Introduction

As per Items No. 6 & 13 of Schedule 10 of Act CXXVII of 2007 on value added tax (entering into effect on 1 July 2018):

“6. The taxable entity shall perform data reporting for each invoice, via an electronic channel as defined in a dedicated regulation, towards the National Tax and Customs Authority, on the data contained, as per the dedicated regulation, within the invoices issued via the invoicing function of a programme, which invoices contain taxes of or in excess of, HUF 100,000 passed on another taxable person registered domestically. The taxable entity shall also perform data reporting, via an electronic channel as per the dedicated regulation, regarding any modifications or annulments of these invoices. Data reporting shall also be performed, as per the dedicated regulation, regarding modifications which result in the amount of tax passed on to another taxable entity on in the invoice, reaching or exceeding HUF 100,000.”

“13. The taxable entity may elect to fulfil their obligation set in this Annex without respect to the threshold amounts defined in Points 1–8.”

According to the new legislation changes is required:

-

Maintenance of issued invoices register.

-

Automatic submitting xml file with issued invoices to Online Invoicing System and processing interaction with service (machine-machine interface without any human intervention within the system).

-

Invoice data should be embedded in the XML file encoded to BASE64 format.

To meet this new legislation changes requirements in Microsoft Dynamics AX there was implemented a new functionality Online invoicing system register. This functionality lets users to:

-

Set up specific Online invoicing system web-services that should be used to automatically transmit data directly to the Online invoicing system

-

Set up technical user login, password, signature and replacement keys.

-

Maintain a register of invoices to support the process of transmission and receiving a response on Issued invoices.

-

Automatically generate and send XML reports to the Online invoicing system in the required formats.

-

Automatically receive and interpret responses from the Online invoicing system.

-

Store and review all the transmitted and received XML reports.

Overview

This document is a guidance for users of Microsoft Dynamics AX 2009 SP1, AX 2012 R2 and AX 2012 R3.

This guidance describes how to set up and use Microsoft Dynamics AX to interact with the Online Invoicing system according to the new legal requirements.

The document includes two parts:

-

Online invoicing system setup.

-

Online invoicing system register.

The Setup part describes how Microsoft Dynamics AX should be set up to let Online invoicing system register work correctly.

The Online invoicing system register part describes how to work with Microsoft Dynamics AX to interact with the Online invoicing system (Online invoicing system official website).

Online invoicing system setup

To get Dynamics AX ready to work with Online invoicing system you need to do the following settings:

-

Technical user login/password and signature and replacement keys.

-

Online invoicing system services.

-

Batch for automatic execution machine-machine interface.

-

Financial reasons.

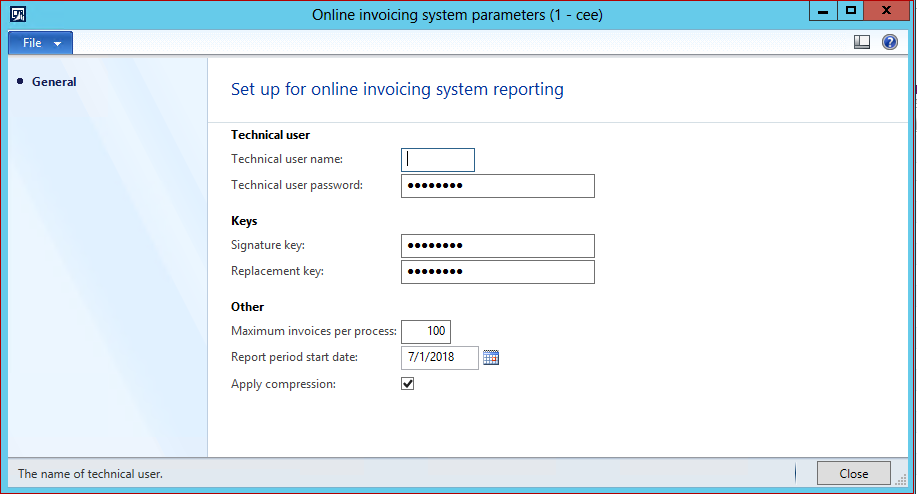

Technical user login/password and signature and replacement keys setup

To set up Technical user login/password and signature and a replacement keys as well as other parameters open General ledger > Setup >Sales tax >External >Online invoicing system parameters.

