Summary

This article describes a country-specific update for Finland in regard to changes on the VAT report.

Starting from Jan 2018, Imported goods (VAT basis and VAT amount) need to be

reported on the VAT report.

Overview

To address the requirements, the following changes need to be done.

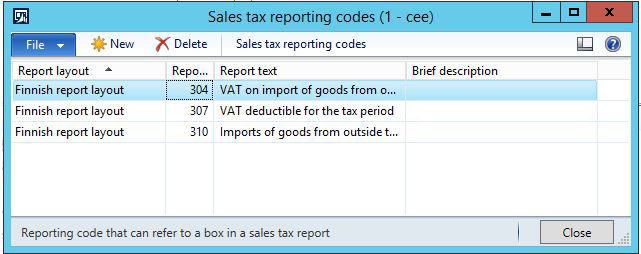

Create new reporting codes 304 (VAT on import of goods from outside the EU ) and 310 (Imports of goods from outside the EU ) in Sales tax reporting codes (General Ledger -> Setup -> Sales tax -> External -> Sales tax reporting codes) with Finnish report layout. Make sure 307 (Tax deductible) is created.

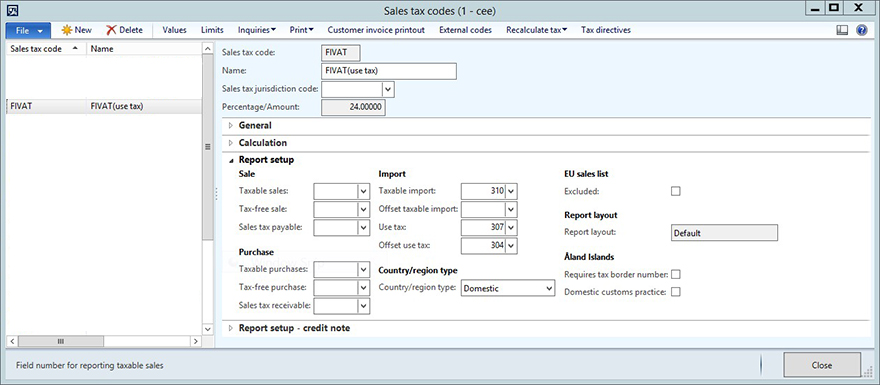

Setup existing sales tax code (or create a new if needed) on which Import operations are booked in the following way:

|

Field on Report setup tab of Sales tax code |

Value |

|

Taxable import |

310 |

|

Use tax |

307 |

|

Offset use tax |

304 |

Note In order the settings work, the sales tax code should be marked as Use tax in the Sales tax group.

Amounts collected on the Reporting code 304 for the period will be summed up to Total amount of the reporting code 308 (VAT amount to pay/receive) on the Finnish sales tax report.

Example

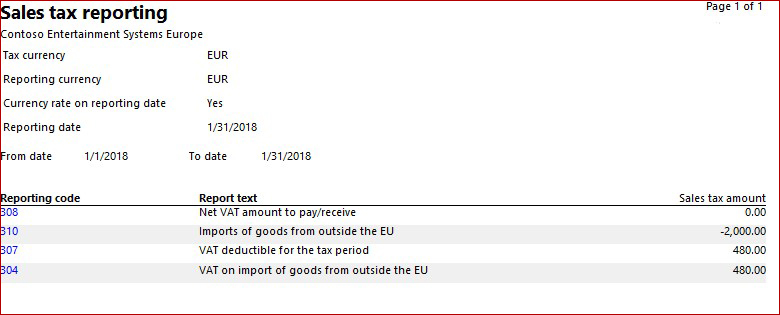

The following table illustrates the settings in forms and report output for scenario when only one transaction on imported goods took place in the period (base amount 2000 EUR, VAT amount 480 EUR):

* Scenario is relevant for Microsoft Dynamics AX 2009 SP1 and Microsoft Dynamics AX 2012/Microsoft Dynamics AX 2012 R2/Microsoft Dynamics AX 2012 R3.

|

Setup |

Form in Microsoft Dynamics AX 2012 R3 |

|

Sales tax reporting codes Report layout = Finnish report layout 304 307 310 |

|

|

Tax setup |

|

|

Sales tax authority Authority = "TA" Report layout = "Finnish report layout" |

|

|

Settlement periods Settlement period = "Mon" Authority = "TA" |

|

|

FIVAT (use tax) Settlement period = "Mon" Report setup >> Import Taxable import = "310" Use tax = "307" Sales tax payable = "304" |

