Introduction

As of 1 July 2018, National Tax and Customs Administration of Hungary announced that companies in Hungary obliged to supply data of their invoices issued through electronic platform of Online Invoicing System.

On February 27, 2020, National Tax and Customs Administration of Hungary announced that as of April 1, 2020, the XSD version 2.0, must be applied in the Online Invoice System. Version 1.1 will not be in use from that day. The process of transition from version 1.1 to 2.0:

-

The XSD version 2.0 can be used from 23:00, 27 February 2020 until midnight on 31 March 2020 in the production Online Invoice System; however, its application is not mandatory during this period.

-

As of 1st April 2020, solely the XSD version 2.0 will be applicable in the productive environment. After this date, NTCA system will not process data disclosures sent with the usage of the XSD scheme, version 1.1.

On March 24, 2020, National Tax and Customs Administration of Hungary announced that the date when XSD version 2.0 becomes mandatory and solely applicable is changed to July 1, 2020. Before this date version 2.0 XSD can already be used live in parallel with Version 1.1 XSD.

Find more related information on https://onlineszamla.nav.gov.hu/.

Table below provides references on previously published articles about implementation of interoperation with Hungarian Online Invoicing System:

|

Version of Dynamics 365 for Finance and Operations |

|

7.1 |

|

7.2 |

|

7.3 |

|

8.0 |

Information about previous update to version 1.1 is available in following KB article:

|

Version of Dynamics 365 for Finance and Operations |

Link on KB article |

|

10.0.1, 7.3 |

Overview

Current update is composed of three parts:

-

Finance application update

-

Electronic reporting configurations update

-

Electronic messages setup change

Finance application update

Hungarian Online invoicing system of version 2.0is now supported in following or later versions of Finance:

|

Dynamics 365 Finance version |

Build number |

|

10.0.11 |

10.0.422 |

|

10.0.10 |

10.0.420.3 |

|

10.0.9 |

10.0.383.10012 |

|

10.0.8 |

10.0.319.20023 |

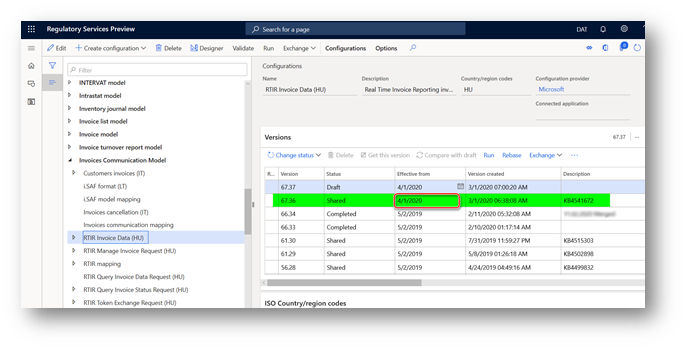

Electronic reporting configurations update

Import following or later versions of Electronic reporting configurations to work with Hungarian Online invoicing system of version 2.0:

|

ER configuration name |

Type |

Version |

Comment |

|

Electronic Messages framework model |

Model |

28, 19 |

If you already have versions 28 and 19 on your environment, you don’t need to import them again. |

|

RTIR import model mapping |

Model mapping |

19.9 |

This configuration was not changed in this update. You don’t need to update it if you already have it on your environment. |

|

RTIR import format (HU) |

Format |

28.19 |

Application update is required. See table above to find compatible versions of Finance. |

|

Invoices Communication Model |

Model |

67 |

|

|

RTIR mapping |

Model mapping |

67.73 |

Application update is required. See table above to find compatible versions of Finance. |

|

RTIR Invoice Data (HU) |

Format |

67.37 |

Application update is required. See table above to find compatible versions of Finance. |

|

RTIR Manage Invoice Request (HU) |

Format |

67.21 |

Application update is required. See table above to find compatible versions of Finance. |

|

RTIR Query Invoice Status Request (HU) |

Format |

67.16 |

Application update is required. See table above to find compatible versions of Finance. |

|

RTIR Token Exchange Request (HU) |

Format |

67.17 |

Application update is required. See table above to find compatible versions of Finance. |

New versions of the electronic reporting configurations are effective from April 1, 2020.

All the new versions of electronic reporting configuration included into current update have date of effectiveness defined - “April 1, 2020”:

This restriction helps system to automatically switch from using of configurations compatible with version 1.1 to configurations compatible with version 2.0 at the appropriate moment of time (00:00, April 1, 2020).

If you want to start using new version of configurations before April 1, 2020, during transition period, you must derive each configuration to get your own version and clean up “Effective from” condition for your versions of the configurations. You also must change setup of actions in Electronic messaging functionality from using of configurations provided by Microsoft, to the configurations created via deriving. Open Tax > Setup > Electronic messages > Message processing actions:

|

Action name |

Related configuration name provided by Microsoft |

|

Generate EM |

RTIR Invoice Data (HU) |

|

Generate invoice request |

RTIR Manage Invoice Request (HU) |

|

Generate status request |

RTIR Query Invoice Status Request (HU) |

|

Generate token request |

RTIR Token Exchange Request (HU) |

|

Import invoice response |

RTIR import format (HU) | RTIR import format to model mapping |

|

Import status response |

RTIR import format (HU) | RTIR import format to model mapping |

|

Import token response |

RTIR import format (HU) | RTIR import format to model mapping |

Electronic messages setup change

Import new version of package of data entities from Shared asset library on LCS portal ‘HU RTIR setup v4 KB4541672.zip’.