Fill in the technical user login/password and signature and replacement keys, which you should get from Online invoicing system (Information on the registration procedure).

Also fill in the following parameters:

-

Maximum invoices per process (<=100).

-

Report period start date (07/01/2018).

-

Apply compression (if necessary). If you select this parameter, the system will compress invoice data before submitting the xml file.

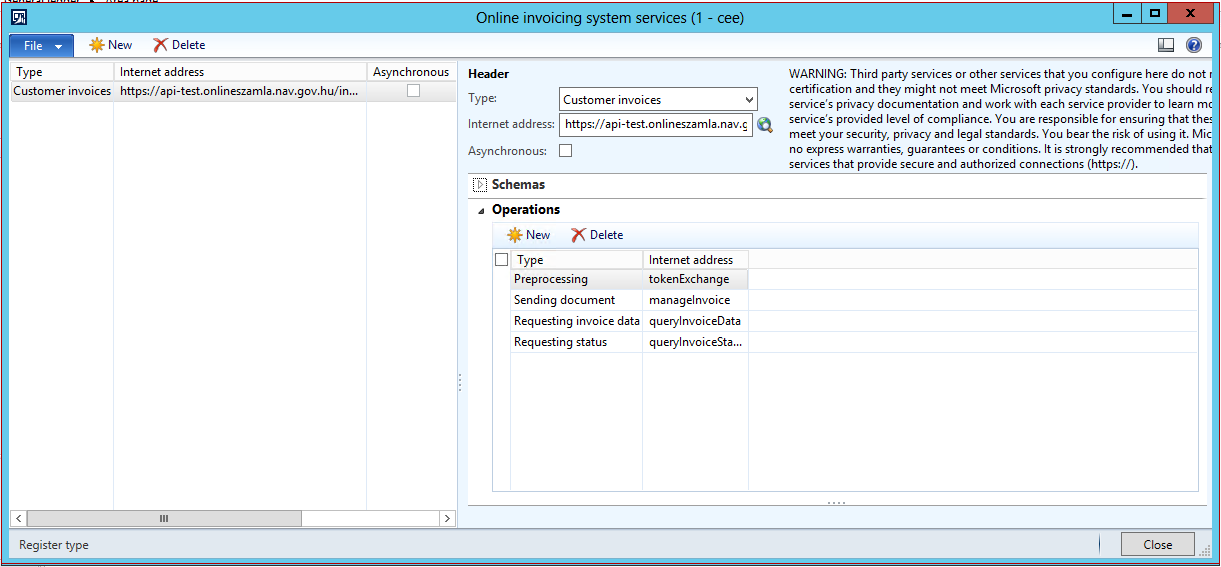

Online invoicing services setup

To set up Online invoicing system services open the General ledger > Setup > Sales tax > External > Online invoices system services.

Create a new record and fill in the following fields:

-

Type (Customer invoices)

