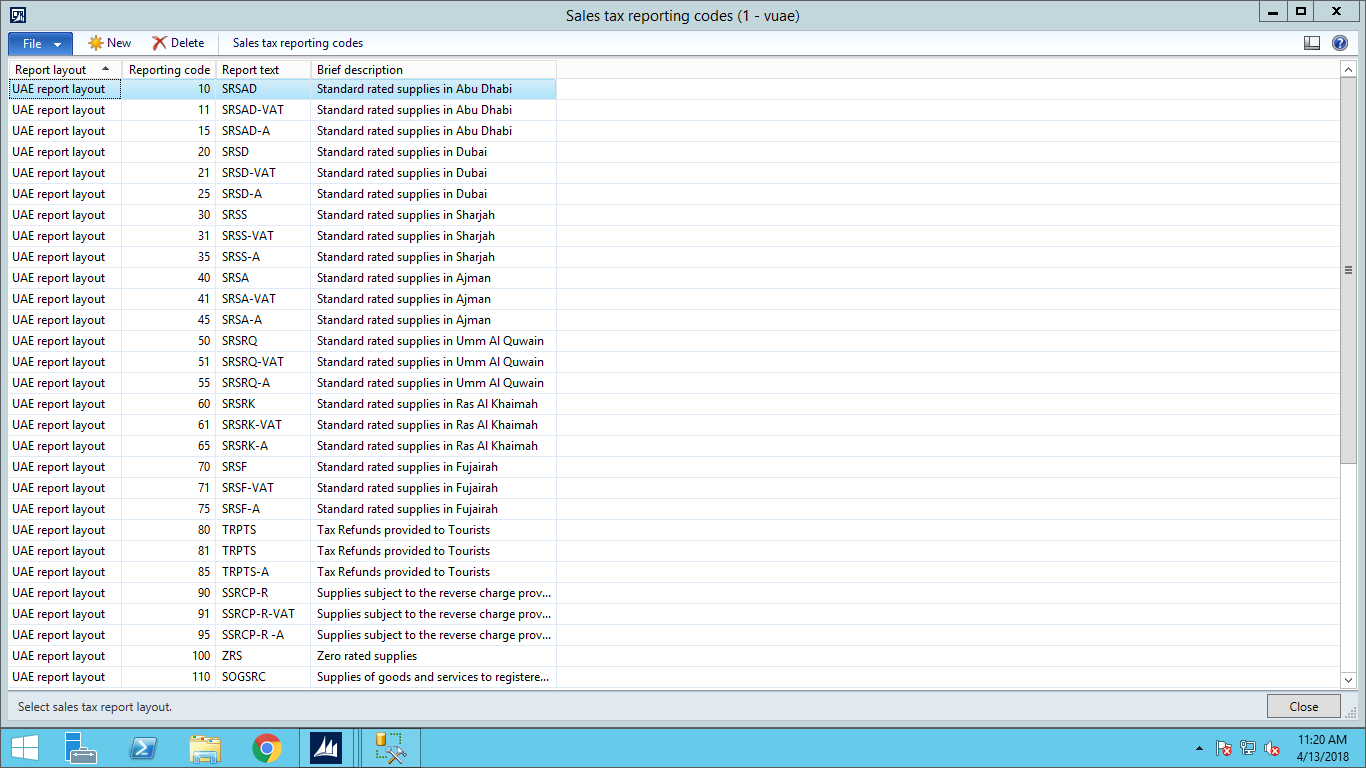

Navigate to General ledger >> Setup >> Sales tax >> External >> Sales tax reporting codes and setup sales tax reporting codes and later Sales tax codes accordingly with instructions from following table:

