Introduction

Introduction:

In the proposed system of new GST Return filing, a normal taxpayer would have to file FORM GST RET-1 (Normal) or FORM GST RET-2 (Sahaj) or FORM GST RET-3 (Sugam), on either monthly (only GST RET-1) or quarterly basis. Annexure of Supplies (GST ANX-1) and Annexure of Inward Supplies (GST ANX-2) will be filed as part of these returns.

All the outward supplies and inward supplies liable to tax on a reverse charge basis, including imports and inward supply of goods from SEZ, will be detailed in GST ANX-1. GST ANX-2 will contain details of inward supplies auto-populated mainly from the suppliers’ GST ANX-1. It will also contain details of auto-populated from Form GSTR-5 and Form GSTR-6.

The taxpayer will be required to take action on details of inward supplies contained in Form GST ANX-2, by accepting or rejecting the entries. The taxpayer can also keep the documents pending by marking the documents accordingly.

On the basis of details uploaded in GST ANX-1 and the actions taken in GST ANX-2, by the taxpayer, the relevant fields of their Form GST RET-1 will be auto-drafted. Taxpayers can now view its details, enter details in the relevant column, save it and download it in pdf format.

GSTN has released a trial version of the New Returns Offline Tool of Form GST ANX-1, Form GST ANX-2 (with Matching Tool built in it) and a template for Purchase Register, which can be used to import data of purchase register for matching with ANX-2.

Microsoft is releasing the new return offline tool format to enable a user to do testing of various business scenarios and provide feedback.

Overview

This article explains how to set up and work with Dynamics 365 Finance to generate CSV file through the new offline tool

The report is supported in following or later versions of Finance:

|

Dynamics 365 Finance version |

Build number |

|

10.0.9 |

10.0.383.22 |

The solution to support the GSTR offline tool reporting is based on electronic reporting functionality. This functionality provides a flexible approach for setting up and supporting reporting processes.

This article contains the following parts:

• Import the configuration

• Generation of ANX-1

• Generation of Purchase Register

Cause

None

Setup

These tasks will prepare Finance to reporting ANX-1:

-

Import and set up Electronic reporting (ER) configurations.

-

Mapping of reporting configuration in Tax setup

-

Provide report data for report generation

-

-

ANX-1

-

Generate ANX-1 (10 CSV) files

-

-

Provide report data for report generation

-

-

Purchase Register

-

Generate Purchase Register excel file

-

Import tax configuration below version:

Taxable Document.version.82

Taxable Document (India). version 82.143

Tax (India GST). version.82.143.267

Import and set up Electronic reporting (ER) configurations

To prepare Finance for GSTR Return reporting, you must import the following or higher versions of ER configurations in sequence provided below:

|

ER configuration name |

Type |

Format |

Version |

|

GST Returns. version |

Model |

XML |

14 |

|

GST Returns model mapping. version |

Model |

XML |

14.5 |

|

GSTR1CSV.version |

Model |

XML |

14.28 |

|

GSTR2CSV.version |

Model |

XML |

14.32 |

|

GST Returns Govt. version |

Model |

XML |

4 |

|

GST Returns govt. model mapping |

Model |

XML |

19.10 |

|

GST Returns govt. model |

Model |

XML |

19 |

|

GST Returns govt. model mapping |

Model |

XML |

19.12 |

|

GST ANX-1 Govt. offline tool |

Model |

XML |

19.22 |

|

Purchase Register |

Model |

XML |

19.7 |

|

ANX-1 |

Format (exporting) |

CSV |

|

|

Purchase Register |

Format (exporting) |

Excel |

Import the latest versions of these configurations. The version description usually includes the changes that were introduced in the configuration version.

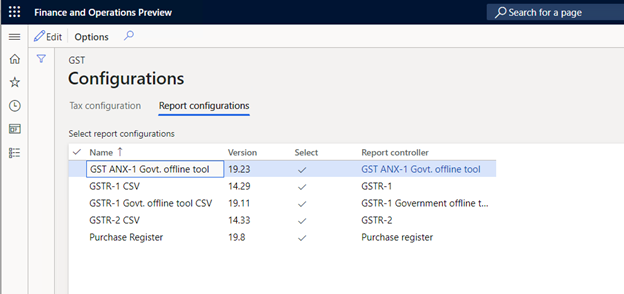

Note: After all the ER configurations from the preceding table are imported, user need to do mapping of Report configuration in the Tax setup

|

Name |

Version |

Report Controller |

Description (Pl) |

|

GST ANX-1 Govt. Offline Tool |

19.22 |

GST ANX-1 Govt. offline Tool |

New GSTR return applicable from 1.4.2020 onward |

|

GSTR-1 CSV |

14.28 |

GSTR-1 |

Existing GSTR-1 format |

|

GSTR-1 Govt. Offline Tool CSV |

19.10 |

GSTR-1 Govt. Offline Tool |

Existing GSTR-1 offline tool. (Ineffective from 1.4.2020) |

|

GSTR-2 CSV |

14.32 |

GSTR-2 |

Existing GSTR-2 format |

|

Purchase register |

19.7 |

Purchase Register |

New Register for inward transaction applicable from 1.4.2020 |

Important transactions for ANX-1

|

Name |

Report |

File Format |

Description |

Fields covered |

|

B2C CSV |

ANX-1 |

CSV |

Supplies made to consumers and un-registered persons (Net of debit notes, credit notes) |

Place of supply, Differential % of Tax Rate, Taxable value, Supply Covered Under Sec 7 of IGST Act, Rate, Integrated tax, central tax, State Tax, Cess |

|

B2B CSV |

ANX-1 |

CSV |

Supplies made to registered persons (other than those attracting reverse charge) (including edit of rejected documents) |