-

Internet address

-

Operations

-

Preprocessing - tokenExchange

-

Sending document - manageInvoice

-

Requesting invoice data - queryInvoiceData

-

Requesting status - queryInvoiceStatus

-

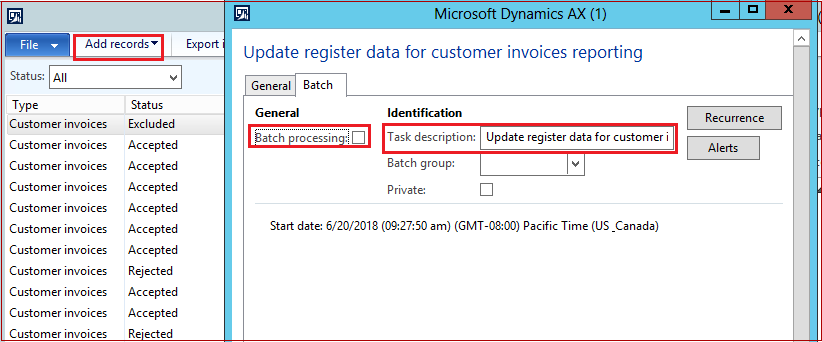

Batch for automatic execution machine-machine interface setup

Activate batch in the Online invoicing system form (General ledger > Periodic > Online invoicing system register) for automatic adding records to the register (previously set up filter for selecting invoices in the General tab):

You may fill in task description with any value, for example, "Update register data for customer invoices reporting."

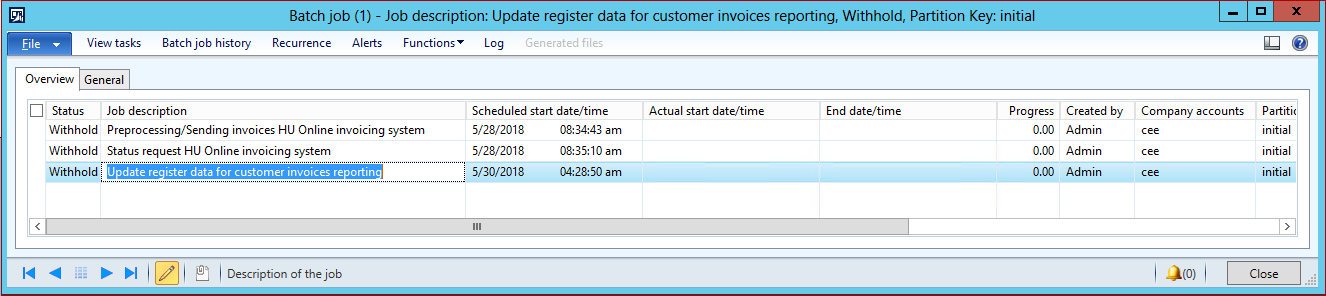

To set up batches, which necessary for automatic submitting issued invoices, open System administration > Inquiries > Batch jobs > Batch job (see creation of a batch in detail under the link Create a batch job [AX 2012]) and create two batches:

-

Preprocessing/Sending invoices HU Online invoicing system (class name SIIRegisterReport_HU)

-

Status request HU Online invoicing system (class name SIIRegisterReport_HU)

