Introduction

Starting from January 2020 all the companies in Norway are obliged to provide by request of Norwegian Tax Administration Standard Audit File for Taxes Financial data (SAF-T) in accordance with the Documentation v.1.4 published on July 08,2019 and Technical documentation v.1.3 published on March 23, 2018 in the format of XML report coincident with the XSD schema v.1.1 of “Norwegian SAF-T Financial data” developed by “SAF-T Working group”, Skatteetaten ©, based on “OECD Standard Audit File - Taxation 2.00” modified on 02-02-2018.

Overview

To support “Norwegian SAF-T Financial data” report in Microsoft Dynamics 365 for Finance and Operations, version of the application must be of the following or later version:

|

Version of Finance and Operations |

Build number |

|

10.0.6 |

10.0.234.20020 |

|

10.0.7 |

10.0.283.10012 |

|

10.0.8 |

10.0.319.12 |

|

10.0.9 |

10.0.328.0 |

For Finance and Operations of version 7.3 the KB #4532651 must be installed.

When version of the Finance and Operations application is suitable, import from the LCS portal the following or later versions of the Electronic reporting (ER) configurations:

|

ER configuration name |

Configuration type |

Version |

|

Standard Audit File (SAF-T) |

Model |

32 |

|

SAF-T Financial data model mapping |

Model mapping |

32.30 |

|

SAF-T Format (NO) |

Format (exporting) |

32.40 |

Import the latest versions of the configurations. The version description usually contains the number of the KB article that explains the change introduced by the configuration version.

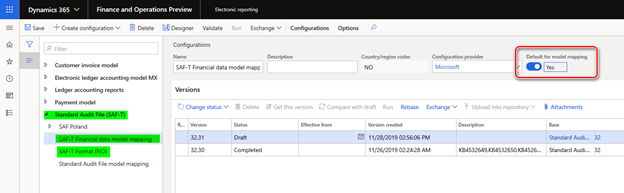

Note: After all the ER configurations from the preceding table are imported, set the Default for model mapping option to Yes for the following configuration:

-

SAF-T Financial data model mapping

For more information about how to download ER configurations from Microsoft Dynamics Lifecycle Services (LCS), see Download Electronic reporting configurations from Lifecycle Services.

Setup

To start using “Norwegian SAF-T Financial data” report in Microsoft Dynamics 365 for Finance and Operations the following setup must be done:

-

General ledger parameters – to setup ER format

-

Sales tax code – to associate with Standard tax codes (read more in the about this requirement in “Norwegian SAF-T Financial data Documentation”)

-

Main accounts – to associate with Standard accounts (read more in the about this requirement in “Norwegian SAF-T Financial data Documentation”)

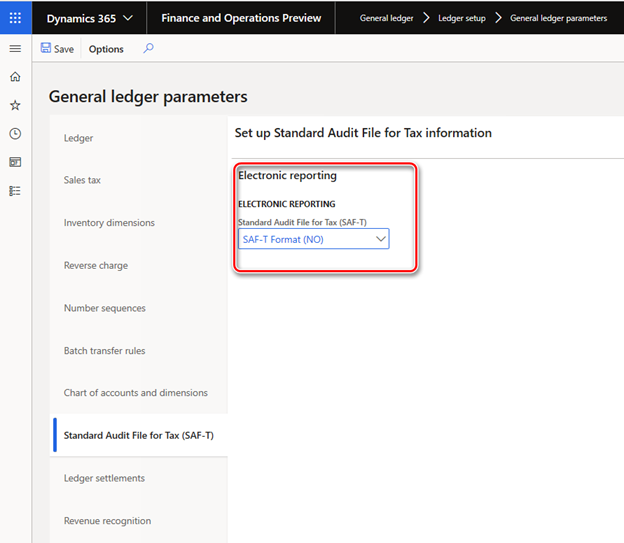

General ledger parameters

Open in Main menu: Modules > General

ledger > Ledger setup > General ledger parameters page,

Standard Audit File for Tax (SAF-T) fast tab and select “SAF-T Format

(NO)” in “Standard Audit File for Tax (SAF-T)” field.

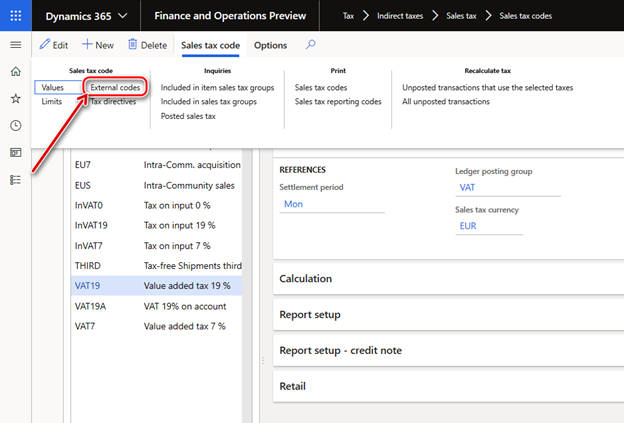

Sales tax code

As it is explained in “Norwegian SAF-T Financial data Documentation”, Sales tax codes that are used in the system must be associated with Norwegian Standard VAT Tax codes <StandardTaxCode> (available at https://github.com/Skatteetaten/saf-t ) for the purpose of SAF-T reporting.

To associate Sales tax codes that are used in the Finance and Operations, open Modules > Tax > Indirect taxes > Sales tax > Sales tax codes page, select Sales tax code record and click External codes in Sales tax codes group of the Action pane:

In the External codes page, specify the Norwegian Standard VAT codes to be used for the selected Sales tax code record for reporting purposes in SAF-T report.

