Summary

This country-specific update for Brazil Rio de Janeiro (RJ) state for the generation of SPED Fiscal.

RJ has published Resolution 13/2019, ( “Resolution” below in text) which defines how an NF-e should be issued, and how to record such information in the EFD ICMS IPI, when executing the following operations (Decree No. 27.815 / 01):

-

EXEMPTION

-

REDUCTION OF THE BASIS OF CALCULATION OR REDUCTION OF RATE

-

PRESUMED CREDIT

-

"TAXATION ON BILLING", "TAXATION ON RECIPE" OR "TAXATION ON OUTPUT"

-

DEFERRAL

-

INEXIGIBILITY OF CREDIT REVERSE

-

FISCAL CREDIT REPAIR OR ACCUMULATED CREDIT BALANCE TRANSFER

According to this Resolution "Exonerations" are to be registered as adjustments on Fiscal Documents and as adjustments in Fiscal Books and to be reported in SPED Files.

The Resolution requirements impact on output the E11, E115, C195/C197/0460 lines in SPEC fiscal.

Overview

Overview of SPED Fiscal records by operations, listed in the Resolution

1. Exemption and credit reversal

During the Sync process two types of adjustment transactions will be created in ICMS tax assessment under these specific criteria:

-

Outgoing fiscal document issued from RJ state with taxation code = 30 or 40

-

Benefit codes from table 5.2 and 5.3 as well as observation code are assigned to the related item and state of above fiscal document.

For example, code from 5.2 table = RJ801137, code from 5.3 table = RJ90980000

Adjustment transactions created automatically in SPED Fiscal (examples):

-

Adjustment code from table 5.2 generates a E115 record

|E115|RJ801137|0||

-

Adjustment code from table 5.3 generates a C197 record

|C197|RJ90980000|RJ801137|ItemId|0,00|0,00|0,00|0.88|

Note. In this example the base amount = 3.5, ICMS %=18, FCP=0,02, amount 0.88 is calculated as:

3,5/ (1-(0,18+0.02)) * (0,18+0,02)

-

Observation code, assigned to the related item and state of above fiscal document, generates C195 and 0460 records:

|C195|<Observation code>|<Observation code description>|

|0460|<Observation code>|<Observation code description>|

To register the reversal of credits, a user creates manual adjustment in the General tax adjustment/ benefit/ incentive journal and fill in Description field with the code from the table 5.2.

Adjustment transactions created automatically (examples) in SPED Fiscal:

|E111|RJ18003| RJ801137|<Adjustment amount>|

2. Reduction

of Tax base or percentage:

During the Sync process two types of adjustment

transactions will be created in ICMS tax assessment under these specific

criteria:

-

Outgoing fiscal document issued from RJ state with taxation code = 20 ,70

-

Benefit code from table 5.2 and 5.3 are assigned to the related item and state of above fiscal document

For example, code from 5.2 table = RJ802164, code from 5.3 table = RJ90980000

Adjustment transactions created automatically (examples) in SPED Fiscal:

-

Adjustment code table 5.2 generates E115 record

|E115|RJ802164|0||

-

Adjustment code from table 5.3 generates a C197 record

|C197|RJ90980000|RJ802164|ItemId|0,00|0,00|0,00|0,20|

Note. In this example the base amount = 3.5, ICMS %= 12, Percentage reduction =41.67, amount 0.20 is calculated as:

3,5 * (1-(0,12*(1-0,4167)))/ (1-0,12)-3,5

-

Observation code, assigned to the related item and state of above fiscal document, generates C195 and 0460 records:

|C195|<Observation code>|<Observation code description>|

|0460|<Observation code>|<Observation code description>|

3. Presumed credit

Out of scope: the system can’t prepare additional % necessary for C197.

To register the reversal of credits, a user creates manual adjustment in the General tax adjustment/ benefit/ incentive journal and fill in Description field with the code from the table 5.2.