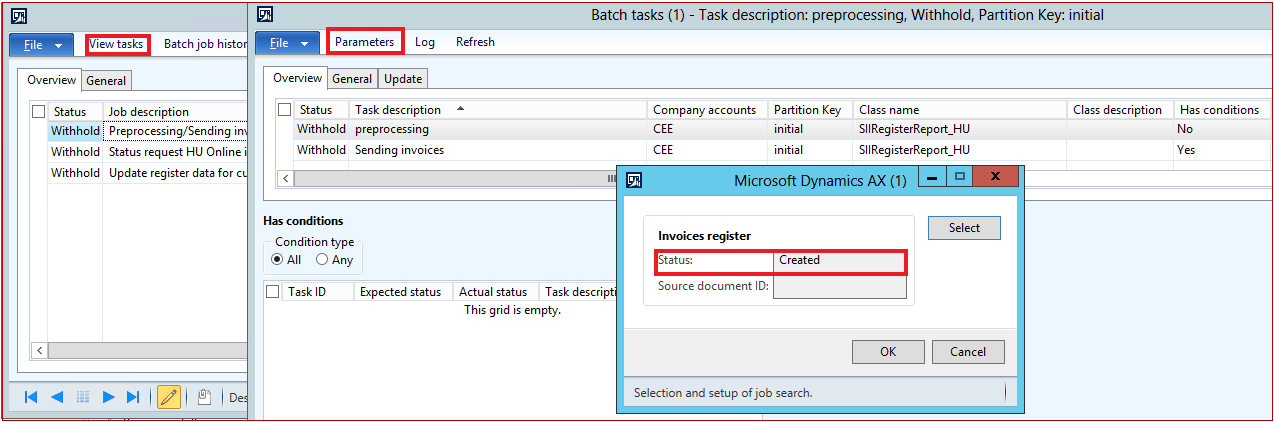

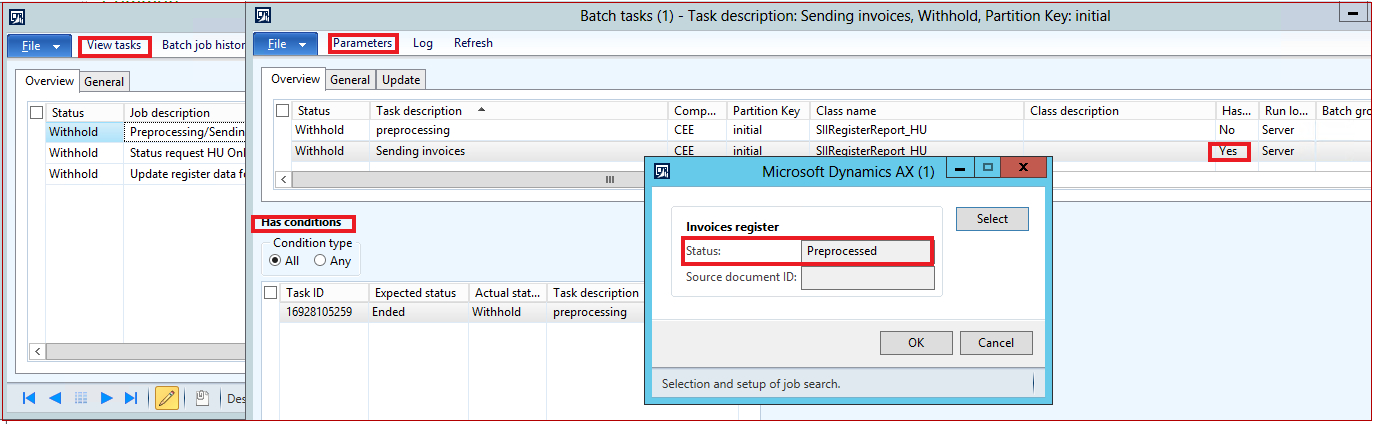

For Preprocessing/Sending invoices HU Online invoicing system batch create two tasks (View task button):

-

preprocessing (Parameter Status Created) (class name SIIRegisterReport_HU)

-

Sending invoices (Parameter Status Preprocessed) (class name SIIRegisterReport_HU)

