Introduction

According to the legislation changes in Spain introduced by Real Decreto 596/2016, de 2 de diciembre, a VAT management system based on Immediate Provision of Information (SII system) allows a two-way, automated and instant relationship between the AEAT and a taxpayer.

See related documentation on how to setup and use Microsoft Dynamics 365 Finance for reporting to SII system: https://learn.microsoft.com/en-us/dynamics365/finance/localizations/emea-esp-sii.

Starting from January 1st, 2021, version 1.1(bis) of the SII system comes into effect. This article provides information about changes in Microsoft Dynamics 365 Finance to support version 1.1(bis) of SII system.

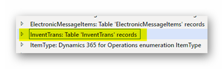

The following versions of GER configurations should be downloaded and imported to support updated functionality:

|

Configuration name |

Configuration type |

Version |

|

Invoices Communication Model |

Model |

61 |

|

SII model mapping |

Model mapping |

61.69 |

|

SII Invoice Issued Format (ES) |

Format |

61.46 |

|

SII Invoice Received Format (ES) |

Format |

61.36 |

Effective from date parameter for the formats from the table above are set to January 1, 2021. This means that system will start using these versions of the formats starting from the January 1, 2021.

Symptoms

Full information about what changes are introduced in the SII system are described in the official documentation for the version 1.1(bis):

|

Link description |

Link |

|

Nueva documentación versión 1-1-2021 |

|

|

Descripción del servicio web(1-1-2021) |

|

|

Documento de validaciones y errores(1-1-2021) |

|

|

Esquemas(1-1-2021) |

Following changes introduced by the version 1.1(bis) which have potential impact on Microsoft Dynamics 365 Finance solution for reporting information to SII system and thus covered by the current hot fix:

|

Change description |

|

NUEVAS VALIDACIONES LIBRO REGISTRO DE FACTURAS EMITIDAS |

|

LRFE. Bloque identificación de la contraparte(I) 1. If the type of invoice is F1, F3, R1, R2, R3 and R4, the identification block of the counterparty has to be completed. 2. If the type of invoice is F2, F4 and R5, the identification block of the counterparty must be omitted. |

|

LRFE. Fecha de expedición y período de liquidación 1. The date of issue may not be prior to the date of operation. This validation will not apply when any of the special regime codes is 14 or 15 or type of communication A4. |

|

LRFE. IVA pendiente de devengo AAPP. When a single regime is marked and it is 14, the type of invoice must be F1, R1, R2, R3 or R4 |

|

NUEVAS VALIDACIONES LIBRO REGISTRO DE FACTURAS RECIBIDAS |

|

LRFR. Cuota deducible

|

|

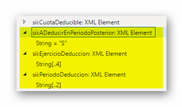

LRFR. Deducción en período posterior. New field "Deduct in later period". If the fields "Ejercicio de deducción" and "Periodo de deducción" are completed, the "Deducir en período posterior" field must be "Yes". |

|

LRFR. Período y ejercicio de deducción New fields "“Ejercicio" (fiscal year) and "Período de deducción" (deduction period). |

Next table describes changes in Microsoft Dynamics 365 Finance solution for reporting information to SII system to support version 1.1(bis) of SII system:

|

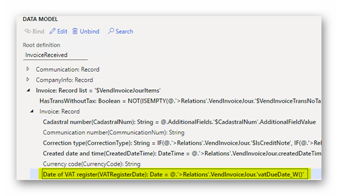

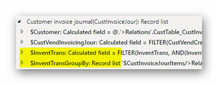

SII model mapping > Invoice received |

|

|

Existing model field was mapped:

|

Path: Invoice/Invoice/VATRegisterDate Formula: @.'>Relations'.VendInvoiceJour.'vatDueDate_W()' |

|

SII Invoice Received Format (ES) |

|

|

Rebased to model version 61 |

|

|

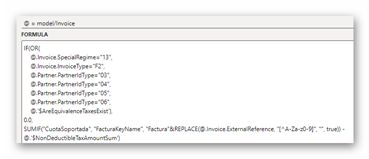

New calculated field "$AreEquivalenceTaxesExist" was added

|

Path: model/Invoice Formula: NOT(ISEMPTY(WHERE(@.'$VATGroupBy', @.'$VATGroupBy'.grouped.TaxRateEquivalence <> 0))) |

|

Changed formula for "CuotaDeducible" element:

|

Old: IF(@.Invoice.SpecialRegime="13", 0.0, SUMIF("CuotaSoportada", "FacturaKeyName", "Factura"&REPLACE(@.Invoice.ExternalReference, "[^A-Za-z0-9]", "", true)) - @.'$NonDeductibleTaxAmountSum')

