Introduction

According to Legislative Decree no. 127/2015, art. 1 and Decree Law 78/2010, art. 21, all companies in Italy must transmit electronically in XML format of the Purchases and Sales Invoices Communications (DATIFATTURA) on a quarterly basis starting from October 2017. It was also announced by Italian tax Authority that from the beginning of 2019 together with an obligation of electronic VAT reporting with a pre-approval with Italian tax authorities Sdl platform, the Purchases and Sales Invoices Communications reporting will be replaced by the Esterometro submission - Purchases and Sales Invoices Communications report of cross-border transactions to or from non-residents, or non-established in the territory of Italy entities.

Feature related publications:

|

Title |

Link |

|

A country-specific update is available for Italy of Purchases and Sales Invoices Communications for Microsoft Dynamics 365 for Finance and Operations |

|

|

Italian Purchase and Sales invoices communication (new Spesometro) version 2.1 on Dynamics 365 for Finance and Operations |

https://support.microsoft.com/en-us/help/4282010 |

|

(ITA) Meet “Esterometro 2019” report requirements in Finance and Operations (White paper) |

https://mbs.microsoft.com/files/customer/AX/Learning/whitepapers/IT_ESTEROMETRO_2019.pdf |

|

Italy: Esterometro/"new Spesometro" to support file splitting by file volume and limits of number of records in Dynamics 365 for Finance and Operations |

This article describes how to change existing Purchases and Sales Invoices Communications (Esterometro) reporting process on Finance and Operations to use together with “Date of VAT register” feature (KB #4511201).

Overview

When a company decides to use “Date of VAT register” feature to enable VAT management by tax point date which differs from the date of transaction posting, setup of “InvoiceCommunication” processing in Electronic reporting must be adjusted to collect invoices by Date of VAT register instead of the transaction posting date.

Open Tax > Setup > Electronic messages > Populate records action page, select each data source record and modify the query as following:

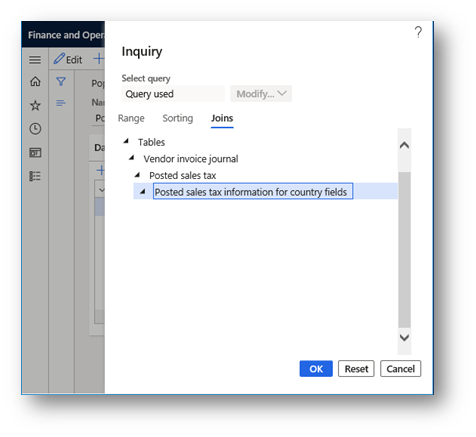

1. Join “Posted sales tax information for country fields” table via “Posted sales tax” table:

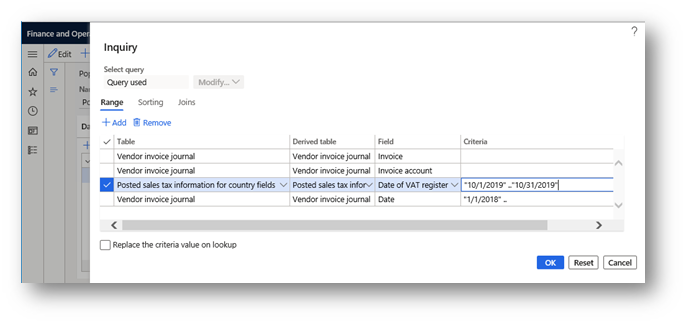

2. Add the “Date of VAT register” field from “Posted sales tax information for country fields” table and specify the criteria as for example for October 2019:

With this change when you run “Populate invoices” action in “InvoiceCommunication” processing, invoices with tax transactions, "Date of VAT register" of which is in the specified criteria will be populated as message items.

In the next reporting period, specify next period in queries of data sources on Populate records action page.

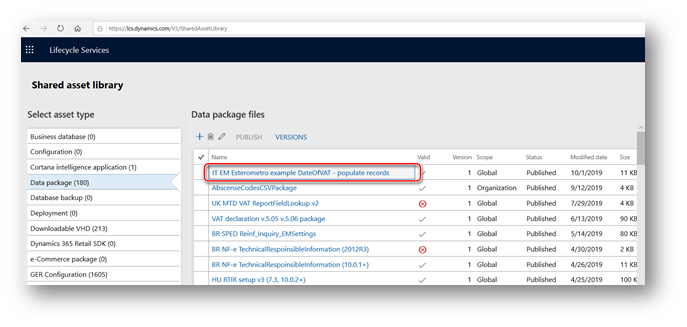

You may download and import an example of the queries setup via Data management workflow instead of manual update of Populate records action queries. To find the package with example queries, open LCS portal by the link http://lcs.dynamics.com/ and after log on the portal, click on Shared asset library. Select Data package > "IT EM Esterometro example DateOfVAT - populate records":

Learn more about Data management: https://learn.microsoft.com/en-us/dynamics365/unified-operations/dev-itpro/data-entities/data-entities-data-packages?toc=/fin-and-ops/toc.json