Introduction

ELSTER is the standard of tax administration in Germany. It provides various tools that companies in Germany use for electronic financial reporting. For the declaration of value-added tax (VAT) returns, ELSTER provides endpoints to the open interface of a web service. These endpoints were supported by Microsoft Dynamics 365 for Finance and Operations and Microsoft Dynamics AX 2012 R3 (and earlier versions). However, ELSTER has announced that, as of January 1, 2019, the open interface for transferring data for sales tax returns will be closed by the German tax authorities.

Starting January 1, 2019, the ELSTER Rich Client (ERiC) interface must be used to transfer data for sales tax returns. For more information about ERiC, see the Appendix of this document.

At the same time, if a company is registered in Germany, users can submit the VAT declaration via the web interface Mein ELSTER or by using ElsterFormular.

Starting from the November 14, 2018 ELSTER open interface of web service will support the transfer of the data for VAT declaration with version 11 of TransferHeader (TH) and user data header (NH). The previous versions TH (Version 8) and NH (Version 10) will no longer be accepted as of this date.

Overview

This hotfix provides changes in XML format according to the new requirements for report submitting via the web interface or ERiC, and possibility of saving of the generated XML.

Submission of a VAT declaration through the web interface or ERiC requires the following adjustments to the XML format:

-

The <Elster> namespace must be changed.

-

The <Vorgang> tag must be reported with the “send-Auth” value.

-

The <Datei> block of fields must be reported.

-

The <TransferHeader> tag must be reported with the version=“11” attribute

-

The <NutzdatenHeader> tag must be reported with the version=“11” attribute.

For AX 2012 R3, the update will let users in Germany complete these tasks:

-

Set up the system to support the new XML format by using a new Use web-service for auto-submission check box in the Electronic tax declaration setup form.

-

Preview the updated format by using the existing Preview tab in the Electronic tax declaration log form.

-

Save the VAT declaration in XML format from an attachment to a record in the Electronic tax declaration log form.

-

Manually update status of the “Electronic tax declaration log” record to Sent.

Setup

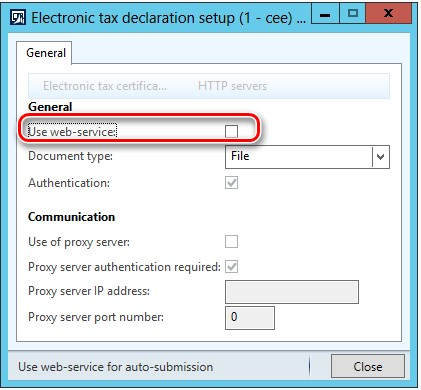

The hotfix provides a new Use web-service for auto-submission check box in the Electronic tax declaration setup form:

Mark this check box after the hot fix installation if you suppose to continue submission of the VAT declaration using ELSTER web service. Pay attention the XML file will be generated in this case in the previously used format. The whole process of generation and submission of the VAT declaration will work in this case in the previously used way.

Unmark this check box to get VAT declaration generated in the new format. This disables setup of other related to web submission fields and buttons.

VAT declaration generation

When Use web-service for auto-submission check box in the Electronic tax declaration setup form is marked, the procedure on VAT declaration generation and submission will not be changed (will work like before the hotfix installation). In case if whilst VAT declaration submission the ELSTER web service has stopped working you will get an error message.

You will need to unmark the Use web-service for auto-submission check box in the Electronic tax declaration setup form and regenerate the XML to make its submission possible in the new way (via web interface or ERiC).

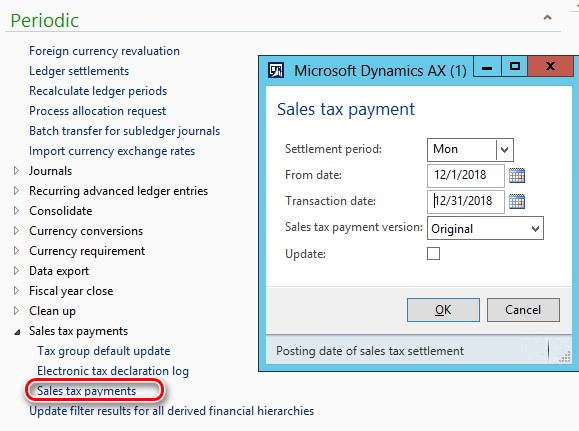

To do so, open General ledger > Periodic > Sales tax payments > Sales tax payments, fill in the dialog and click “OK”:

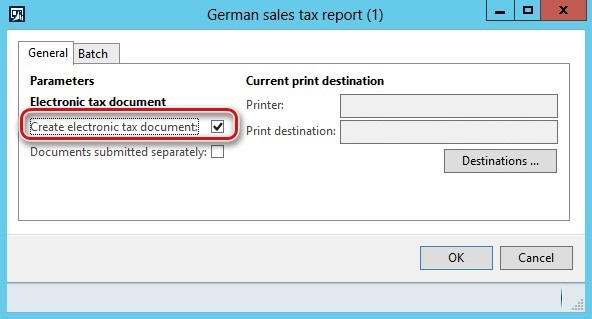

In the German sales tax report dialog mark Create electronic tax document check box as previously:

Pay attention that the previously existed Style sheet for preview parameter will not appear in the dialog any more. Style sheets for preview both of formats the old and the new one are in AOT resources and system will automatically define which style sheet to be used for which format and apply it on Preview tab of the Electronic tax declaration log form.

