Introduction

On July 4, 2019 the Act on Tax on Goods and Services, binding from September 1, 2019 introduces the obligation to report in an electronic document that consist of Jednolity Plik Kontrolny VAT (JPK_VAT) with the declaration (Jednolity Plik Kontrolny VDEK – “JPK_VDEK”) – JPK-V7M.

Microsoft Dynamics 365 Finance supports JPK_V7M format. To read general feature documentation, see VAT declaration with registers (JPK-V7M, VDEK) - Finance | Dynamics 365 | Microsoft Learn. For details on the initial feature release and further updates, see the following KB articles:

|

KB number |

Title |

|

JPK_V7M replacing JPK_VAT (SAF VAT) from October 1, 2020 in Dynamics 365 Finance |

|

|

Supplemented pack I for Standard Audit File VAT declaration with registers (JPK_V7M) in Dynamics 365 Finance |

|

|

VAT declaration with registers JPK-V7M (VDEK) in Excel format in Dynamics 365 Finance |

|

|

VAT declaration with registers JPK-V7M (VDEK) unlock partial generation possibility in Dynamics 365 Finance |

|

|

VAT declaration with registers JPK-V7M (VDEK) – mandatory split payment reporting in Dynamics 365 Finance |

|

|

Retail-specific scenarios for "RO/FP" document types in Polish Jednolitego Pliku Kontrolnego VDEK (JPK-V7M) in Dynamics 365 Finance |

|

|

Poland: JPK_V7M (VDEK) - Procedural markings enhancement |

|

|

Poland: Jednolitego Pliku Kontrolnego VDEK (JPK-V7M, VDEK) July 2021 changes in Dynamics 365 Finance |

This article is dedicated to implementation of changes in schema of JPK-V7M report required for the reporting periods starting from January 1, 2022 – JPK-V7M(2).

Overview of changes in version 2 of JPK-V7M

Version “2” of JPK-V7M introduces the following changes:

-

XSD version 2, valid for the reporting periods starting from January 1, 2022.

-

Description for P_26 tag has changed to “Wysokość podatku należnego z tytułu importu towarów rozliczanego zgodnie z art. 33a ustawy”

-

Calculation of the P_53 has changed to “If P_51> 0 then P_53 = 0 otherwise if (P_48 + P_49 + P_52) - P_38> = 0 then the calculation P_53 = P_48 - P_38 + P_49 + P_52 otherwise 0 should be shown.”

-

New P_540 tag has been introduced under Deklaracja node: “Zwrot na rachunek rozliczeniowy podatnika w terminie 15 dni: 1 – tak”.

-

Description for P_55 tag has changed to “Zwrot na rachunek VAT podatnika w terminie 25 dni: 1 - tak”

-

Description for P_56 tag has changed to “Zwrot na rachunek rozliczeniowy podatnika w terminie 25 dni (art. 87 ust. 6 ustawy): 1 - tak”

-

New P_560 tag has been introduced under Deklaracja node: “Zwrot na rachunek rozliczeniowy podatnika w terminie 40 dni: 1 - tak”.

-

Description for P_57 tag has changed to “Zwrot na rachunek rozliczeniowy podatnika w terminie 60 dni: 1 - tak”

-

Description for P_58 tag has changed to “Zwrot na rachunek rozliczeniowy podatnika w terminie 180 dni: 1 - tak”

-

New P_660 tag has been introduced under Deklaracja node: “Podatnik ułatwiał w okresie rozliczeniowym dokonanie czynności, o których mowa w art. 109b ust. 4 ustawy: 1 - tak”.

-

Description of values for TdowoduSprzedazy tag under Ewidencja node has been changed with a reference to the “Wypełnić zgodnie z § 10 ust. 5 rozporządzenia Ministra Finansów, Inwestycji i Rozwoju z dnia 15 października 2019 r. w sprawie szczegółowego zakresu danych zawartych w deklaracjach podatkowych i w ewidencji w zakresie podatku od towarów i usług (Dz. U. z 2019 r. poz. 1988, z późn. zm.)”

-

Description of values for TDowoduZakupu tag under Ewidencja node has been changed with a reference to the “Wypełnić zgodnie z § 11 ust. 8 rozporządzenia Ministra Finansów, Inwestycji i Rozwoju z dnia 15 października 2019 r. w sprawie szczegółowego zakresu danych zawartych w deklaracjach podatkowych i w ewidencji w zakresie podatku od towarów i usług”

-

Description of GTU_* tags has been changed with a reference to the “Wypełnić zgodnie z § 10 ust. 3 rozporządzenia Ministra Finansów, Inwestycji i Rozwoju z dnia 15 października 2019 r. w sprawie szczegółowego zakresu danych zawartych w deklaracjach podatkowych i w ewidencji w zakresie podatku od towarów i usług”.

