Introduction

On July 13, 2017, the Financial Secretary to the Treasury and Paymaster General in the United Kingdom announced that Making Tax Digital (MTD) for value-added tax (VAT) will take effect on April 1, 2019.

Dynamics 365 for Finance and Operations starting from version 10.0.1 supports MTD for VAT of the United Kingdom.

To support the MTD for VAT requirements on Dynamics 365 for Finance and Operations version 7.3 the hotfixes were released: #4492999, #4493076.

The documentation about setting up and usage Dynamics 365 for Finance and Operations for MTD for VAT is published on https://learn.microsoft.com/en-us/dynamics365/unified-operations/financials/localizations/emea-gbr-mtd-vat-integration.

Online transfer of value-added tax (VAT) reports to Her Majesty’s Revenue and Customs (HMRC) requires additional information (fraud prevention parameters) that will be used to uniquely identify all request to HMRC. This information must be collected from the user devices used to submit VAT request as part of the requirement for submission to HMRC. You can learn more about this requirement at Microsoft documentation about fraud prevention headers and HMRC fraud prevention.

First part of fraud prevention parameters is supported in:

|

Dynamics 365 for Finance and Operations version |

Build number |

|

10.0.1 |

10.0.51.30002 |

|

10.0.2 |

10.0.80.10022 |

|

10.0.3 |

10.0.107.0 |

For version 7.3 of Dynamics 365 for Finance and Operations the KB # 4504462 must be installed.

All the details related to the first part of fraud prevention parameters are explained in the KB # 4504462 and incorporated to the documentation on https://learn.microsoft.com/en-us/dynamics365/unified-operations/financials/localizations/emea-gbr-mtd-vat-integration as well.

Second part provides additionally to the previously delivered scope of the fraud prevention parameters possibility of identifying and transmission of fraud prevention parameters about originating device when “WEB_APP_VIA_SERVER” connection method is used for interoperation with HMRC and supported starting from the application version:

|

Dynamics 365 for Finance and Operations version |

Build number |

|

10.0.5 |

10.0.197.14 |

For version 7.3 of Dynamics 365 for Finance and Operations the KB #4513878 must be installed.

All the details related to the second part of fraud prevention parameters are explained in the KB # 4513878 and incorporated to the documentation on https://learn.microsoft.com/en-us/dynamics365/unified-operations/financials/localizations/emea-gbr-mtd-vat-integration as well.

Current update provides changes in both the Finance and Operations application and Electronic reporting configurations to support consent of system administrator of the company transmitting VAT data together with fraud prevention parameters to further transmit data collected from the user devices used to submit VAT request as part of the requirement for submission to HMRC. This change triggers one-time action from system administrator side which must be done in both cases: when company already uses MTD for VAT feature or starts using it for the first time.

Overview

To prevent frauds HMRC requires on mandatory bases to transmit additional information (fraud prevention parameters) collected from the user devices used to submit VAT requests. Fraud prevention parameters are used to uniquely identify all request to VAT APIs for HMRC. System administrator of the company transmitting VAT data together with fraud prevention parameters must consent once for each web application used for interoperation with VAT APIs of HMRC to further transmit data collected from the user devices used to submit VAT request.

The change is supported in Finance and Operations starting from version 10.0.8:

|

Dynamics 365 for Finance and Operations version |

Build number |

|

10.0.8 |

10.0.314.0 |

System administration consent is available in the following versions of Electronic reporting configurations (can be imported for application of version mentioned in the table above (Electronic configurations table) or later):

|

# |

GER configuration name |

Type |

Version |

|

1 |

Electronic Messages framework model |

Model |

27 |

|

2 |

MTD VAT model mapping (UK) |

Model mapping (exporting, importing) |

27.35 |

|

3 |

MTD VAT authorization format (UK) |

Format (exporting) |

27.11 |

Important note! When new versions of ER configurations are imported, check that following configurations are marked as Default for model mapping:

-

Tax declaration model mapping

-

MTD VAT model mapping (UK)