|

Sales Tax Code |

VAT Reporting Code |

Report Setup |

Description |

VAT rate |

|

SRSAD |

10 |

Sale>Taxable sales |

Standard rated supplies in Abu Dhabi |

5 |

|

11 |

Sale>Tax Payable |

|||

|

SRSAD-A |

15 |

Sale>Tax Payable |

Standard rated supplies in Abu Dhabi – Adjustment |

|

|

SRSD |

20 |

Sale>Taxable sales |

Standard rated supplies in Dubai |

5 |

|

21 |

Sale>Tax Payable |

|||

|

SRSD-A |

25 |

Sale>Tax Payable |

Standard rated supplies in Dubai – Adjustment |

|

|

SRSS |

30 |

Sale>Taxable sales |

Standard rated supplies in Sharjah |

5 |

|

31 |

Sale>Tax Payable |

|||

|

SRSS-A |

35 |

Sale>Tax Payable |

Standard rated supplies in Sharjah – Adjustment |

|

|

SRSA |

40 |

Sale>Taxable sales |

Standard rated supplies in Ajman |

5 |

|

41 |

Sale> Tax Payable |

|||

|

SRSA-A |

45 |

Sale> Tax Payable |

Standard rated supplies in Ajman – Adjustment |

|

|

SRSRQ |

50 |

Sale>Taxable sales |

Standard rated supplies in Umm Al Quwain |

5 |

|

51 |

Sale>Tax payable |

|||

|

SRSRQ-A |

55 |

Sale>Tax payable |

Standard rated supplies in Umm Al Quwain – Adjustment |

|

|

SRSRK |

60 |

Sale>Taxable sales |

Standard rated supplies in Ras Al Khaimah |

5 |

|

61 |

Sale>Tax payable |

|||

|

SRSRK-A |

65 |

Sale>Tax payable |

Standard rated supplies in Ras Al Khaimah – Adjustment |

|

|

SRSF |

70 |

Sale>Taxable sales |

Standard rated supplies in Fujairah |

5 |

|

71 |

Sale> Tax Payable |

|||

|

SRSF-A |

75 |

Sale>Tax payable |

Standard rated supplies in Fujairah – Adjustment |

|

|

TRPTS |

80 |

Sale>Taxable sales |

Tax Refunds provided to Tourists |

5 |

|

81 |

Sale> Tax Payable |

|||

|

TRPTS-A |

85 |

Sale>Tax payable |

Tax Refunds provided to Tourists – Adjustment |

|

|

SSRCP-R |

90 |

Purchases>Taxable Purchases |

Supplies subject to the reverse charge provisions-Sales |

5 |

|

91 |

Purchases>Taxable Receivable |

|||

|

SSRCP-R-A |

95 |

Purchases>Taxable Receivable |

Supplies subject to the reverse charge provisions-Sales – Adjustment |

|

|

ZRS |

100 |

Sale> Taxable sales |

Zero rated supplies |

0 |

|

SOGSRC |

110 |

Sale> Taxable sales |

Supplies of goods and services to registered customers in other GCC implementing states |

