Introduction

From January 1, 2019, GST registered businesses are required to apply customer accounting (aka, reverse charge) on a relevant supply of prescribed goods made to a GST-registered customer for his business purpose.

The changes in the hotfix contain a solution for setting up reverse charge rules for sales tax code and reflecting related information in customer invoice and tax and base amounts in the respective boxes of the GST report.

Setup

Below you can find a brief guide, on how to set up the functionality. Please note this is an example of the settings.

It is recommended that you create and use separate sales tax codes for sales operations and purchase operations.

-

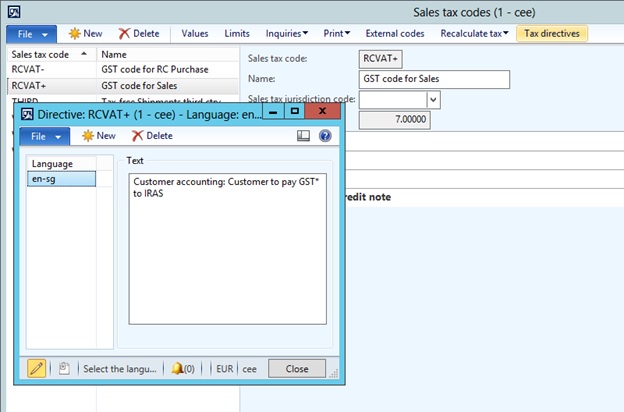

Create a sales tax code for reverse charge sales operations (General ledger > Setup> Sales tax > Sales tax codes).

-

For sales tax code for Sales operations define special wording to be printed in invoice for the sales tax code. Click Tax directives and in the opened form type the wording, for instance “Customer accounting: Customer to pay GST* to IRAS”.

-

Create positive and negative sales tax codes for purchases (Tax > Indirect taxes > Sales tax > Sales tax codes).

-

-

Create a sales tax code that has a positive value.

-

Create a sales tax code that has a negative value. Set the Allow negative sales tax percentage option to Yes. You must include this negative sales tax code to an item sales tax group and then assign that item sales tax group to the items that are subject to the reverse charge.

-

-

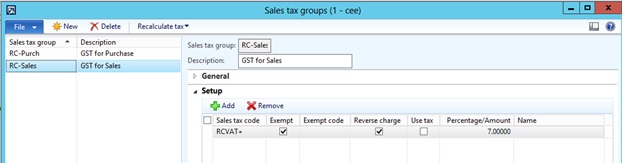

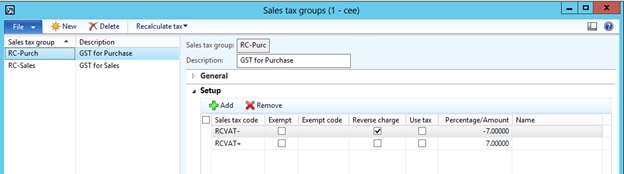

Create separate sales tax groups for Sales and for Purchase purposes.

-

Include the sales tax code for created for the sales in the sales tax group for sales. Select the Exempt and Reverse charge check boxes for the sales tax code.

-

Include both positive and negative sales tax codes in Sales tax groups for purchases. Select the Reverse charge check box for the sales tax code that has a negative value.

-

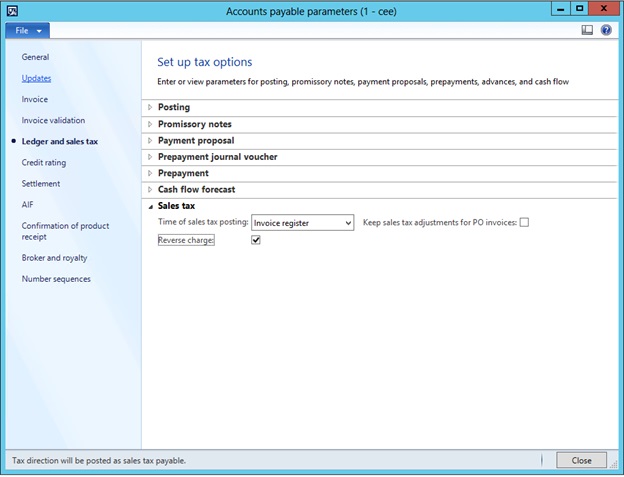

In Accounts payable parameters set Reverse charge to Yes.

-

When a sales invoice that has the reverse charge is posted, the sales tax transactions have the Sales tax payable tax direction and zero sales tax, and the Reverse charge check box is selected. Thus, the exclusive value of the prescribed goods sold is reported in Box 1 “Total value of standard-rated supplies” of GST return. And there is no output tax to be reported under Box 6 “Output tax due”.

-

When a purchase invoice that has the reverse charge is posted, two sales tax transactions are created. One transaction has the Sales tax receivable tax direction. The other transaction has the Sales tax payable tax direction, and the Reverse charge check box is selected. Thus, the value of prescribed goods purchased is reported in Box 5 “Total value of taxable purchases” of GST return; the GST as input tax - in Box 7 “Input tax and refunds claimed” of GST return. Since you are required to account for GST on behalf of your supplier, the GST-exclusive price of the goods is reported in Box 1 “Total value of standard-rated supplies” and the GST amount in Box 6 “Output tax due” of the GST return.

Hotfix Information

This update is available for manual download and installation from Download Center:

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

More Information

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request.

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here in is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.