New: IF(OR( @.Invoice.SpecialRegime="13", @.Invoice.InvoiceType="F2", @.Partner.PartnerIdType="03", @.Partner.PartnerIdType="04", @.Partner.PartnerIdType="05", @.Partner.PartnerIdType="06", @.'$AreEquivalenceTaxesExist'), 0.0, SUMIF("CuotaSoportada", "FacturaKeyName", "Factura"&REPLACE(@.Invoice.ExternalReference, "[^A-Za-z0-9]", "", true)) - @.'$NonDeductibleTaxAmountSum') |

|

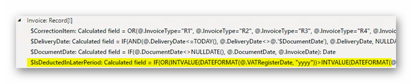

New calculated "$IsDeductedInLaterPeriod" field under Invoice:

|

Formula: IF( OR( INTVALUE(DATEFORMAT(@.VATRegisterDate, "yyyy")) > INTVALUE(DATEFORMAT(@.'$DocumentDate', "yyyy")), AND( INTVALUE(DATEFORMAT(@.VATRegisterDate, "yyyy")) = INTVALUE(DATEFORMAT(@.'$DocumentDate', "yyyy")), INTVALUE(DATEFORMAT(@.VATRegisterDate, "MM")) > INTVALUE(DATEFORMAT(@.'$DocumentDate', "MM")))), true, false) |

|

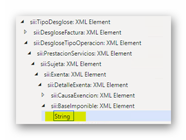

New elements under "siiLR:FacturaRecibida" element:

|

All have the following formula for "Enabled": @.Invoice.'$IsDeductedInLaterPeriod' |

|

SII model mapping > Invoice issued |

|

|

New data source InventTrans:

|

|

|

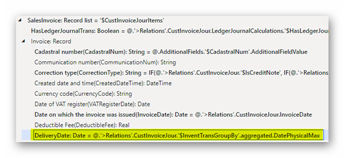

New calculated fields under CustInvoiceJour:

|

$InventTrans: IF( ISEMPTY(FILTER(InventTrans, AND(InventTrans.InvoiceId = @.InvoiceId, InventTrans.DateFinancial = @.InvoiceDate))), EMPTYLIST(InventTrans), FILTER(InventTrans, AND(InventTrans.InvoiceId = @.InvoiceId, InventTrans.DateFinancial = @.InvoiceDate)))

$InventTransGroupBy: What to group: '$CustInvoiceJourItems'.'>Relations'.CustInvoiceJour.'$InventTrans'

Aggregations: Field: '$CustInvoiceJourItems'.'>Relations'.CustInvoiceJour.'$InventTrans'.DatePhysical Method: Max Name: DatePhysicalMax |

|

Existing model field was mapped:

|

Path: SalesInvoice/Invoice/DeliveryDate Formula: @.'>Relations'.CustInvoiceJour.'$InventTransGroupBy'.aggregated.DatePhysicalMax |

|

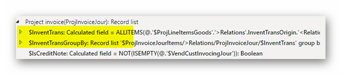

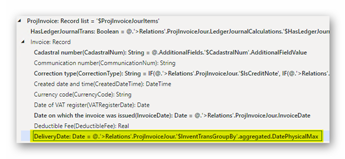

New calculated fields under ProjInvoiceJour:

|

$InventTrans: IF( ISEMPTY(ALLITEMS(@.'$ProjLineItemsGoods'.'>Relations'.InventTransOrigin.'<Relations'.InventTrans)), EMPTYLIST(InventTrans), ALLITEMS(@.'$ProjLineItemsGoods'.'>Relations'.InventTransOrigin.'<Relations'.InventTrans))

$InventTransGroupBy: What to group: '$ProjInvoiceJourItems'.'>Relations'.ProjInvoiceJour.'$InventTrans'

Aggregations: Field: '$ProjInvoiceJourItems'.'>Relations'.ProjInvoiceJour.'$InventTrans'.DatePhysical Method: Max Name: DatePhysicalMax |

|

Existing model field was mapped:

|

Path: ProjInvoice/Invoice/DeliveryDate Formula: @.'>Relations'.ProjInvoiceJour.'$InventTransGroupBy'.aggregated.DatePhysicalMax |

|

SII Invoice Issued Format (ES) |

|

|

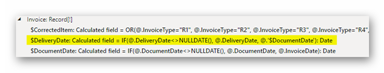

New calculated field "$DeliveryDate" was added under Invoice:

|

Formula: IF(@.DeliveryDate <> NULLDATE(), @.DeliveryDate, @.'$DocumentDate') |

|

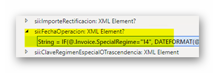

New formula and enabling condition for FechaOperacion:

|

Formula: Old: DATEFORMAT(@.Invoice.InvoiceDate, "dd-MM-yyyy") New: IF(@.Invoice.SpecialRegime = "14", DATEFORMAT(@.Invoice.'$DocumentDate' + 30, "dd-MM-yyyy"), DATEFORMAT(@.Invoice.'$DeliveryDate', "dd-MM-yyyy"))

Enabled: Old: false New: IF( OR( @.Invoice.SpecialRegime = "14", @.Invoice.SpecialRegime = "15", model.Communication.CommunicationType = "A4", @.Invoice.'$DocumentDate' > @.Invoice.'$DeliveryDate'), true, false) |

|

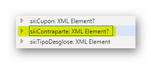

New enabling condition for Contraparte element:

|

Old: AND(AND(@.Invoice.InvoiceType <>"F2", @.Invoice.InvoiceType <>"R5"), OR(@.Invoice.InvoiceAmount <> @.Invoice.TaxBaseGroup, OR(@.Partner.TaxRegistrationNumber <> "", @.Partner.PartnerID <> "")))

New: OR( @.Invoice.InvoiceType = "F1", @.Invoice.InvoiceType = "F3", @.Invoice.InvoiceType = "R1", @.Invoice.InvoiceType = "R2", @.Invoice.InvoiceType = "R3", @.Invoice.InvoiceType = "R4") |

|

Transformation was set to NumberFormat for the following elements:

|

|

More information

You can contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.