5 |

|

ES |

120 |

Sale> Taxable sales |

Exempt supplies |

0 |

|

GITUAE |

130 |

Sale>Taxable sales |

Goods imported in to the UAE |

|

|

131 |

Sale>Tax Payable |

|||

|

GITUAE-A |

135 |

Purchases>Taxable Receivable |

Goods imported in to the UAE – Adjustment |

5 |

|

A&AGIUAE |

140 |

Sale>Taxable sales |

Adjustments and additions to goods |

|

|

141 |

Sale>Tax Payable |

|||

|

A&AGIUAE-A |

145 |

Sale>Tax Payable |

Adjustments and additions to goods – Adjustment |

5 |

|

SRE |

150 |

Purchases>Taxable Purchases |

Standard rated expenses |

|

|

151 |

Purchases>Taxable Receivable |

|||

|

SRE-A |

160 |

Purchases>Taxable Receivable |

Standard rated expenses – Adjustment |

5 |

|

SSRCP |

170 |

Sale>Taxable sales |

Supplies subject to the reverse charge provisions |

|

|

171 |

Sale>Tax Payable |

-5 |

||

|

SSRCP-A |

175 |

Sale>Tax Payable |

Supplies subject to the reverse charge provisions – Adjustment |

|

|

GTTKOB |

180 |

Sale>Taxable sales |

Goods transferred to the Kingdom of Bahrain |

|

|

181 |

Sale>Tax Payable |

5 |

||

|

GTTKOB-A |

185 |

Sale>Tax Payable |

Goods transferred to the Kingdom of Bahrain – Adjustment |

|

|

GTTSOK |

190 |

Sale>Taxable sales |

Goods transferred to the State of kuwait |

|

|

191 |

Sale>Tax Payable |

5 |

||

|

GTTSOK-A |

195 |

Sale>Tax Payable |

Goods transferred to the State of kuwait – Adjustment |

|

|

GTTSOO |

200 |

Sale>Taxable sales |

Goods transferred to the Sultanate of Oman |

|

|

201 |

Sale>Tax Payable |

5 |

||

|

GTTSOO-A |

205 |

Sale>Tax Payable |

Goods transferred to the Sultanate of Oman – Adjustment |

|

|

GTTSOQ |

210 |

Sale>Taxable sales |

Goods transferred to the State of Qatar |

5 |

|

211 |

Sale>Tax Payable |

|||

|

GTTSOQ-A |

215 |

Sale>Tax Payable |

Goods transferred to the State of Qatar – Adjustment |

|

|

GTTKOSA |

220 |

Sale>Taxable sales |

Goods transferred to the Kingdom of Saudi Arabia |

|

|

221 |

Sale>Tax Payable |

|||

|

GTTKOSA-A |

225 |

Sale>Tax Payable |

Goods transferred to the Kingdom of Saudi Arabia – Adjustment |

5 |

|

RVPKOB |

230 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the Kingdom of Bahrain |

|

|

231 |

Purchases>Taxable Receivable |

|||

|

RVPKOB-A |

235 |

Purchases>Taxable Receivable |

Recoverable VAT paid in the Kingdom of Bahrain – Adjustment |

5 |

|

RVPSOK |

240 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the State of kuwait |

|

|

241 |

Purchases>Taxable Receivable |

|||

|

RVPSOK-A |

245 |

Purchases>Taxable Receivable |

Recoverable VAT paid in the State of kuwait – Adjustment |

5 |

|

RVPSOO |

250 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the Sultanate of Oman |

|

|

251 |

Purchases>Taxable Receivable |

|||

|

RVPSOO-A |

255 |

Purchases>Taxable Receivable |

Recoverable VAT paid in the Sultanate of Oman – Adjustment |

5 |

|

RVPSOQ |

260 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the State of Qatar |

|

|

261 |

Purchases>Taxable Receivable |

|||

|

RVPSOQ-A |

265 |

Purchases>Taxable Receivable |

Recoverable VAT paid in the State of Qatar – Adjustment |

5 |

|

RVPKOSA |

270 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the Kingdom of Saudi Arabia |

|

|

271 |

Purchases>Taxable Receivable |

|||

|

RVPKOSA-A |

275 |

Purchases>Taxable Purchases |

Recoverable VAT paid in the Kingdom of Saudi Arabia – inAdjustment |

5 |

In the result Sales tax reporting codes configuration should look similar to following image:

Configure Sales tax codes associating them with relevant Sales tax reporting codes in Report setup section of each relevant to your company busienss Sales tax code using instructions from colum Report setup provided in the above table.

Learn more about sales tax configuration intax section of documentation.

Set up of VAT reverse charge

In cases when a Taxable Customer is obligated to pay Tax on a supply received from a non-resident supplier, VAT should be calculated and paid to tax authorities VAT Reverse Charge basis. The customer must calculate and report the output tax on the supply and relevant input tax.