|

|

Tax value = 24 |

|

|

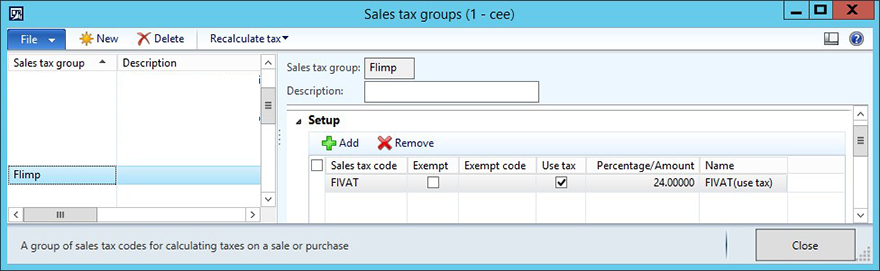

Sales tax group |

|

|

FIimp Include FIVAT, Use tax = Yes |

|

|

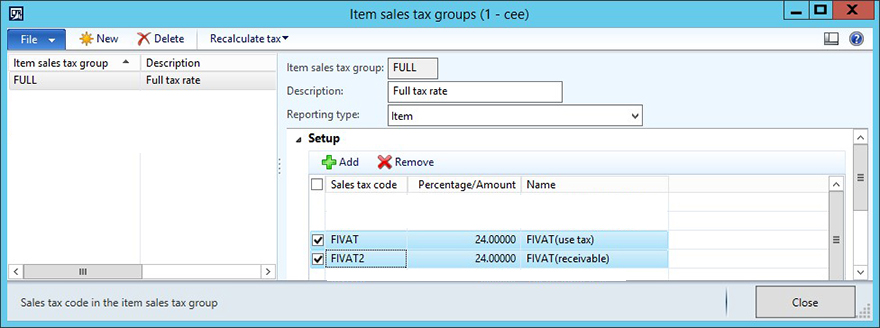

Item sales tax group FULL Include FIVAT |

|

|

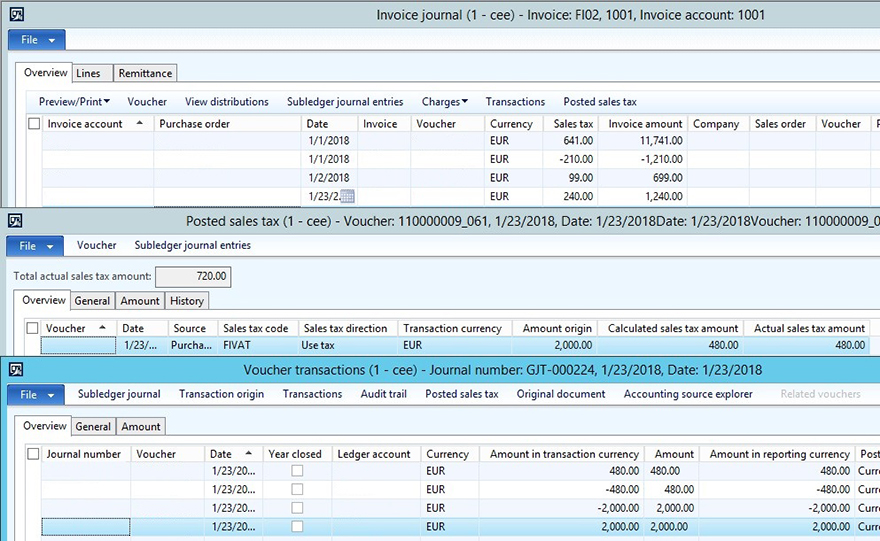

Post vendor invoice |

|

|

Invoice FI02 Line amount 2000 Tax item group FULL Tax group FIimp Note posted tax Base 2000 Tax 480 Direction Use tax |

|

|

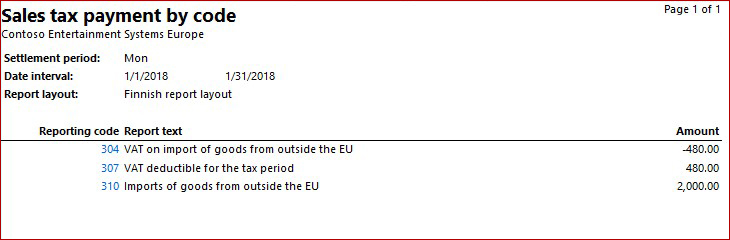

Supplementary report run |

|

|

GL >> Reports >> Transactions >> Groupings >> Sales tax payments by code Sales tax reporting codes >> Select > >Report layout = "Finnish layout" |

|

|

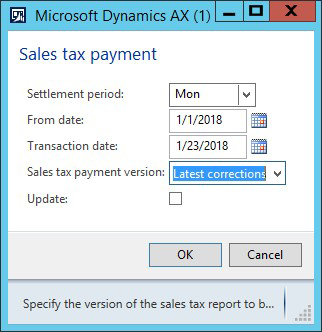

Sales tax payment report run |

|

|

GL >> Sales tax payments >> Sales tax payments |

|

|

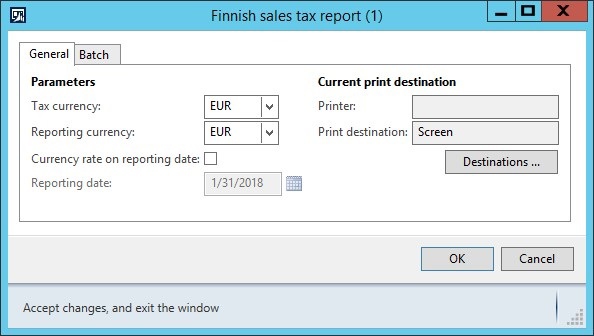

Settlement period = "Mon" From date = any < invoice date Sales tax payment version = Origin OR Latest corrections |

|

|

Tax currency = EUR Reporting currency = EUR (step is relevant for v2012 only) |

|

|

Cf. the Sales tax payments by code "304" = -(-480) "307" = 480 "310" = -(2000) "308" = "304" - "307" |

|

Hotfix information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

-

Microsoft Dynamics AX 2012 R2

-

Microsoft Dynamics AX 2012

-

Microsoft Dynamics AX 2009 SP1

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.