Adjustment transactions created automatically (examples) in SPED Fiscal:

|E111| RJ018003|RJ805289|<Adjustment amount>|

4. Tax on Total sales, output, billing

During the Sync process one type of adjustment transactions will be created in ICMS tax assessment under these specific criteria:

-

Outgoing fiscal document issued from RJ state with taxation code = 00

-

Benefit code from the table 5.2 is assigned to the related item and state of above fiscal document (code from the table 5.3 is not assigned)

For example, code from 5.2 table = RJ822371

Adjustment transactions created automatically (examples) in SPED Fiscal:

-

Adjustment code table 5.2 generates E115 record:

|E115| RJ822371|0||

Note. As there is no code 5.3, records C195, C197 and 0460 are note created

To register the reversal of credits/ debits/ the debits of 3,5%, a user creates manual adjustments in the General tax adjustment/ benefit/ incentive journal and fill in Description field with the code from the table 5.2.

Adjustment transactions created automatically (examples) in SPED Fiscal:

|E111|RJ18003|RJ822371|<Adjustment amount>|

|E111|RJ38003|RJ822371|<Adjustment amount>|

|E111|RJ08006|RJ822371|<Adjustment amount>|

5. Deferral

During the Sync process two types of adjustment transactions will be created in ICMS tax assessment under these specific criteria:

-

Outgoing fiscal document issued from RJ state with taxation code = 51

-

Benefit codes from table 5.2 and 5.3 are assigned to the related item and state of above fiscal document.

For example, code from 5.2 table = RJ818317, code from 5.3 table = RJ90980001

Adjustment transactions created automatically (examples) in SPED Fiscal:

-

Adjustment code from table 5.2 generates a E115 record

|E115| RJ818317|0||

-

Adjustment code from table 5.3 generates a C197 record

|C197| RJ90980001| RJ818317|ItemId|0,00|0,00|0,00|6585.36|

Note. In this example the base amount = 30000,00, amount 6585.36 is calculated as:

30000,00/ (1-0,18)*0,18

-

Observation code, assigned to the related item and state of above fiscal document, generates C195 and 0460 records:

|C195|<Observation code>|<Observation code description>|

|0460|<Observation code>|<Observation code description>|

6. Enforceability of credit reversal

During the Sync process two types of adjustment transactions will be created in ICMS tax assessment under these specific criteria:

-

Outgoing fiscal document issued from RJ state with taxation code = 40

-

Benefit codes from table 5.2 and 5.3 are assigned to the related item and state of above fiscal document.

For example, code form 5.2 table = RJ801163, code form 5.3 table = RJ90980000

Adjustment transactions created automatically (examples) in SPED Fiscal:

-

Adjustment code from table 5.2 generates a E115 record

|E115| RJ801163|0||

-

Adjustment code from table 5.3 generates a C197 record

|C197|RJ90980000|RJ801137|ItemId|0,00|0,00|0,00|20|

Note. In this example the base amount = 200, ICMS %=18, FCP=0,02, amount 20 is calculated as:

200/ (1-(0,18+0,02))*(0,18+0.02)

-

Observation code, assigned to the related item and state of above fiscal document, generates C195 and 0460 records:

|C195|<Observation code>|<Observation code description>|

|0460|<Observation code>|<Observation code description>|

To register the reversal of credits, a user creates manual adjustments in the General tax adjustment/ benefit/ incentive journal and fill in Description field with the code from the table 5.2.

Adjustment transactions created automatically (examples) in SPED Fiscal:

|E111|RJ18003| RJ801163|<Adjustment amount>|

7. Passing on or transfer of Tax credit

During the Sync process two types of adjustment transactions will be created in ICMS tax assessment under these specific criteria:

-

Outgoing tax fiscal document issued from RJ state with taxation code = 90

-

Benefit codes from table 5.2 and 5.3 are assigned to the related item/ CFOP and state of above fiscal document.

For example, code form 5.2 table = RJ801163, code form 5.3 table = RJ90980000

To register the reversal of credits, the system automatically creates adjustments in the General tax adjustment/ benefit/ incentive journal and relates the journal line to the tax fiscal document.