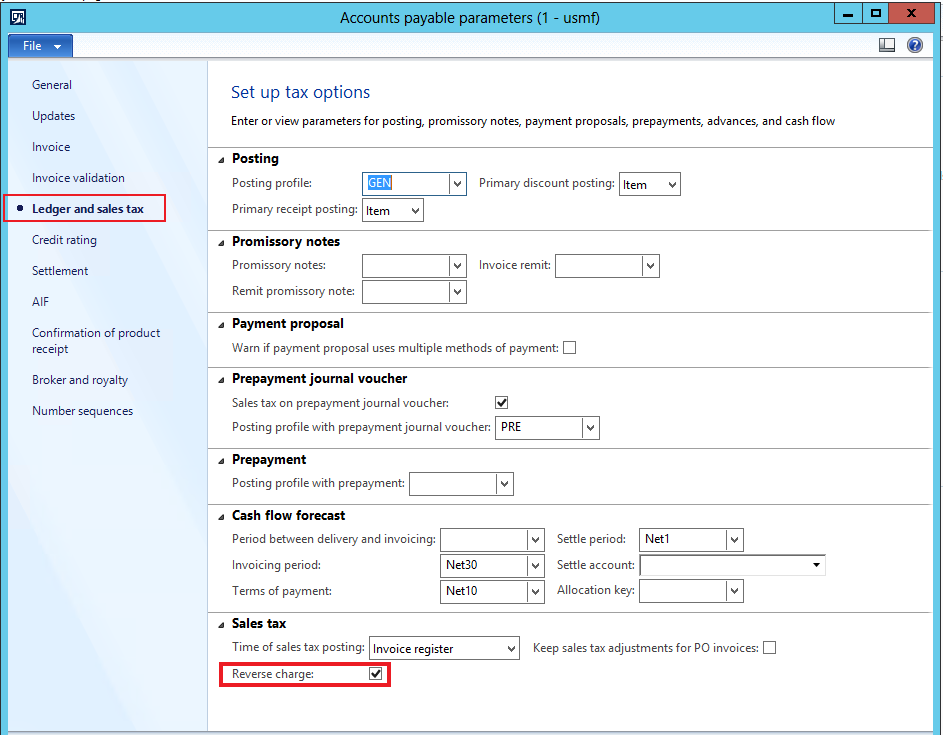

In order to use reverse charge functionality it is necessary to select the Reverse charge option in the Accounts Payable >> Setup >> Accounts Payable Parameters form (see screenshot below).

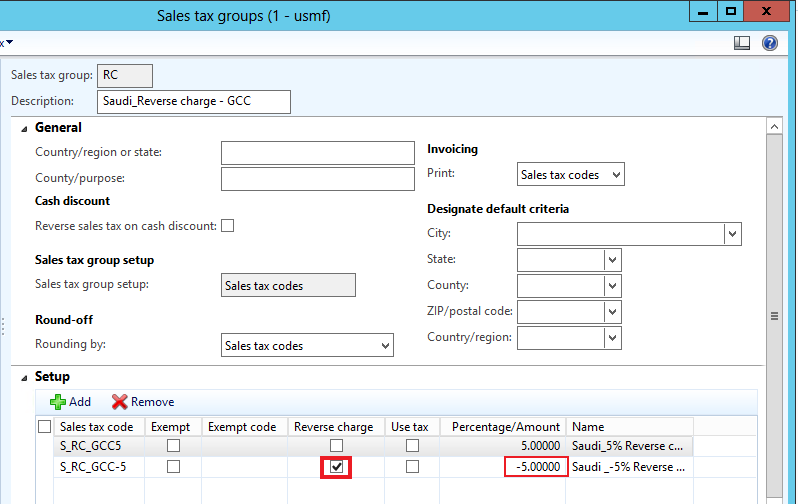

Before setting the sales tax group for reverse charge, you should set up two sales tax codes: one for input sales tax and other for output sales tax. Output sales tax code should be set up with a negative value. For more information, see Setting up sales tax codes.

It is necessary to select the Reverse charge check box on the line with the negative sales tax rate (see screenshot below) in the reverse charge sales tax group.

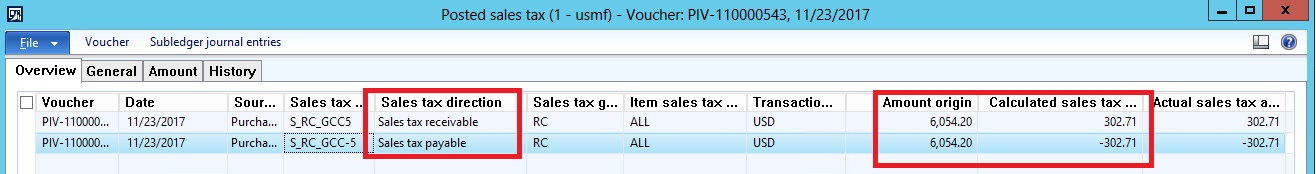

When posting the invoice line with reverse charge sales tax group, the system will create two sales tax transactions: one with Sales tax receivable tax direction and other with Sales tax payable tax direction.

Download and setup electronic reports configurations

Implementation of VAT reporting for United Arab Emirates is based on Electronic Reporting configurations. Learn more about capabilities and concepts of configurable reporting at Electronic reporting website.