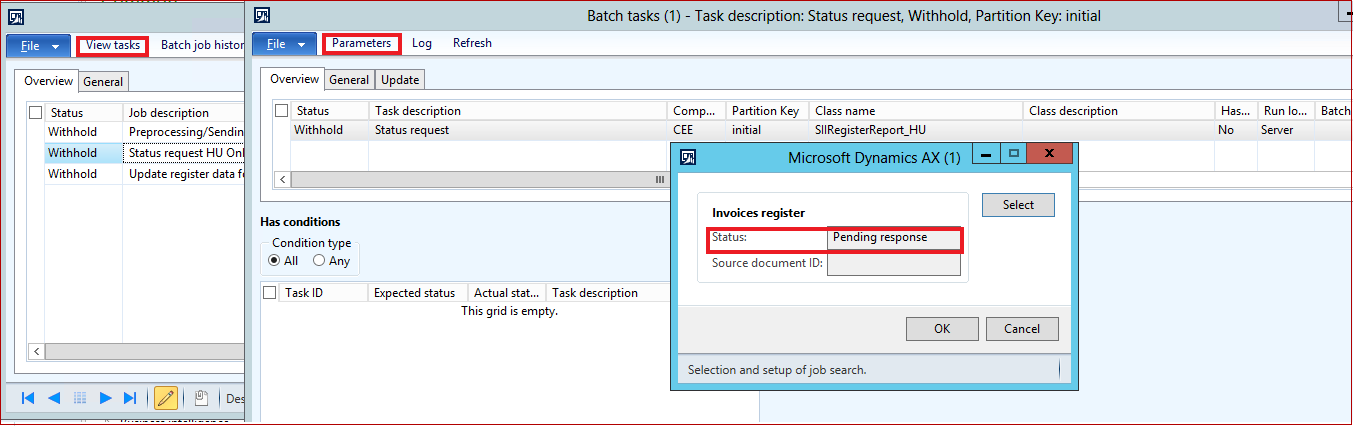

For Status request HU Online invoicing system batch create one task:

-

Status request (Parameter Pending response, class name SIIRegisterReport_HU)

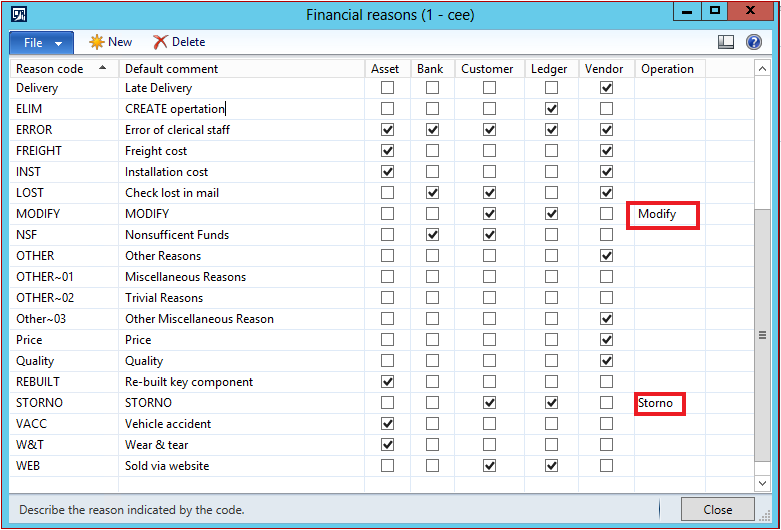

Financial reasons setup

To set up Financial reason open Organization administration > Setup > Financial reasons

You may set up Financial reason, if you want specify invoice operation manually when you posting/creating invoice. The system supports the following operations, which specified in Online invoicing system documentation: CREATE, MODIFY and STORNO.

For example, if a user create invoice and select MODIFY operation, it means that the user considers the invoice as modification of invoice, posted earlier. In this case, the system creates invoice record in the Online invoicing system register but not submit this invoice until the user specifies reference to the invoice, which should be modify, and changes register record status.

You may create several reasons with the same operation.