-

Description of Procedury tags has been changed with a reference to the “Wypełnić zgodnie z § 10 ust. 4 rozporządzenia Ministra Finansów, Inwestycji i Rozwoju z dnia 15 października 2019 r. w sprawie szczegółowego zakresu danych zawartych w deklaracjach podatkowych i w ewidencji w zakresie podatku od towarów i usług.”.

-

Description of IMP tag has been changed with a reference to the “Wypełnić zgodnie z § 11 ust. 2 pkt 1 rozporządzenia Ministra Finansów, Inwestycji i Rozwoju z dnia 15 października 2019 r. w sprawie szczegółowego zakresu danych zawartych w deklaracjach podatkowych i w ewidencji w zakresie podatku od towarów i usług.”.

-

New WSTO_EE marker has been added for “Wewnątrzwspólnotowej sprzedaży na odległość towarów, które w momencie rozpoczęcia ich wysyłki lub transportu znajdują się na terytorium kraju, oraz świadczenia usług telekomunikacyjnych, nadawczych i elektronicznych, o których mowa w art. 28k ustawy, na rzecz podmiotów niebędących podatnikami, posiadających siedzibę, stałe miejsce zamieszkania lub miejsce pobytu na terytorium państwa członkowskiego innym niż terytorium kraju”

-

New IEDmarker has been added for “Dostawy towarów, o której mowa w art. 7a ust. 1 i 2 ustawy, dokonanej przez podatnika ułatwiającego tę dostawę, który nie korzysta z procedury szczególnej, o której mowa w dziale XII w rozdziale 6a lub 9 ustawy lub w odpowiadających im regulacjach, dla której miejscem dostawy jest terytorium kraju”

-

"MPP" marker has been excluded for all documents in the report.

-

"SW" marker has been excluded for all documents in the report.

-

"EE" marker has been excluded for all documents in the report.

-

Two supplementary tags are introduced for reporting of documents with enabled KorektaPodstawyOpodt tag: TerminPlatnosci – “Data upływu terminu płatności w przypadku korekt dokonanych zgodnie z art. 89a ust. 1 ustawy” and DataZaplaty – “Data dokonania zapłaty w przypadku korekt dokonanych zgodnie z art. 89a ust. 4 ustaw”. One of these dates must be reported when KorektaPodstawyOpodt tag is reported depending of if the invoice is overdue or paid overdue.

Changes listed above are applicable for the reporting periods after January 1, 2022. Thus, the new condition was introduced to the algorithm of reporting of the tags from the list above: for the periods with start date before January 1, 2022 – the old completion rules will be applied, when for the period with start date after the January 1, 2022 – the new completion rules will be applied.

Setup for JPK-V7M(2)

To upgrade your setup for JPK-V7M(2) from JPK-V7M(1) in Finance, you must follow the steps described in this section. To setup JPK-V7M(2) in case this feature was not previously used, follow the general guidance: VAT declaration with registers (JPK-V7M, VDEK) - Finance | Dynamics 365 | Microsoft Learn.

1. Upgrade Dynamics 365 Finance application

To report JPK-V7M(2) Dynamics 365 Finance application must be of the following or later versions:

|

Dynamics 365 Finance version |

Build number |

|

10.0.23 |

10.0.1037.30 |

|

10.0.24 |

10.0.1060.0 |

2. Import new versions of Electronic reporting configurations

After Dynamics 365 Finance application upgrade, import the following versions of Electronic reporting configurations, which deliver changes described in this article:

|

ER configuration name |

Type |

Version |

|

Standard Audit File (SAF-T) |

Model |

129 |

|

Standard Audit File model mapping |

Model mapping |

129.268 |

|

JPK_V7M XML format (PL) |

Format (exporting) |

129.216 |

|

JPK-V7M Excel format (PL) |

Format (exporting) |

129.216.66 |

Import the latest versions of these configurations. The version description usually includes the number of the Microsoft Knowledge Base (KB) article that explains the changes that were introduced in the configuration version. Use “Issue search” tool of the LCS portal to find the KB by the number.

Note: After all the ER configurations from the preceding table are imported, set the Default for model mapping option to Yes for “Standard Audit File model mapping” configuration.