GSTIN/UIN of Recipient, Trade/Legal Name, Document Type (Debit note/credit note/Invoice) ,document number, document date, document value, place of supply, Differential % of tax rate, Supply covered under section 7 of IGST Act, HSN, rate, Taxable value , Integrated tax, central tax ,State Tax/UT, Cess |

|

EXP |

ANX-1 |

CSV |

Exports with payment of tax and Without payment of tax |

Not supported with current Tax configuration version 82.143.267 or earlier version. |

|

SEZ |

ANX-1 |

CSV |

Supplies to SEZ units/developers with payment of tax and without payment of tax (including edit of rejected documents) |

Not supported with current Tax configuration version 82.143.267 or earlier version. |

|

DE |

ANX-1 |

CSV |

Deemed Exports |

Not supported with current Tax configuration version 82.143.267 or earlier version. |

|

RV |

ANX-1 |

CSV |

Inward supplies attracting reverse charge (to be reported by recipient, GSTIN wise, net of debit/credit notes and advances paid, if any) |

GSTIN/PAN of Supplier, Trade/Legal Name, place of supply, Differential % of tax rate, Supply covered under section 7 of IGST Act, Supply Type (inter-state/Intra-state) , HSN code, rate, Taxable value , Integrated tax, central tax ,State Tax/UT, Cess |

|

IMPS |

ANX-1 |

CSV |

Import of services (net of credit/debit notes and advances paid, if any) |

place of supply, HSN code, rate, Taxable value, Integrated tax, central tax, State Tax/UT, Cess |

|

IMPG |

ANX-1 |

CSV |

Import of services (net of credit/debit notes and advances paid, if any) |

place of supply, HSN code, rate, Taxable value, Integrated tax, central tax, State Tax/UT, Cess |

|

IMPGSEZ |

ANX-1 |

CSV |

Import of goods from SEZ units on a Bill of Entry |

Not supported with current Tax configuration version 82.143.267 or earlier version. |

|

ECOM |

ANX-1 |

CSV |

Details of the supplies made through e-commerce operators liable to collect TCS under section 52 |

GSTIN of E-com, Trade/Legal Name, Value of supplies, value of supplies returned, Net value of supplies, Integrated tax, central tax, State Tax/UT, Cess |

Important transactions for Purchase Register

|

Name |

Report |

File Format |

Description |

Fields covered |

|

Purchase Register |

PR |

XLSX |

This cover inward supplies from following sources: B2B, DE, SEZWP, SEZWOP |

GSTIN of supplier, Trade/Legal name ,Type of inward supplies, Document type, Document number, document date, Taxable value, Total tax, Integrated tax, Central tax, State/UT tax, Cess |

Process to Generate data in .CSV file

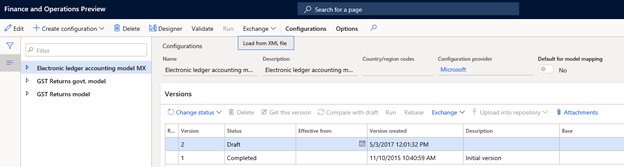

(a) Load Report configuration in the workspaces

Path: Workspaces>Electronic reporting >Reporting configurations>exchange. Load configurations

Import configuration files in the sequence provided above

(b) Mapping of Report configuration in the Tax setup

Path: Click Tax > Setup > Tax configuration > Tax setup > Configurations > Report configurations > Select report configuration

-

Click Configurations > Report configuration tab.

-

Mark Select checkbox.

-

Select the value in Report data provider field.

-

Click Close.

Note: In case user does not select any Report under report controller than report will not be available for generation under Sales tax reports.

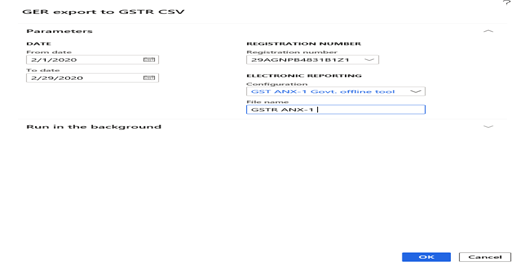

(c) Generate ANX-1 report and Purchase Register

(I) ANX-1 Govt. Offline tool report data

1. Navigate to Tax > Sales Tax reports > India > GER export to GSTR CSV

2. Define From date

3. Define To date

4. Select GSTIN Registration number

5. Select Configuration ‘GST ANX-1 Govt. Offline Tool”

6. Define file name, to save the report with name.

7. Click OK

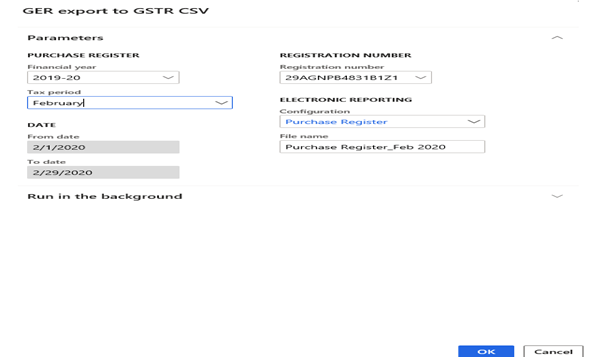

(II) Purchase Register Report Data

-

Navigate to Tax > Sales Tax reports > India > GER export to GSTR CSV

-

Select financial Year: Select financial year from the dropdown list.

-

Select tax period: Select Month or Quarter from the dropdown list

-

Select GSTIN Registration number

-

SelectConfiguration “Purchase Register”

-

Define file name, to save the report in CSV format

-

Click OK

Hotfix information

None

File information

None

More information

You can contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained herein is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Usefor other considerations.