Online invoicing system register

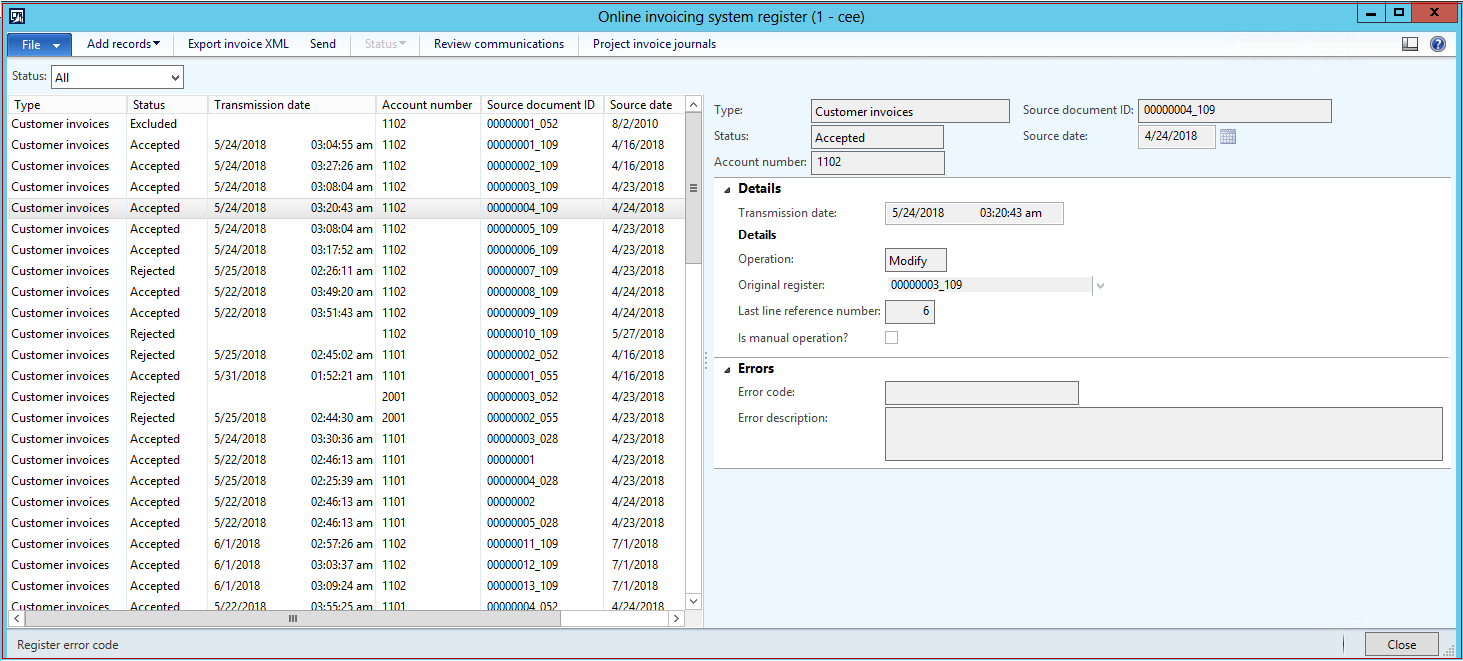

The Online invoicing system register form is used for interaction Dynamics AX with Online invoicing system.

To overview and submit issued invoices open General ledger > Periodic > Online invoicing system register.

Fields description (table):

|

Field name |

Field description |

|

Type |

Always is equal to Customer invoices. Customer invoices register records are created from Account receivable invoice journal and Project invoices |

|

Status |

The field reflects the actual status of the invoice in correspondence with the Type of scheme. This field can be filled in automatically only on adding an invoice to the register and can have the following values:

|

|

Transmission date |

This is the date and time of the last invoice Status change. |

|

Account number |

Account number of a Customer |

|

Source document ID |

Invoice Id |

|

Source date |

Inoice date |

Fields description (right form part, Detail, Errors):

|

Field name |

Field description |

|

Operation |

CREATE, MODIFY, STORNO. The system defines CREATE and MODIFY operations automatically. The system defines operation CREATE if there is no any reference to original invoice and operation Modify - if there is reference to the original invoice STORNO operation should be define only via Financial reason with STORNO operation in the Operation field. If a user specified STORNO operation on the invoice, the system create register record with Excluded status. A user may enter reference to the original invoice and change the register status to Created. |

|

Original register |

Reference to the register record with original invoice. If register operation is equal MODIFY or STORNO the Original register field should be filled in otherwise, Online invoice system returns error. |

|

Last line reference number |

CREATE – last number is equal to invoice line quantity MODIFY/STORNO - last number is equal to invoice line quantity + original invoice line quantity + summary quantity lines of all invoices, referred to the same original register. |

|

Is manual operation? |

If register record was created on invoice with financial reason with filled Operation field |

|

Error code |

Error code, which was received from Online invoicing system. |

|

Error description |

Description of error |

Functions

All functions in this form may be executed either in automatically (see setting of batches) or manually.