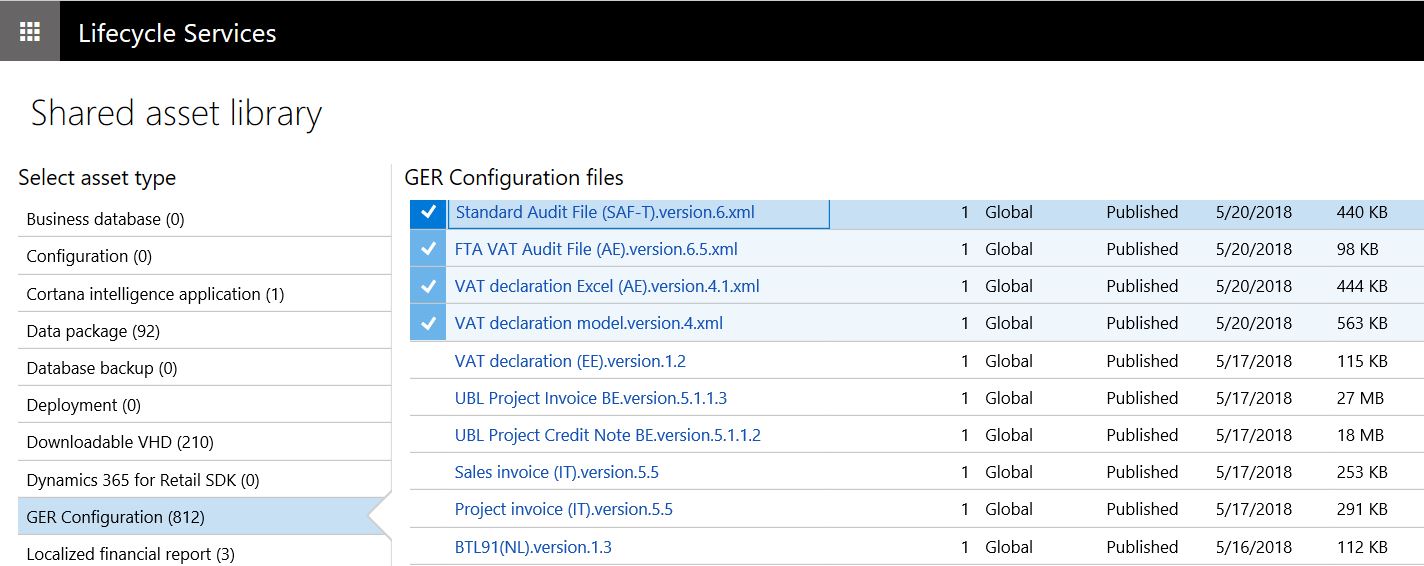

Following configurations have to be installed in order to use VAT declaration and FAF audit file functionality in UAE localization:

|

Configuration Name |

Configuration Type |

|

VAT declaration model.version.4.xml |

Data model |

|

VAT declaration Excel (AE).version.4.1.xml |

UAE specific MS Excel output format |

|

Standard Audit File (SAF-T).version.6.xml |

Data model |

|

FTA VAT Audit file (AE).version.6.5.xml |

UAE FTA audit file CSV output format |

To download these configurations, first open http://lcs.dynamics.com/ and after log on the portal, click on Shared asset library:

In Shared asset library select GER configurations and click on Download all:

Specify the path where zip file with all the GER configuration files should be stored, extract all configurations. Create new folder and move only required configurations as per above table.