Main accounts

As it is explained in “Norwegian SAF-T Financial data Documentation”, Main accounts that are used in the system must be associated with Norwegian Standard Accounts (available at https://github.com/Skatteetaten/saf-t ) for the purpose of SAF-T reporting.

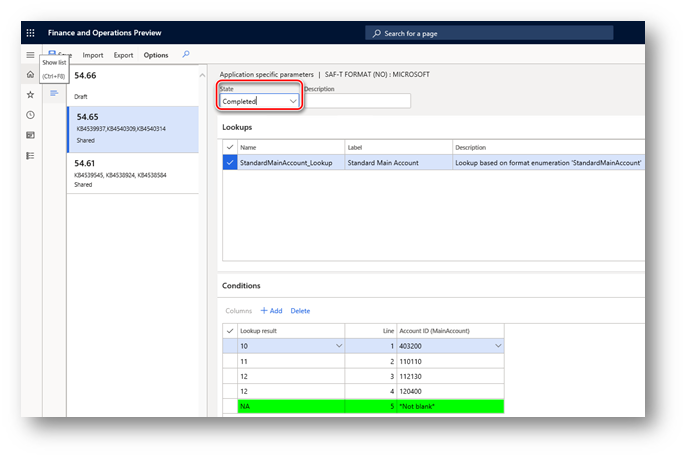

Starting from version 54.61 “SAF-T Format (NO)”electronic reporting format supports setup of Standard accounts for Main accounts of the company via Application specific parameters.

To set up Standard accounts for Main accounts of the company via Application specific parameters do the following steps:

-

Open Electronic reporting workspace, select in the configuration tree “SAF-T Format (NO)” electronic reporting format.

-

Make sure that company you are working is the company you want to do Application specific parameters setup.

-

On the Action Pane, on the Configurations tab, in the Application specific parameters group, select Setup.

-

Select the version of the format that you want to use on the left side of the Application specific parameters page.

-

Select StandardMainAccount_Lookup on the Lookups FastTab, and then specify criteria on the Conditions FastTab by adding lines for each Result value which must be used in the selected company. If several Main accounts in the selected company must result the same Standard account, add separate line for each Main account and specify the same Standard account for each of them.

-

Set up NA value as the last condition in the list. It must be set to *Not blank* in Main account column. Check by the value in the Line column that “NA” is the last condition in the table.

-

When you've finished setting up conditions, change the value of the State field to Completed, save your changes, and close the page.

You can easily export the setup of application-specific parameters from one version of a report and import it into another version by using Export and Import buttons on the Action pane. You can also export the setup from one report and import it into the same report in another company if Main accounts are the same in both companies.

Generate “Norwegian SAF-T Financial data” report

To generate “Norwegian SAF-T Financial data” report in Microsoft Dynamics 365 for Finance and Operations, open Modules > General ledger > Inquires and reports > Standard Audit File for Tax (SAF-T) > Standard Audit File for Tax (SAF-T) menu item.

Specify start and end date of the period for which you want to generate SAF-T report in From date and To date fields of the dialog page of the report respectively. Mark check boxes for Customers, Vendors, Financial dimensions if you want to include to the report all the records from the related tables. When these check boxes are not marked only those Customers and Vendors of your company will be included to the report for which there were transactions in the reporting period or the balance on which is non-zero. When Financial dimensions check box is not marked, only those Financial dimensions that are used in the transactions during the reporting period will be reported in <MasterFiles> node of the report. Select the Employee in the Personnel number field of the dialog page of the report to specify the Employee to be reported in <UserID> node of the report (ID of the user that generated the audit file.).

You may also apply filters on “Main accounts” and “General journal entry” via Records to include fast tab of the dialog page of the report.

Report naming and splitting

“Norwegian SAF-T Financial data Documentation” requires using the following naming of the resulting XML reports:

<SAF-T export type>_<organization number of the vendor who the data represents>_<date and time(yyyymmddhh24hmise>_<file number of total files>.xml

For example: SAF-T Financial_999999999_20160401235911_1_12.xml

Where:

-

“SAF-T Financial” states the SAF-T type of file

-

“999999999” represents the organization number belonging to the owner of the data.

-

“20160401235911” represents the date and time when the file was created using a 24-hour clock.

-

"1_12" represents file 1 of 12 total files in the export (same selection)

Volume of single XML file must be less than 2 GB. All single XML files submitted must validate with the schema: All <MasterFiles> are in the first file, and the associated transactions in the subsequent files (flexible number of files).

Example selection of one accounting year with 12 periods. One file per period with transactions:

|

File number |

Contents of the AuditFile |

|

1 |

Header and MasterFiles |

|

2 … 13 |

Header and GeneralLedgerEntries |

Maximum number of XML files in the same zip archive is 10.

In accordance to these requirements, in “SAF-T Format (NO)” ER format for Finance and Operation auto-splitting of the resulting report in XML is implemented with the following assumptions:

-

Maximum volume of resulting XML report is 2000000KB

-

All the XML files are named according to the following rule: <SAF-T export type>_<organization number of the vendor who the data represents>_<date and time(yyyymmddhh24hmise>

-

All the XML files are included into one zip archive

-

Each individual XML file validates with the schema (as it is explained above).

After the report generation if there are more than 1 XML file generated, user provides manual numbering of the files in the name of the generated files in archive adding “_<file number of total files>”. User controls manually that there are no more than 10 XML files in the same archive and split the archive to several archives manually so that maximum number of XML files in the same zip archive was 10.

Hotfix information

Electronic reporting configuration download instruction from Lifecycle Services: https://learn.microsoft.com/en-us/dynamics365/unified-operations/dev-itpro/analytics/download-electronic-reporting-configuration-lcs

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center for version 7.3:

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics 365 for Finance and Operations (7.3)

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

More information

You can contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.