Both automatic and mannually process goes via the following states (in general):

-

Add records to Online invoicing register

-

Requesting/receiving token

-

Submitting request with encoded invoices and receiving transaction ID

-

Requesting/Receiving invoice statuses

To execute submitting invoices to Online invoicing system automatically it is necessary to set up batches (see Set up section).

Manual regime means that users should execute all steps themselves.

|

Function |

Button |

|

Add records to the register |

Add records/ Customer invoices |

|

Send/Receive token |

Send |

|

Submitting request with encoded invoices and receiving transaction ID |

Send |

|

Requesting/Receiving invoice statuse |

Send |

Add records

Note When calculating the VAT amount, the system selects Tax transaction with Type of Tax, specified in Sales tax code, equal to Standard VAT or Reduced VAT. Reverse charge VAT is defined by Tax code equal to RC.

Use this function to automatically update Online invoicing system register and add new invoices in it (Add records/ Customer invoices button).

You can define, which invoices should be added to the register by clicking the Select button.

If you modify or storno invoices in past period (with date less, than 07/01/2018) the record of invoices in past period should be in the register, in order to the system might fill in Original register reference automatically. It is advisable to add invoice records of past periods (for example invoices, posted in 2018 year or for one year before 07/01/2018). When you add records before 07/01/2018 the system automatically set Excluded status for these records, and invoices will not be submitted to Online invoicing system.

The system set value in modifyWithoutMaster=True if original register reference is to the record in the past period. It means for Online invoicing system that "the original invoice was issued before 1 June 2018 and data reporting for the modifying document is compulsory".

Use Ctrl+F3 to set up filters on Online invoicing system register form.

Use Ctrl+G to set up filters on columns of register.

Send

Use Send function several times to execute all steps, described above.

Click the Send button and set Status value the records on which report should be generated and submitted.

Created status is set up by default and usually the invoice report generated on register records with Created status.

But in some cases it is necessary to generate and submit report with Rejected status due to different technical errors when register records, the system generated report on, were transferred to Rejected status. In this case you may generate and send report on the records with Rejected status.

Change status

It an invoice record in the Online invoicing system register is in status Created or Rejected user can manually change the status to Excluded to optimize queries and work with the register record.

Press the Status > Excluded button to change the register record status from Created to Excluded status.

Press the Status > Created button to change the register record status from Excluded to Created status .

Review communications

The system stores all the xml requests (reports) and responses to/from Online invoicing system. You can review all the sent and received XML files related with the selected register record if click the Review communications button.

In this form you may overview all steps of register record processing.

In the General tab of every processing step you may overview operation type and additional exchange parameter (token - in first step, transaction id - in second step).

Invoice journal

Use this function to open Invoice journal record for the selected register record.

Export

Use this function for overview xml file, generated on the invoice, related with the register record (please, notice that the system sends report to Online invoicing system with encoding invoices).

Hotfix information

How to obtain the Microsoft Dynamics AX updates files

This update is available for manual download and installation from the Microsoft Download Center.

Prerequisites

You must have one of the following products installed to apply this hotfix:

-

Microsoft Dynamics AX 2012 R3

-

Microsoft Dynamics AX 2012 R2

-

Microsoft Dynamics AX 2009 SP1

Restart requirement

You must restart the Application Object Server (AOS) service after you apply the hotfix.

If you are encountering an issue downloading, installing this hotfix, or have other technical support questions, contact your partner or, if enrolled in a support plan directly with Microsoft, you can contact technical support for Microsoft Dynamics and create a new support request. To do this, visit the following Microsoft website:

https://mbs.microsoft.com/support/newstart.aspx

You can also contact technical support for Microsoft Dynamics by phone using these links for country specific phone numbers. To do this, visit one of the following Microsoft websites:

Partners

https://mbs.microsoft.com/partnersource/resources/support/supportinformation/Global+Support+Contacts

Customers

In special cases, charges that are ordinarily incurred for support calls may be canceled if a Technical Support Professional for Microsoft Dynamics and related products determines that a specific update will resolve your problem. The usual support costs will apply to any additional support questions and issues that do not qualify for the specific update in question.