Electronic reporting configuration download instruction from Lifecycle Services: https://learn.microsoft.com/en-us/dynamics365/unified-operations/dev-itpro/analytics/download-electronic-reporting-configuration-lcs

System administrator consent

When Electronic configurations from the Electronic configurations table are successfully imported, system administrator must do the following steps in the Legal entity interoperating with HMRC (it is supposed that MTD for VAT feature setup is done):

-

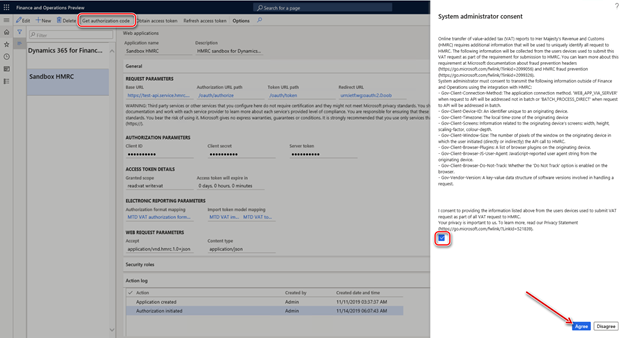

Open Modules > Tax > Setup > Electronic messages > Web applications page, select the web application you are going to use for interoperation with MTD for VAT APIs and click “Get authorization code” button on the Action pane. This step must be done even if you have previously successfully authorized the web application.

-

Type “write:vat read: vat” in the in the “Scope” field of the “Electronic report parameters” page and click OK to continue.

-

New page with “System administrator consent” will be shown. Read the information, mark the check box to confirm “I consent to providing the information listed above from the users devices used to submit VAT request as part of all VAT request to HMRC.” and click “Agree” button.

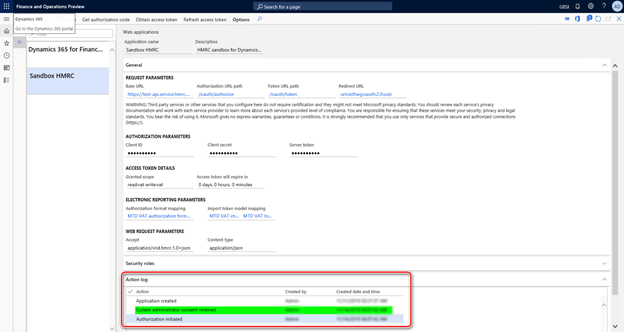

4. New record of “System administrator consent received” type will be stored in the Actionlog of the related web application:

5. Continue Authorization process as it is explained in the documentation if your web application was not previously authorized.

6. If your web application was previously authorized on HMRC side, you don’t need to continue the authorization and you may skip all other steps of authorization.

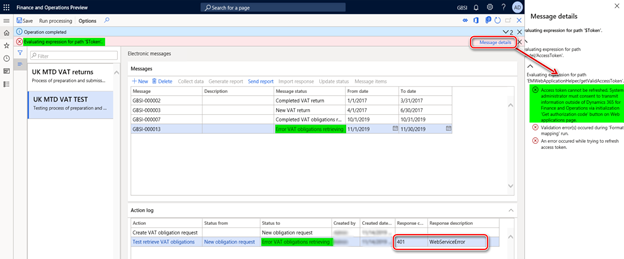

When Electronic configurations from the Electronic configurations table above are successfully imported but system administrator didn’t provide the consent as it is described in the steps above, refreshing of the access token will be blocked and no new requests to MTD for VAT APIs will be accepted by HMRC due to the old access token will be used.

In this case, if for example a new VAT obligations request is sent to HMRC, user will get “401” error and in the Message details it will be informed that “Access token cannot be refreshed. System administrator must consent to transmit information outside of Dynamics 365 for Finance and Operations via initialization 'Get authorization code' button on Web applications page.”:

Hotfix information

Electronic reporting configuration download instruction from Lifecycle Services: https://learn.microsoft.com/en-us/dynamics365/unified-operations/dev-itpro/analytics/download-electronic-reporting-configuration-lcs

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.