Business requirements

Transport tax declaration form, format and filling rules were updated by Federal tax authority order from 05.12.2016 N ММВ-7-21/668@.

New info is added into the Transport tax declaration in the Chapter 2:

Line 070 – Date of vehicle registration

Line 080 – Date of removal from register

Line 130 – Year of vehicle production

Line 280 – Tax deduction code

Line 290 – Tax deduction amount

The calculation of transport tax logic should consider the tax deduction amount for each fixed asset where it is applicable.

Overview

User now has a possibility to choose the code of tax deduction in the fixed asset card and identify the amount of tax deduction for reporting year. The entered data is further transferred to the Tax register journal for Transport tax registers and considered for calculation of Transport tax.

Overview of transport tax functionality is available in the Technet articles:

(RUS) Set up the calculation of transport tax [AX 2012]

Setup

Before calculating the transport tax declaration according to the updated forma and format, user should enter the following information:

-

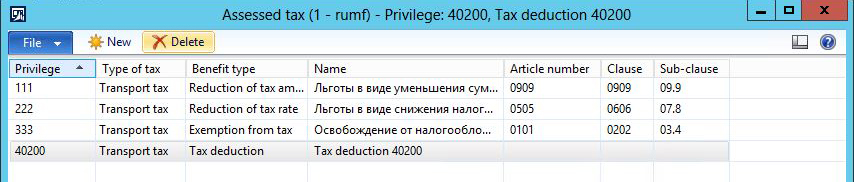

Create Tax deduction code in the form Fixed assets (Russia) > Setup > Tax reporting > Tax allowances

-

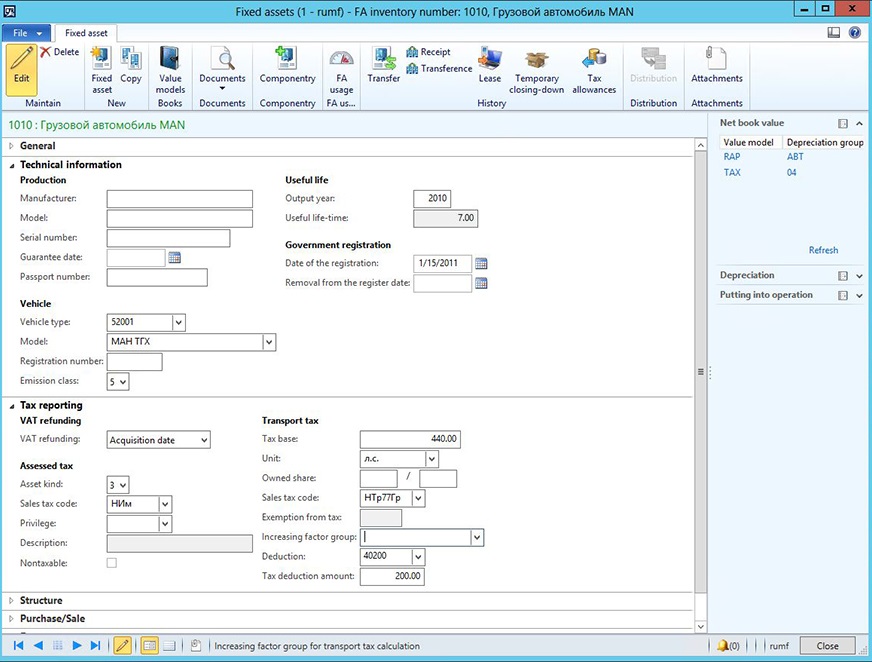

Update information in the Fixed assets of Vehicle type:

|

Field |

Description |

|

Tab Technical information: Output year |

Enter Year of vehicle production. |

|

Date of registration |

Enter Date of vehicle registration. |

|

Removal from the register date |

Enter Date of removal from register, if applicable. |

|

Tab Tax reporting: Deduction |

Choose code of tax allowance created above (Tax deduction code). |

|

Tax deduction amount |

Enter Tax deduction amount. |

Transactions

Create and calculate tax registers for Transport tax in the form Fixed assets (Russia) > Journals > Tax register journal.

Tax register Vehicle - tax calculation now contains 2 additional fields:

-

Deduction (presents Tax deduction code)

-

Tax allowance amount (presents Deduction amount)

Deduction amount is considered in calculation of the Tax amount field for current vehicle.

This register also contains information about:

-

Output year

-

Date of registration

-

Removal form the register date

All these data are exported to the updated form of Transport tax declaration.

Electronic format

The updated setup of Transport tax declaration for Electronic Reporting Module for year 2017 is available:

On CustomerSource:

https://mbs.microsoft.com/customersource/Global/AX/downloads/hot-fixes/msdaxelecrepdec2017russia

And PartnerSource:

Hotfix information

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

-

Microsoft Dynamics AX 2012 R2

-

Microsoft Dynamics AX 2009 SP1

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

https://mbs.microsoft.com/customersource/northamerica/help/help/contactus

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.