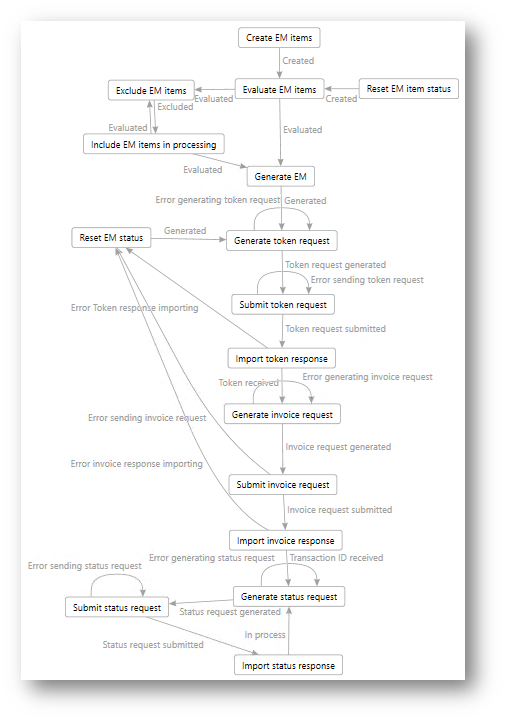

General schema of “Online invoicing” processing implemented in Electronic messages has not changed and schematically looks as following:

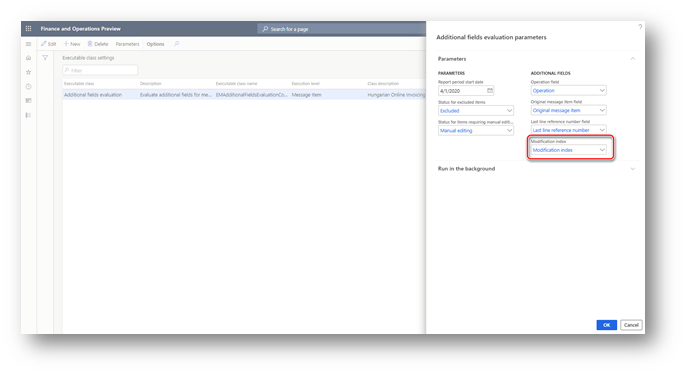

New version of the package of data entities introduces the following changes:

-

New “Modification index” additional field – to report serial number of the modifying document referencing invoice. This field values defined automatically by ‘EMAdditionalFieldsEvaluationController_HU’ executable class during “Evaluate EM items” action run. You must define this field as new parameter of the executable class. Open Tax > Setup > Electronic messages > Executable class settings page, select “Additional fields evaluation” executable class related to ‘EMAdditionalFieldsEvaluationController_HU’ Finance class, click “Parameters” on the Action pane, select “Modification index” in the “Modification index” field and click OK button.

-

New “Saved” status of action items. This value is introduced on Online invoicing system side and will be automatically set for a message item via importing of the response, when such response is relatively obtained from Online invoicing system.

-

New version of Web service setting data entity is delivered with predefined internet addressed on new testing endpoints of Online invoicing system:

-

-

Manage invoices web service: https://api-test.onlineszamla.nav.gov.hu/invoiceService/v2/manageInvoice

-

Query invoice status web service: https://api-test.onlineszamla.nav.gov.hu/invoiceService/v2/queryTransactionStatus

-

Token exchange web service: https://api-test.onlineszamla.nav.gov.hu/invoiceService/v2/tokenExchange

-

For interoperation with production Online invoicing system, use the following internet addresses:

-

-

Manage invoices web service: https://api.onlineszamla.nav.gov.hu/invoiceService/v2/manageInvoice

-

Query invoice status web service: https://api.onlineszamla.nav.gov.hu/invoiceService/v2/queryTransactionStatus

-

Token exchange web service: https://api.onlineszamla.nav.gov.hu/invoiceService/v2/tokenExchange

-

Find latest documentation related to “The NAV Online Invoicing System” on the official web site: https://onlineszamla.nav.gov.hu/dokumentaciok .

Changes overview

Version 2.0 of Online invoicing system introduces many changes related mostly to the architecture of interoperation. Current update covers the following important changes to support version 2.0 of Online invoicing system:

-

'Request signature' in 'User' node in all requests now implements new hashing algorithm SHA3-512 (instead of SHA-512).

-

'Software node' in all requests became mandatory.

-

RTIR InvoiceData (HU) - 'lineNatureIndicator' flag added. It describes the nature of the line and can have one of the following values: 'PRODUCT', 'SERVICE', 'OTHER'. Related data is collected from “Reporting type” field of related “Item sales tax group”. If this parameter is not filled for “Item sales tax group” used in a tax transaction - 'OTHER' value will be reported.

-

RTIR InvoiceData (HU) - Every monetary expression in invoice lines and their corresponding invoice summary data are extended to contain the value both in the currency of the invoice and in Hungarian Forints. Refer to page 159 of documentation for full list of fields. Amounts in HUF are calculated by multiplying amount in invoice currency on exchange rate.

-

RTIR mapping - Changed mapping for 'LineTaxAmountCur' under 'Line' node. This field was previously bind to TaxTrans.SourceTaxAmountCut, in new version of the model mapping it is bind to TaxTrans.SourceRegulateAmountCur (to cover the case when tax transaction information was adjusted).

-

Message processing action Generate status request - File name was changed from 'QueryInvoiceStatusRequest.xml' to 'QueryTransactionStatusRequest.xml'.

Additional information

To guaranty correct reporting in Online invoicing system of data from the system, we recommend you to create credit note for one invoice. Avoid scenario when one credit note is created for several invoices.

More information

You can contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.