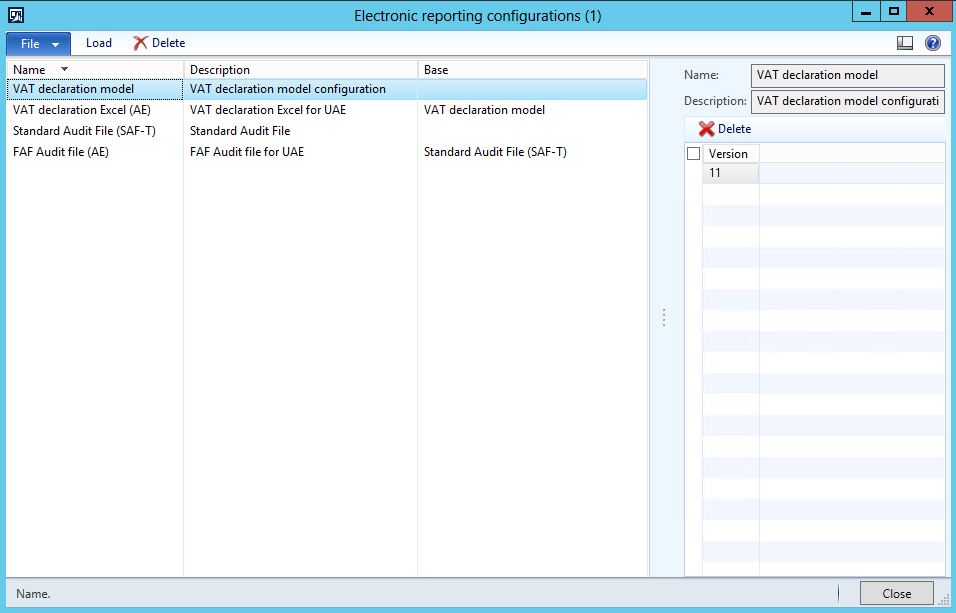

In the application navigate to Organization administration >> Setup >> Electronic reporting >> Electronic reporting configurations. Select folder with selected configurations and click button Load to upload required configuration for VAT declaration and FAF declaration.

VAT declaration electronic reporting file

To generate VAT declaration report in Excel format use standard procedure for reporting sales tax for settlement reporting period to settle taxes and print VAT declaration report.

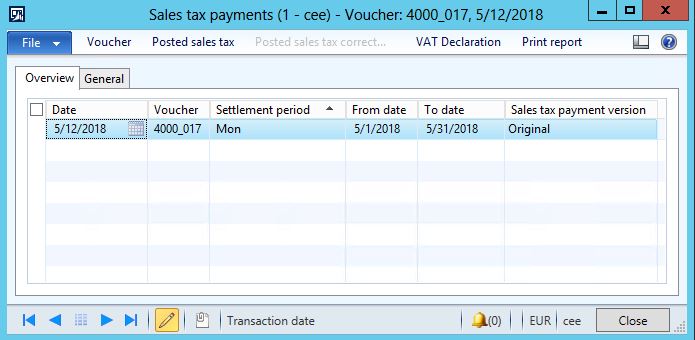

In order to generate VAT Declaration after settlement is done for a period navigate to: General Ledger >> Reports >> External >> Sales tax payments select required sales tax payment and press VAT Declaration button on action pane.

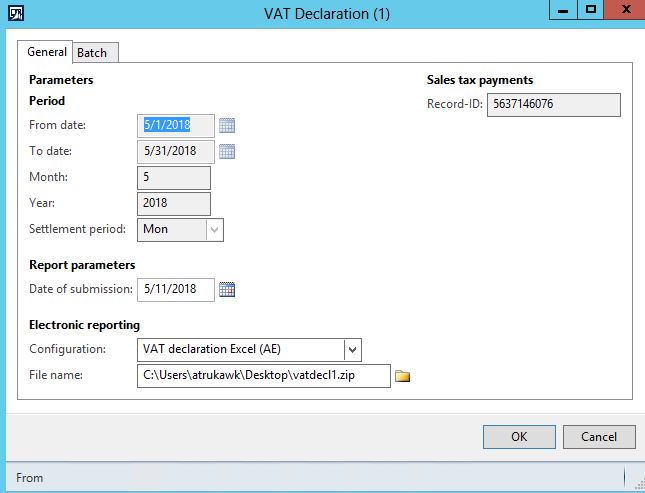

Follow VAT declaration report dialog and fill in required information.

Save and verify content of reported data inside of the Excel spreadsheet. According to FTA accounting systems requirements electronic reporting file cannot be edited after generation from system. In case corrections of reported data needs to be done it has to happen in the system.

After corrections proceed with generating new reporting file. After successful validation proceed with procedure of file uploading to FTA e-Tax portal using procedures specific to your company registration with FTA.

Note: Before executing generation of VAT declaration and also FAF file, make sure you have setup directory for system file store in System Administration >> System Parameters >> File store. Otherwise you will not be able to download files created by the system.

Generate FTA VAT audit file

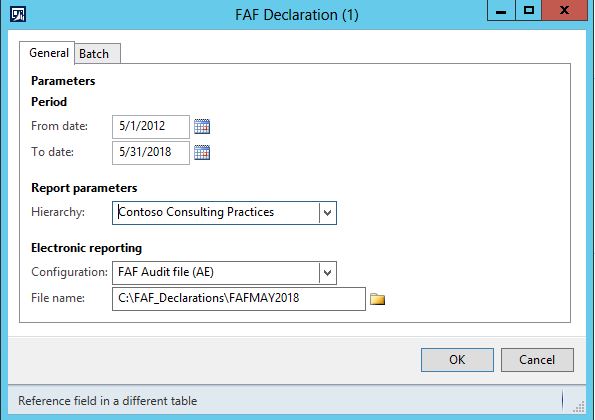

In case FTA VAT Audit file has been requested follow dialog questions after running generation of FAF audit file at General Ledger >> Sales tax payments >> FAF Declaration.