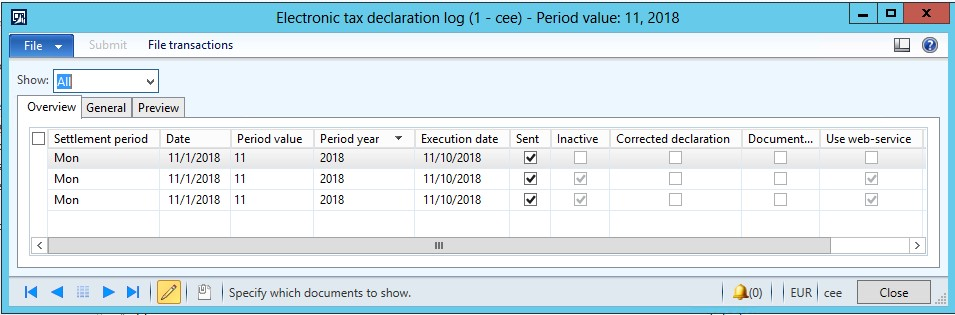

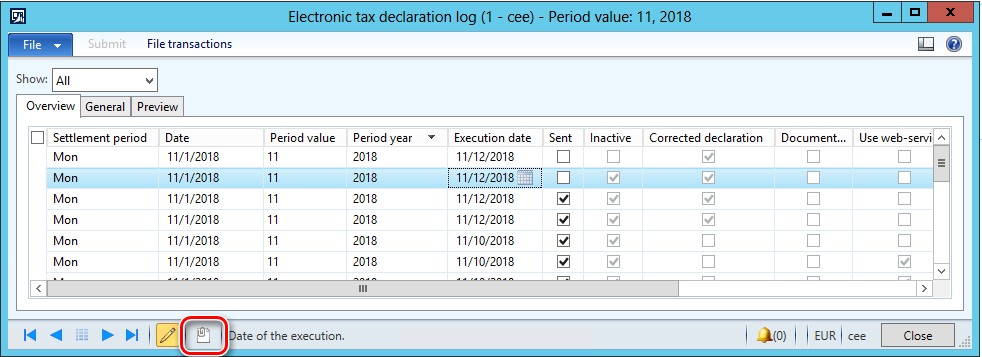

By “OK” button of the German sales tax report dialog, a new line in the Electronic tax declaration log form will be created:

Use web service column shows if the report was created for auto submission via ELSTER web service or (if not marked) in the new format.

The XML file is already generated basing on the criteria defined in the German sales tax report dialog and generated XML file is attached via Document management to the line in the Electronic tax declaration log table. To review or save this file for further submission (out of the system), select the line in Electronic tax declaration log form file for which you want to save and click on Document handling button in the bottom of the form:

Document handling form will be opened showing generated file. Form this window you may open the file (an application associated with .xml extension in your system will open the file).

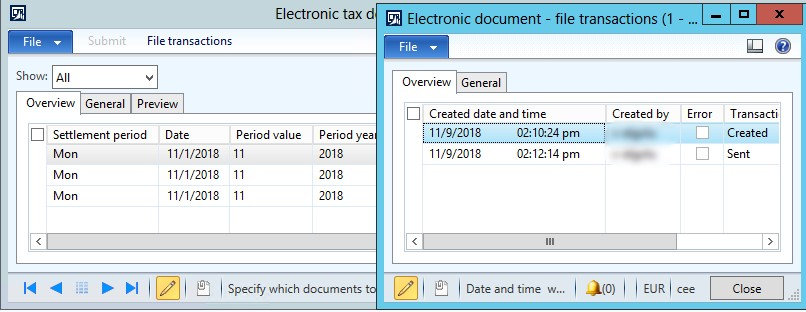

Sent field is now available for manual marking. When marked a new line in the File transactions table is created:

This form shows which user and when created and marked the report as Sent. Once marked, a report cannot be unmarked. Open Preview tab of the Electronic tax declaration log form to preview the reported values.

Appendix

The Developers area of the ELSTER website provides examples that show how developers can interact with ERiC for the submission of VAT declarations. Examples are provided for C++, C#, and Java. To access this area of the website, you must be registered as a developer. An example may help to create your own executable file to submit XML file using ERiC. You will need to download ERiC DLLs to submit XML file to ELSTER using executable file.

ERiC-Release 27 version is announced to be supported by ELSTER until the April 2019 and can be downloaded by the link. For Windows you need to download the following JAR files with ERiC DLLs:

-

ERiC-27.10.2.0-Windows-x86.jar

-

ERiC-27.10.2.0-Windows-x86_64.jar

See more information about ERiC releases.

Hotfix Information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this update, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request.

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

More Information

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.