For more information about how to download ER configurations from the Microsoft global repository, see Download ER configurations from the Global repository.

3. Update setup of application-specific parameter

After importing … version of “JPK-V7M XML format (PL)” and … version of “JPK-V7M Excel format (PL)”, you must export your setup of application-specific parameters from the previous version of ER format configuration and import it for the new version. In additional, you must do the needful adjustment of your application-specific parameters setup for JPK-V7M(2):

-

Provide necessary setup for new P_660 marker in the DeclarationMarkersSelector lookup field if this marker is applicable for your company.

-

Provide necessary setup for new WSTO_EE marker in the ProceduralMarkingsSelector lookup field if this marker is applicable for your company.

-

Provide necessary setup for new IEDmarker in the ProceduralMarkingsSelector lookup field if this marker is applicable for your company.

-

You can keep your existing setup for SW and EE markers. This setup will be used in case you will need to run JPK-V7M report for reporting periods before January 1, 2022.

When the setup for “JPK-V7M XML format (PL)” is done, export it to an XML file and import respectively for “JPK-V7M Excel format (PL)” format.

(!) Complete the application-specific parameters setup for both: “JPK-V7M XML format (PL)” and “JPK-V7M Excel format (PL)” formats.

Note (!):

We recommend that you enable the feature, Use application specific parameters from previous versions of ER formats in the Feature management workspace. When this feature is enabled, parameters that are configured for the earlier version of an ER format automatically become applicable for the later version of the same format. If this feature is not enabled, you must configure application-specific parameters explicitly for each format version. The Use application specific parameters from previous versions of ER formats feature is available in the Feature management workspace starting in Finance version 10.0.23. For more information about how to set up the parameters of an ER format for each legal entity, see Set up the parameters of an ER format per legal entity.

4. Import new version or Electronic messaging setup

To generate JPK-V7M of version 2 you must import PL JPK-V7M EM setup v.6 KB5007691 package of setup of Electronic messaging processing for “JPK-V7M”.

-

In LCS, in the Shared asset library, select the Data package asset type. Then find PL JPK-V7M EM setup v.6 KB5007691.zip in the list of data package files, and download it to your computer.

-

After the PL JPK-V7M EM setup v.6 KB5007691.zip file has been downloaded, open Finance, select the company that you will generate the JPK-V7M report from, and then go to Workspaces > Data management.

-

Before you import setup data from the package of data entities, you must make sure that the data entities in your application are refreshed and synced. For more information about how to refresh the entity list, see Entity list refresh.

-

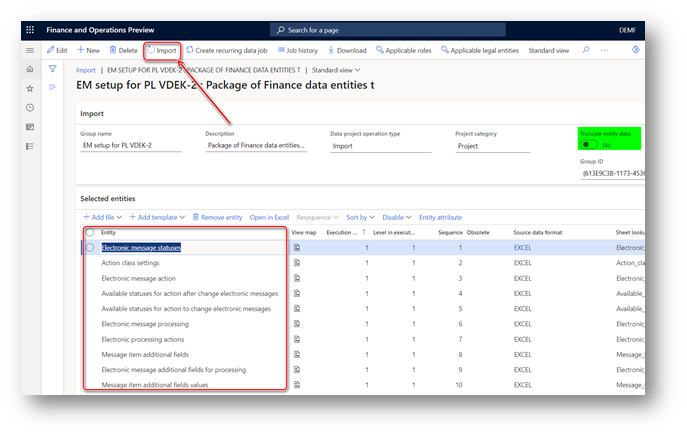

In the Data management workspace, select Import, set the Source data format field to Package, and create a new importing project by selecting New on the Action Pane.

-

On the Select entities FastTab, select Add file.

-

Select Uploadand add, select the PL JPK-V7M EM setup v.6 KB5007691.zip file on your computer, and upload it.

-

When entities from the package are listed in the grid, select Close.

-

Make sure that Truncate entity data check box is NOT marked.

-

On the Action Pane, select Import to start to import data from the data entities.