In case you expected large volume of transactions is scope of audited period, you can decide to deliver for FAT audit multiple files. Consider running the FAF file generation in background with batch processing and dividing audited periods into smaller intervals months, weeks or days periods.

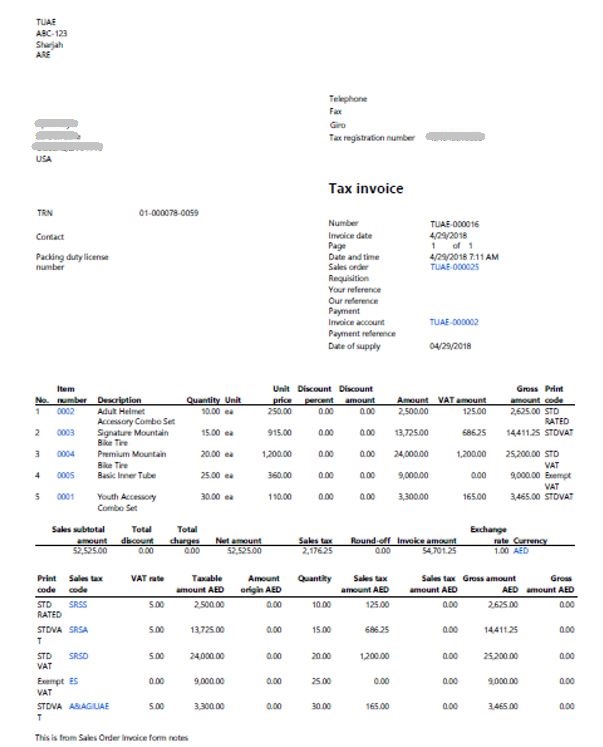

Printing Sales Invoice in UAE layout

With UAE localization package of functionality there are included Sales Invoice and Credit notes printouts in layout specified in FTA requirements for accounting systems. See following example of Free Text Invoice printout:

Additionally printing in two languages was accommodated. System will print two Sales Invoice printouts, first in language of User Interface and simultaneously second printout accordingly to setup of language of a customer in case those two languages are different.

In order to achieve consistent printout results other data in the system should be setup using translations like Name, Description of items in different languages. Additionally Sales tax descriptions and Exempt code should also be considered for setup with translations.

Modifying Electronic reporting configurations for AX 2012 R3

General Electronic reporting module in AX 2012 R3 allows users to execute reporting configurations prepared in Electronic reporting configuration designer. The configuration designer lets users define electronic format structures, and then describe how those structures should be filled by using data and algorithms that exist in AX 2012 R3. Users can use a formula language that is very similar to the Excel language for data transformation. To make the database-to-format mapping more manageable, reusable, and independent of format changes, an intermediate data model concept is introduced. To learn more study documentation how to Create an Electronic reporting configuration.

In case you decide about changing configurations you need the configuration designer. The designer is available in Dynamics 365 for Finance and Operations fall 2017 release (v.7.3). If you do not have access to version 7.3, the link below will direct you to the tutorial that provides you with the steps necessary to sign-up for the Microsoft Dynamics 365 for Finance and Operations (Dynamics AX) trial version.

Learn how to sign-up for trial version at: https://learn.microsoft.com/en-us/dynamics365/unified-operations/dev-itpro/dev-tools/sign-up-preview-subscription

NOTE: this trial offer is not to be used for Production / Go Live activities.

Prerequisites:

-

Global Administrator of the O365 tenant MUST be the person who executes signing up for the offer below.

-

Use an In-Private or Incognito browser to ensure you are signed in correctly with the O365 credentials.

-

If you do not have an existing AAD/O365 tenant, you can use the link below to create a tenant for the trial duration.