Adjustment transactions created automatically (example for a sender) in SPED Fiscal:

E115|RJ821231|0||

C197| RJ40080001|RJ821231|codigoitem|0,00|0,00|<Tax amount>|0,00|

Adjustment transactions created automatically (example for a recipient) in SPED Fiscal:

E115|RJ821231|0||

C197|RJ10080002|RJ821231|codigoitem|0,00|0,00|<Tax amount>|0,00|

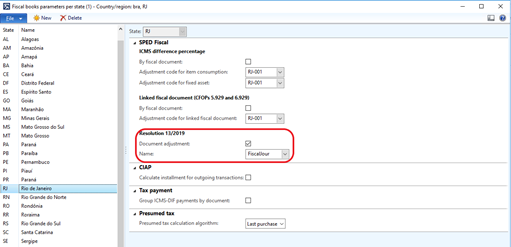

Fiscal books parameters per state

-

Navigate Fiscal books > Setup > Fiscal books parameters per state

-

Expend SPEC Fiscal FastTab and in the Resolution 13/2019 field group:

-

-

Select Document adjustment check box – Processing document adjustment according to Resolution 13/2019. If this parameter is not selected, the system does not apply the Resolution requirements.

-

Name – Journal name for General tax adjustment/ benefit/ incentive journal. The system uses this journal name, when a user needs to perform ICMS transfer operation to another fiscal establishment.

-

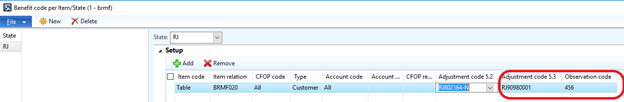

Benefit code per Item/ state

-

Navigate General ledger > Setup > Sales tax > Benefit code per Item/ state.

-

The new Adjustment code 5.3 and Observation fields were added in Benefit code per Item/ State form:

These settings are used for automatic creation ICMS adjustment records for Fiscal document line when posting and Sync operation executing.

A user should setup records in this form, in order to get the correct SPEC fiscal according to the Resolution.

Tax fiscal document

If the Document adjustment check box is selected in Fiscal books parameters per state for the state then a user may select only sales tax code with Fiscal value equal to 3 (taxation code, related to the sales tax code has Fiscal value=3, without credit/debit) in the Tax fiscal document line (General ledger > Journals > All tax fiscal documents).

Note. For correct posting the tax fiscal document the selected sales tax code should have the following calculation setting:

-

Origin Percentage of net amount

-

Marginal base Net amount per line.

-

Calculation method Whole amount.

When posting a Tax fiscal document that has such sales tax code attached to the line, the system does not create voucher transaction. But when a user executes Sync operation (Fiscal books > Common > Booking period, the Sync button), the system creates and posts General tax/ adjustment/ benefit / incentive journal (Fiscal books > Journals) related with the posted Tax fiscal document for ICMS transfer to another fiscal establishment.

The system fills in data in the journal lines from Posting profile of adjustment code 5.3 (Fiscal books > Setup > Tax adjustment codes > Adjustment and information for fiscal documents, Posting FastTab) and the amount fills in from the Tax fiscal document.

Note. A user should setup Benefit code per Item/ State (General ledger > Setup > Sales tax > Benefit code per Item/ state) for ICMS transfer before using this functionality. According to the Resolution adjustments codes should be set up for ICMS transfer:

-

Adjustment code 5.2 =RJ821231 and Adjustment code 5.3= RJ10080002 for Sender

-

Adjustment code 5.2 =RJ821231 and Adjustment code 5.3 = RJ10080002 for Recipient.

Hotfix information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have the following product installed to apply this hotfix:

-

Microsoft Dynamics AX2012 R3 CU8

More information

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request.

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.

Note This is a "FAST PUBLISH" article created directly from within the Microsoft support organization. The information contained here is provided as-is in response to emerging issues. As a result of the speed in making it available, the materials may include typographical errors and may be revised at any time without notice. See Terms of Use for other considerations.