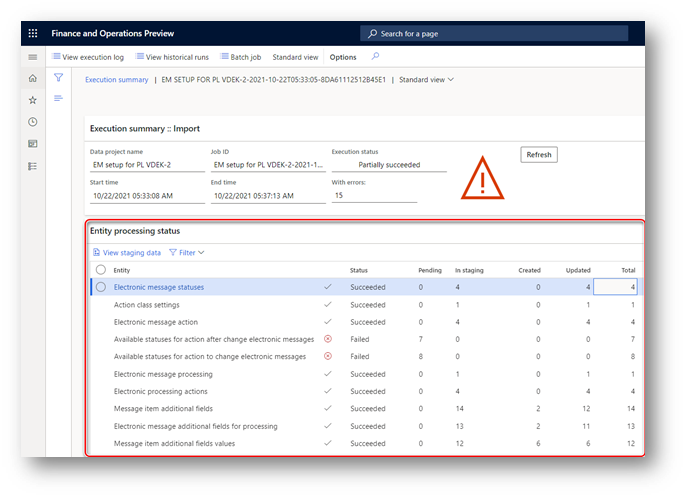

You will receive a notification in Messages, or you can manually refresh the page to view the progress of the data import. When the import process is completed, the Execution summary page shows the results.

Because the previous version of EM setup for JPK-V7M report existed in your system, some entities will be marked with Failed value in the Status column. This failed importing does not require any additional actions.

5. Update parameters of EMGenerateJPKVDEKReportController_PL executable class

Electronic reporting configurations supporting the version 2 of JPK-V7M work for both versions of JPK-V7M: (1) – for the periods before January 1, 2022 and (2) – for the periods starting from January 1, 2022. To enable this capability, new “Wersja schematu” additional field was introduced to the “JPK-V7M” EM processing. By using the “Wersja schematu” additional field user can define which version of JPK-V7M to be used during report generation. To enable the “Wersja schematu” additional field usage by the EMGenerateJPKVDEKReportController_PL executable class follow the steps:

-

Go to Tax > Setup > Electronic messages > Message processing actions page and select the Wygeneruj plik (Generate file) action in the left-hand list of actions.

-

Delete value from Executable class field, save the change.

-

Go to Tax > Setup > Electronic messages > Executable class settings page and select Wygenerowanie JPK-V7M executable class.

-

Click Parameters on the Action pane and note your settings.

-

Click Delete on Action pane to delete the Wygenerowanie JPK-V7M executable class, save the change.

-

Click New on Action pane and fill in the fields of the new line:

|

Field name |

Value |

|

Executable class |

Wygenerowanie JPK-V7M |

|

Description |

Wygenerowanie JPK-V7M |

|

Executable class name |

EMGenerateJPKVDEKReportController_PL |

7. Save the change.

8. Click Parameters on the Action pane and restore your settings from the note don on the step 4.

9. In the Schema version field select “Wersja schematu” value from the list, save your changes.

10. Go to Tax > Setup > Electronic messages > Message processing actions page and select the Wygeneruj plik (Generate file) action in the left-hand list of actions.

11. Select “Wygenerowanie JPK-V7M” value in the Executable class field, save the change.

6. Set up default version of XSD for JPK-V7M

Electronic reporting configurations supporting the version 2 of JPK-V7M work for both versions of JPK-V7M: (1) – for the periods before January 1, 2022 and (2) – for the periods starting from January 1, 2022. By using the “Wersja schematu” additional field user can define which version of JPK-V7M to be used during report generation. With PL JPK-V7M EM setup v.6 KB5007691 package “Wersja schematu” additional field will get “1” value by default. This means that when user creates new electronic message, “Wersja schematu” additional field will be set to “1”. If you want to change default value of this field do the following steps:

-

Go to Tax > Setup > Electronic messages > Electronic message processing page, select JPK-V7M on the left-hand side of the page and expand the Message additional fields FastTab.

-

Find “Wersja schematu” additional field and select the needful value from the lookup list.

-

Save your change.

7. P_540 and P_560 tags of Deklaracja node

With PL JPK-V7M EM setup v.6 KB5007691 package new values become available for “P_54_Powód” additional field. Make sure that these values are available for the user:

-

Go to Tax > Setup > Electronic messages > Electronic message processing page, select JPK-V7M on the left-hand side of the page and expand the Message additional fields FastTab.

-

Find “P_54_Powód” additional field and expand the lookup list.

-

Make sure that P_540 and P_560 values are in the list.