Once you have the Microsoft Dynamics 365 for Finance and Operations offer tied to your AAD/O365 tenant to deploy an instance of Microsoft Dynamics 365 for Finance and Operations to Azure, you must have a Microsoft Azure subscription in order to deploy to the cloud. You will also be able to download a local VHD (virtual hard drive) that contains Microsoft Dynamics 365 for Finance and Operations. The ability to deploy/download the Dynamics 365 for Finance and Operations is found in the Lifecycle Services project that will be created for you when you complete the sign-up process.

The organization global administrator should click: https://portal.microsoftonline.com/Signup/MainSignUp.aspx?OfferId=AA972CC1-91DB-4CF9-94A1-4A9163ED50C9&pc=6cc7f567-e72c-45a5-b89a-10e8145b7d00&dl=ERP_INSTANCE_SKUThis trial offer code will expire in 18 months.

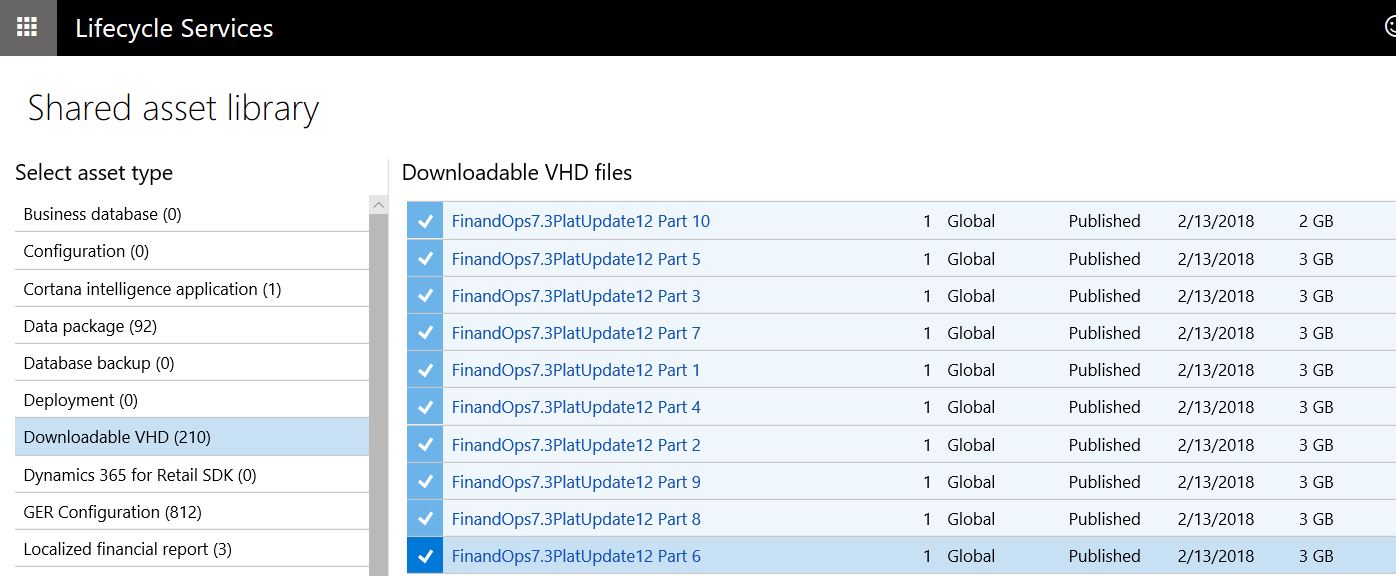

You can download free copy of virtual machine with complete deployment of Dynamics 365 for Finance and Operations fall 2017 release (v.7.3) from LCS. Login to https://lcs.dynamics.com/ and navigate to Shared Assets library select asset type: Downloadable VHD and download VM disk with deployment of version 7.3.

Create new VM and attach the downloaded VHD. Access the environment using rules like any other Demo Virtual Machine offered from Microsoft. Find User provisioning tool shortcut at VM desktop and provision access to demo instance of Dynamics 365 for Finance and Operations using your email associated with Azure account and the subscription.

With Dynamics 365 for Finance and Operations fall 2017 release (v.7.3) operational in development mode proceed to deploy UAE localization hotfix.

Environment configured in the above way will provide you with opportunity to customize electronic reporting configurations through embeded configuration designer in Electronic reporting workspace of Dynamics 365 for Finance and Operations.

Hotfix Information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country/region specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

More information

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.