Supplementary changes

In addition to changes necessary for version 2 of JPK-V7M the following changes are introduced to the current update per the ideas registered on Ideas portal:

-

Microsoft Idea · JPK_V7M and missing sales tax reporting codes under mapping (dynamics.com): JPK_V7M and missing sales tax reporting codes under mapping

-

Microsoft Idea · [POL] JPK V7M (VDEK) - possibility to create correction file for one part (dynamics.com): JPK V7M (VDEK) - possibility to create correction file for one part

K_31 and K_32 tags are now supported

Extended list of Sales tax reporting codes is supported in the JPK-V7M formats and are reported respectively in K_31 and K_32 tags of Ewidencja/SprzedazWiersz/Kwoty dotyczące transakcji node:

|

Sales tax codes |

Sales tax reporting code |

Description |

Tag name in JPK-V7 |

Sign in JPK-V7M |

|

VAT17_1.5 |

11901 |

Taxable sales |

K_31 |

- |

|

11903 |

Sales tax payable |

K_32 |

- |

|

|

11904 |

Taxable sales credit note |

K_31 |

- |

|

|

11906 |

Sales tax on sales credit note |

K_32 |

- |

You can download new PL JPK Sales tax reporting codes.xlsx from LCS’s Shared asset library (in the Data package asset type) or add manually necessary reporting codes to your Finance.

Generation of JPK-V7M without Deklaracja node (for corrections in Ewidencja node only)

PL JPK-V7M EM setup v.6 KB 5007691 package introduces new “Sklad pliku” additional field to the JPK-V7M EM processing. By using the “Sklad pliku” additional field user can select whether JPK-V7M will include Deklaracja node (Pelny plik XML – full XML file) or it will not include Deklaracja node (Tylko Ewidencja - Ewidencja node only). With PL JPK-V7M EM setup v.6 KB5007691 package “Sklad pliku” additional field will get “Pelny plik XML” value by default. This means that when user creates new electronic message, “Sklad pliku” additional field will be set to “Pelny plik XML”. If you want to change default value of this field do the following steps:

-

Go to Tax > Setup > Electronic messages > Electronic message processing page, select JPK-V7M on the left-hand side of the page and expand the Message additional fields FastTab.

-

Find “Sklad pliku” additional field and select the needful value from the lookup list.

-

Save your change.

Troubleshooting

“An error occurred while running action "Wygeneruj plik"…” due to executable class parameters’ structure change

After upgrade to version of Finance containing EMGenerateJPKVDEKReportController_PL executable class with new “Schema version” parameter you may get the following error when run SAF VDEK getting below error: “An error occurred while running action "Wygeneruj plik" for the message XXX. See action log attachment for details.”

We recommend following the next steps to overcome this error:

-

Go to Tax > Setup > Electronic messages > Message processing actions page and select the Wygeneruj plik (Generate file) action in the left-hand list of actions.

-

Delete value from Executable class field, save the change.

-

Go to Tax > Setup > Electronic messages > Executable class settings page and select Wygenerowanie JPK-V7M executable class.

-

Click Parameters on the Action pane and note your settings.

-

Click Delete on Action pane to delete the Wygenerowanie JPK-V7M executable class, save the change.

-

Click New on Action pane and fill in the fields of the new line:

|

Field name |

Value |

|

Executable class |

Wygenerowanie JPK-V7M |

|

Description |

Wygenerowanie JPK-V7M |

|

Executable class name |

EMGenerateJPKVDEKReportController_PL |

-

Save the change.

-

Click Parameters on the Action pane and restore your settings from the note don on the step 4.

-

In the Schema version field select “Wersja schematu” value from the list, save your changes.

-

Go to Tax > Setup > Electronic messages > Message processing actions page and select the Wygeneruj plik (Generate file) action in the left-hand list of actions.

-

Select “Wygenerowanie JPK-V7M” value in the Executable class field, save the change.

“Application specific parameters are not set correctly for the configuration”

When application-specific parameters are not specified and completed for the selected version of the ER configuration in Electronic reporting workspace, user may see the following error when try to generate JPK-V7M report: “Application specific parameters are not set correctly for the configuration. Application specific parameters was not found for the configuration. Application specific parameters are not set correctly for the configuration. Export failed.”. When you see this error, follow the steps described in section 3 of Setup part of this KB article (“Update setup of application-specific parameter”).

We recommend that you enable the feature, Use application specific parameters from previous versions of ER formats in the Feature management workspace. When this feature is enabled, parameters that are configured for the earlier version of an ER format automatically become applicable for the later version of the same format. If this feature is not enabled, you must configure application-specific parameters explicitly for each format version. The Use application specific parameters from previous versions of ER formats feature is available in the Feature management workspace starting in Finance version 10.0.23. For more information about how to set up the parameters of an ER format for each legal entity, see Set up the parameters of an ER format per legal entity.